GBP/CAD reacted higher after ending double correction lower

In this technical blog, we will look at the past performance of the 1-hour Elliott Wave Charts of GBPCAD. In which, the rally from 28 September 2023 low is unfolding as a leading diagonal sequence and called for an extension higher to take place. Therefore, we knew that the structure in GBPCAD should remain supported & extend higher. So, we advised members not to sell the pair & buy the dips in 3, 7, or 11 swings at the blue box areas. We will explain the structure & forecast below:

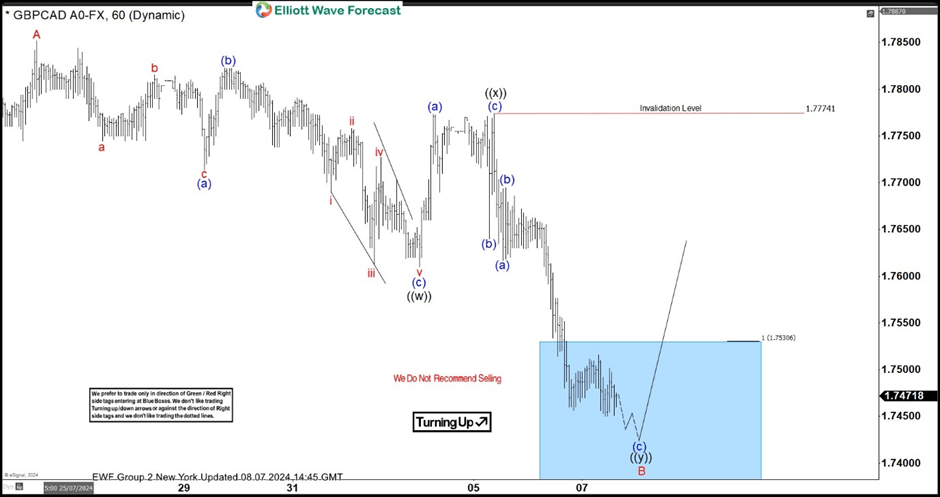

GBPCAD 1-Hour Elliott Wave Chart From 8.07.2024

Here’s the 1-hour Elliott wave Chart from the 8.07.2024 NY update. In which, the rally to 1.7852 high-ended wave A & made a pullback in wave B. The internals of that pullback unfolded as Elliott wave double correction where wave ((w)) ended in 3 swings at 1.7610 low. Then a bounce to 1.7773 high-ended wave ((x)) & started the next leg lower in wave ((y)) towards 1.7530- 1.7378 blue box area. From there, buyers were expected to appear looking for new highs ideally or for a 3-wave bounce minimum.

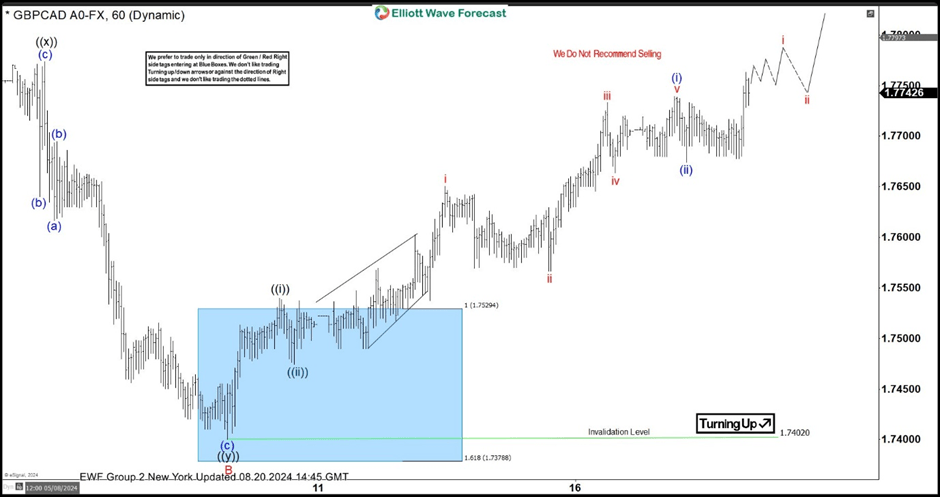

GBPCAD Latest 1-Hour Elliott Wave Chart From 8.20.2024

This is the latest 1-hour Elliott wave Chart from the 8.20.2024 NY update. In which the pair is showing a strong reaction higher taking place, right after ending the double correction within the blue box area. Allowed members to create a risk-free position shortly after taking the long position at the blue box area. However, a break above 1.7852 high is still needed to confirm the next extension higher & avoid deeper pullback.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com