From stars to stats – WTI Crude Oil forecast using technical, astro and macro tools

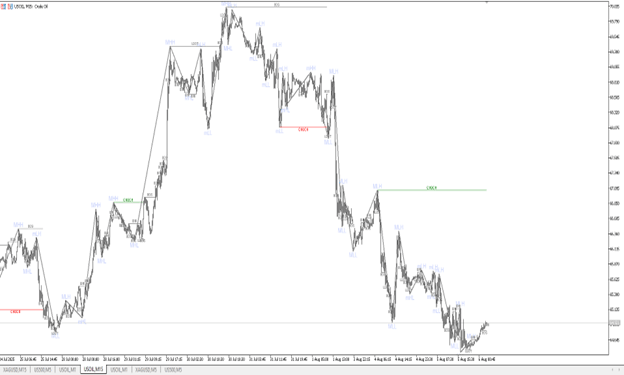

With oil consolidating near the $64.50 support zone, we plan to initiate a long position at 6412, with a stop loss at 6377 and a first target at 6505, as the current market structure suggests a potential accumulation phase forming after sweeping recent sell-side liquidity. Price action has shown compression near minimal surface area regions, indicating a possible volatility expansion is imminent. However, traders should remain cautious due to the ongoing Mercury retrograde, which tends to bring confusion, misreads, and false breakouts around key levels.

The active Mars–Ketu conjunction further amplifies the potential for sharp intraday reversals and aggressive liquidity grabs. From a macro perspective, today’s Bank of England rate decision could inject volatility into global inflation expectations—if the BOE delivers a hawkish tone or surprise hike, oil may catch a reflation bid. Conversely, a dovish tilt could strengthen the dollar, pressuring oil downward.

Simultaneously, EIA oil inventories are due out and will play a pivotal role: a bullish drawdown could trigger a rally toward $66.20 (fair value gap) and potentially $67.35 (CHoCH resistance), while a bearish build may cause a breakdown below $63.70, opening the path to $63.20 or even $62.50. For tactical hedging, aggressive sellers may consider shorting into a spike toward 6645, with tight stops above 6675, targeting a retrace to 6465. Overall, this is a day for tight execution, quick reactions, and respect for time-based volatility cycles.

Author

Faysal Amin

Mind Vision Traders

Faysal Amin is a seasoned financial analyst and market strategist with over a decade of experience in global markets, including equities, forex, and commodities.