FTSE 100: A lot of indecision in the market for the coming week

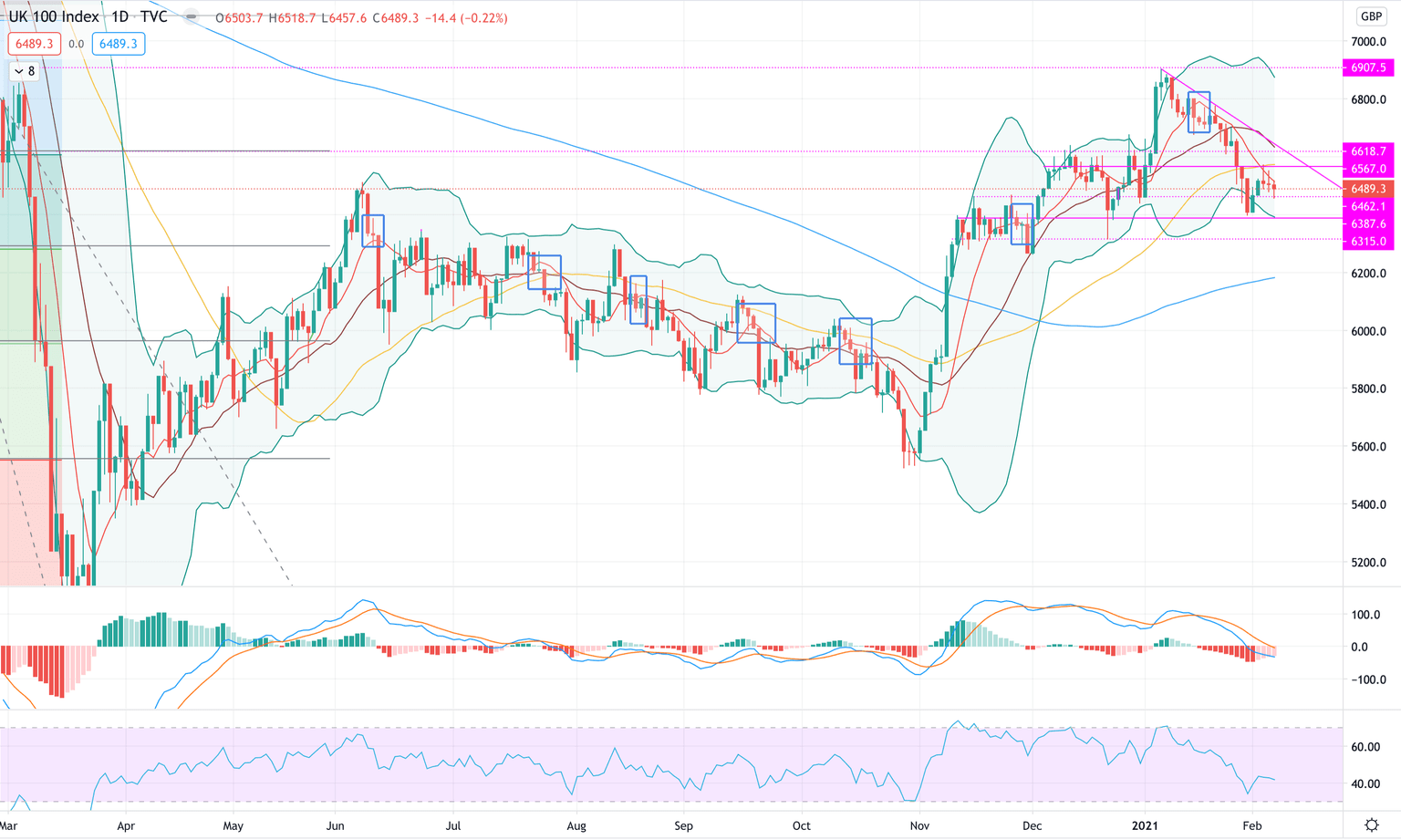

FTSE 100 (#UKX)

The #UKX, compared to other European markets, had a modest week up +0.97% where it moved perfectly between the support and resistance we highlighted on our preview market brief.

Despite a bullish start of the week, indecision took over the last trading days and most important rejected by the 9MA.

From a technical point of view, the intermediate level of 6,462 plays a very important role as when it is broken or crossed above leads the way in either directions.

The MACD is signalling a mild sloping up together with an RSI that left the low point but it is now moving sideways.

For the coming week, there is a lot of indecision in the Market and we expect the #UKX to move sideways and if it keeps being rejected by the 9MA, we are more in favour of a move to the downside and test again support level.

Support at 6387 and resistance at 6567.

FTSE MIB (#FTSEMIB)

The #FTSEMIB has a very strong week up +6.12%, this was mainly driven by the appointment of the new PM.

The index has been, since the beginning of November 2020, trading sideways. After the positive news, the Index managed to bounce from support level till the current resistance.

From a technical perspective, given the reversal looking candle formed on Friday we believe the Index might retrace slightly before considering moves in either direction. This would be supported also by a slight divergence between RSI and Price.

On the other side, the MACD is curving up which could signal positive momentum for the #FTSEMIB

DAX (#DAX)

The #DAX had a very strong week, up +3.63% where it almost re-touched the all time market high. The reversal from last week was strong and indicates how the 50MA plays a very important support level.

From a technical perspective, the breath is to the upside however given the doji candle reported on Friday, we believe the Index may retrace slightly before eventually keep moving to the upside.

The MACD is crossing over which is positive and it keeps the indicator still above 0. The RSI recovered from the lows and the fact that is not in overbought territory might leave room for further upside.

For the coming week, we expect the #DAX to retrace to 13,900 before considering further moves: strong volumes in either direction could signal a re-test of support/resistance.

Support at 13,756 and resistance at 14,127.

S&P500 (#SPX)

The #SPX had a positive week, closing up +3.60% fully recovering last week losses.

It is important to notice how the 50MA is playing a crucial role on supporting the index on this bullish trend to the upside and to new all market high.

From a technical perspective, the low of last week helped us to understand even better the upward channel that has been taking place since September 2020. However, we want to invite our reader to proceed with cautions. In fact, if last week was indeed a good “buy the deep” opportunity, we believe the indecision candle reported on Friday is leading us to believe that there is more downside potential for the near future.

The MACD is signalling a reversal which represent the bullish environment in which we are in, the RSI on the contrary is reporting divergence with the price which is indeed cause of concern.

For the coming week, despite the fact that #SPX has managed to break resistance, we believe it will retrace slightly and move sideways between 3,806 and 3,871.

Given the current level, we see support at 3,871 and resistance at 3,942. If support will get broke, we see support at 3,806 and resistance at 3,871.

support at 3,806 and resistance at 3,871.

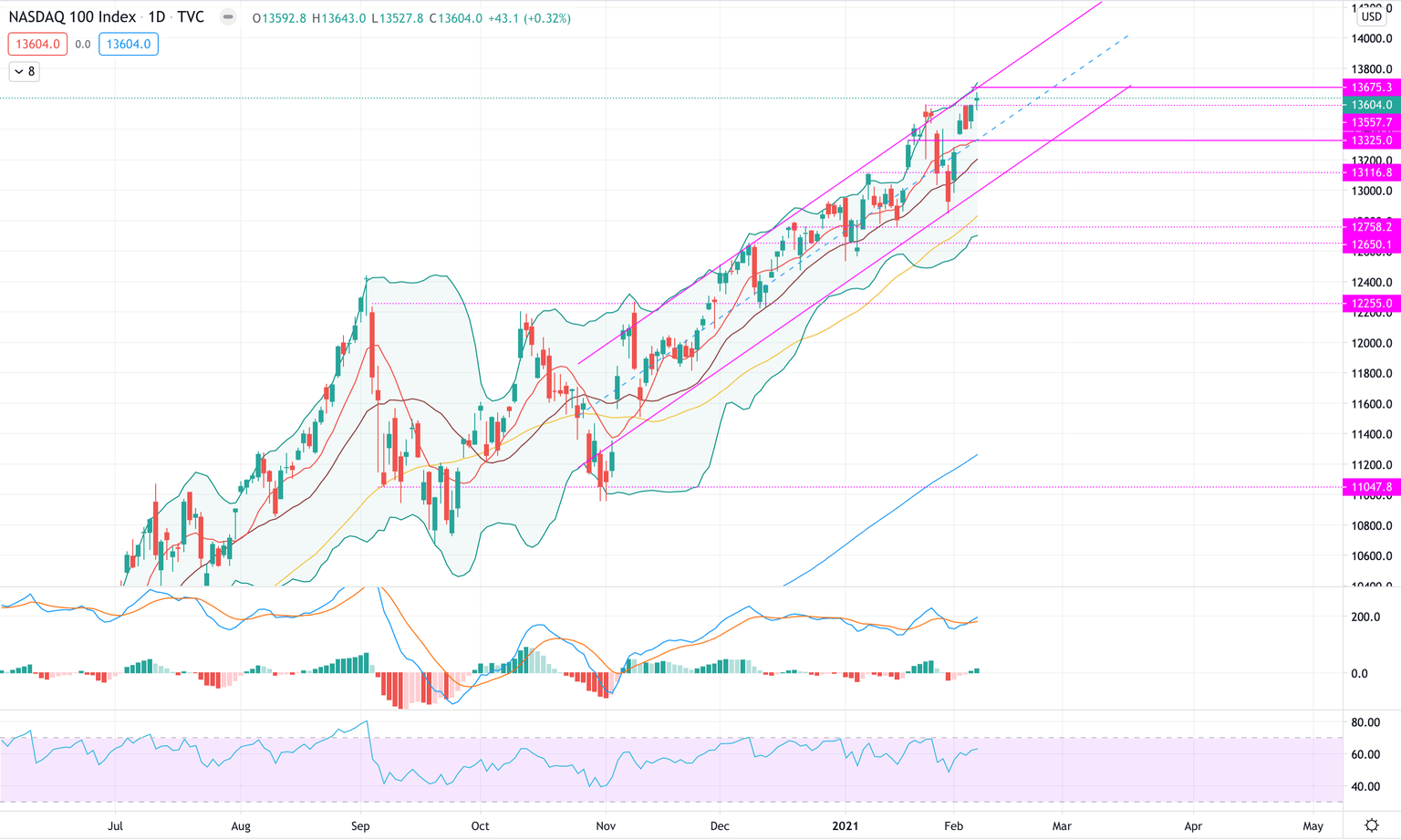

NASDAQ (#NDX)

The Nasdaq had a positive week up +3.79% where it managed to break previous levels and reach a new all time market high: from the lower end of the upward channel has managed to fully recover from the low of end of January.

From a technical perspective, the MACD is bullish and pointing upwards confirming the positive sentiment for the #NDX. This is confirmed by the RSI as well, however the indicator is reporting a slight divergence with the price.

For the coming week, we expect the #NDX to follow previous patter: at the moment, it is at the upper end of the channel and has formed a reversal doji candle. We expect, the Index to retrace to at least 13,400 before consider further moves.

Given the volatility of the index, we see support at 13,325 and resistance at 13,675.

Dow Jones (#DJI)

The Dow, together with the other US indexes, had a strong week up +3.10%. The lows of last week, represent a good reversal opportunity that brought the #DJI to previous resistance level.

The 50MA keeps moving upward representing a strong level of support to overcome.

From a technical perspective, the bounce of last week made the MACD recovering and almost crossing over. On the other side, the RSI is now showing divergence with the price which creates cause of concern for moves to the downside.

For the coming week, despite bullish context we expect the #DJI to test intermediate support at 30,800 before consider moves in either direction. At this level, the volumes will be very important to understand whether the Index will bounce or continue to the downside.

At present, we see support at 30,345 and resistance at 31,251

Author

Francesco Bergamini

OTB Global Investments

Francesco, BSc Finance and Msc in Business Management, graduated with Merit, is a professional with experience in the financial services industry and a keen interest in the financial markets.