Forex technical analysis and forecast: Majors, equities and commodities

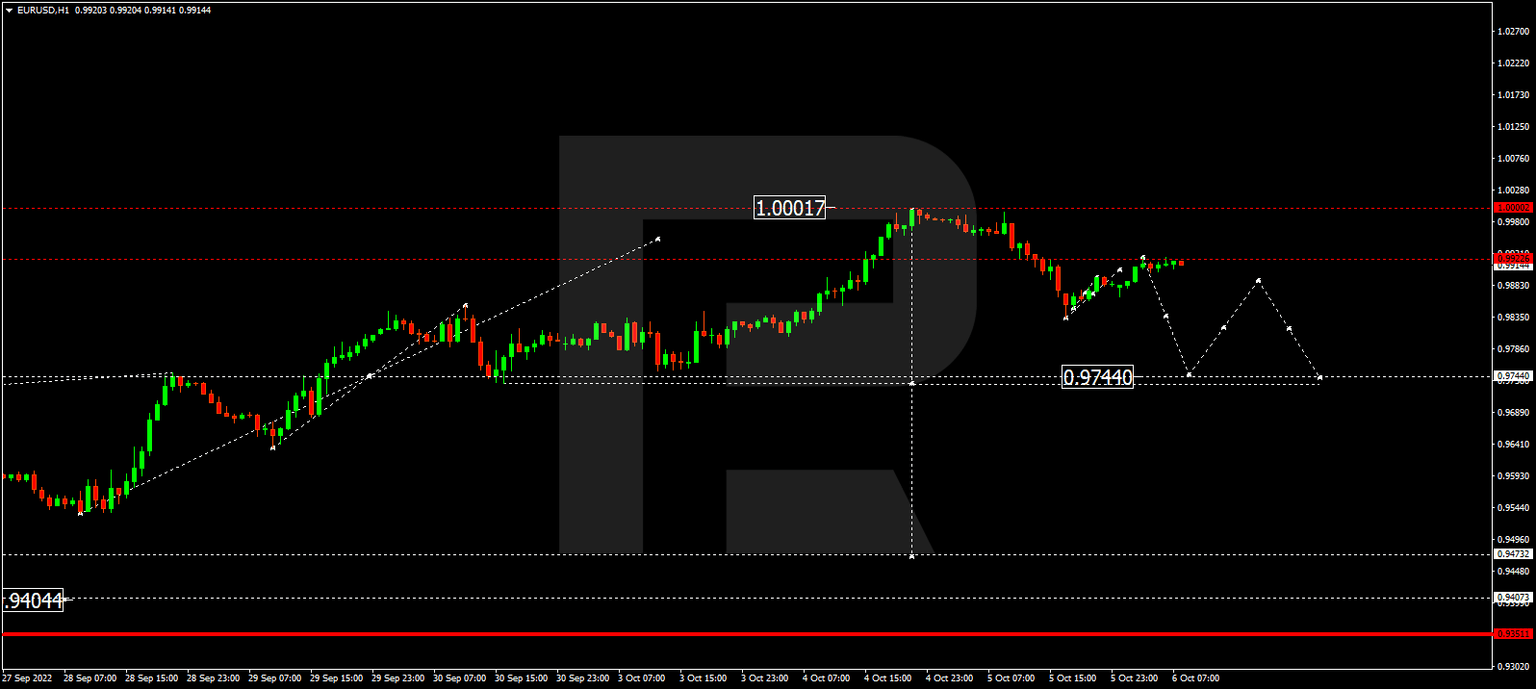

EUR/USD, “Euro vs US Dollar”

After completing the descending wave at 0.9834 along with the correction up to 0.9922, EURUSD is expected to fall to break 0.9800 and then continue trading downwards with the short-term target at 0.9744.

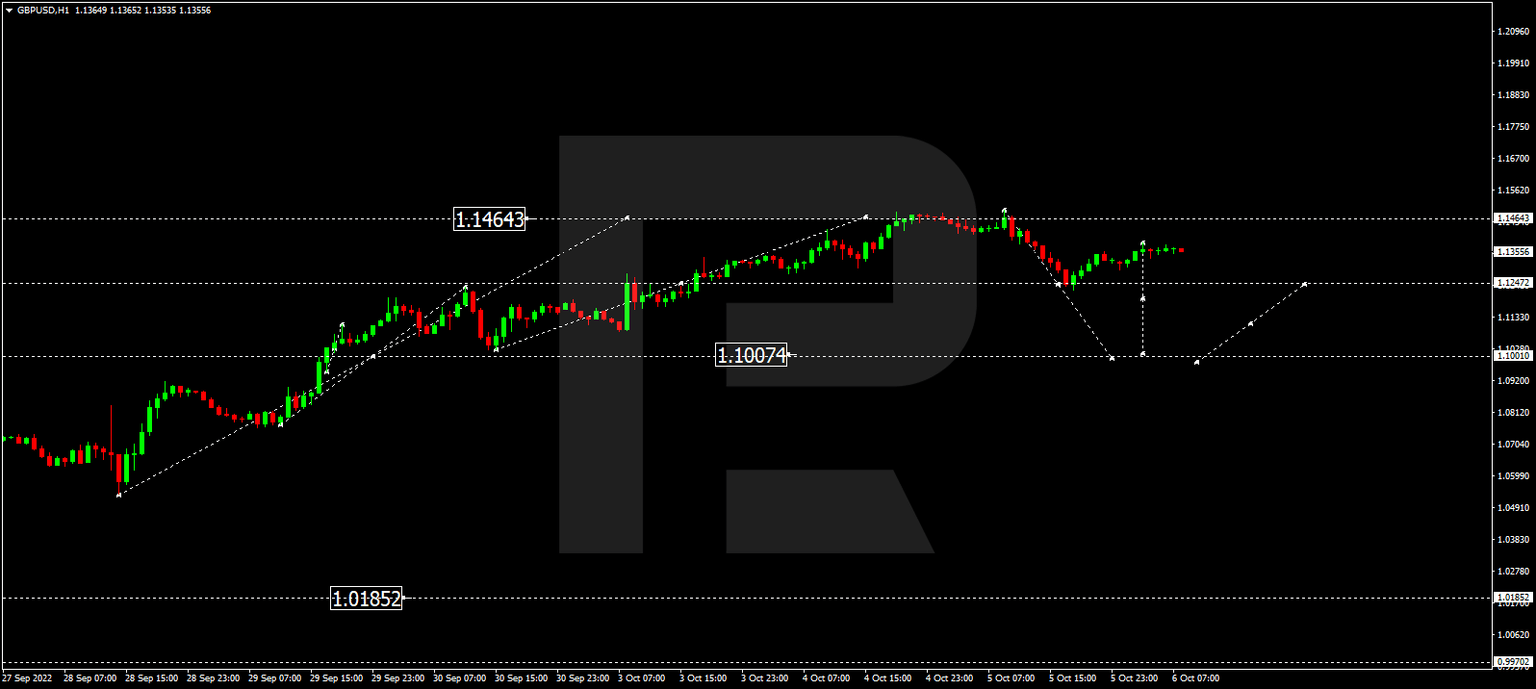

GBP/USD, “Great Britain Pound vs US Dollar”

GBP/USD has finished the descending structure at 1.1226 along with the correction up to 1.1355. Today, the pair may resume trading downwards to break 1.1220 and then continue falling with the short-term 1.1000.

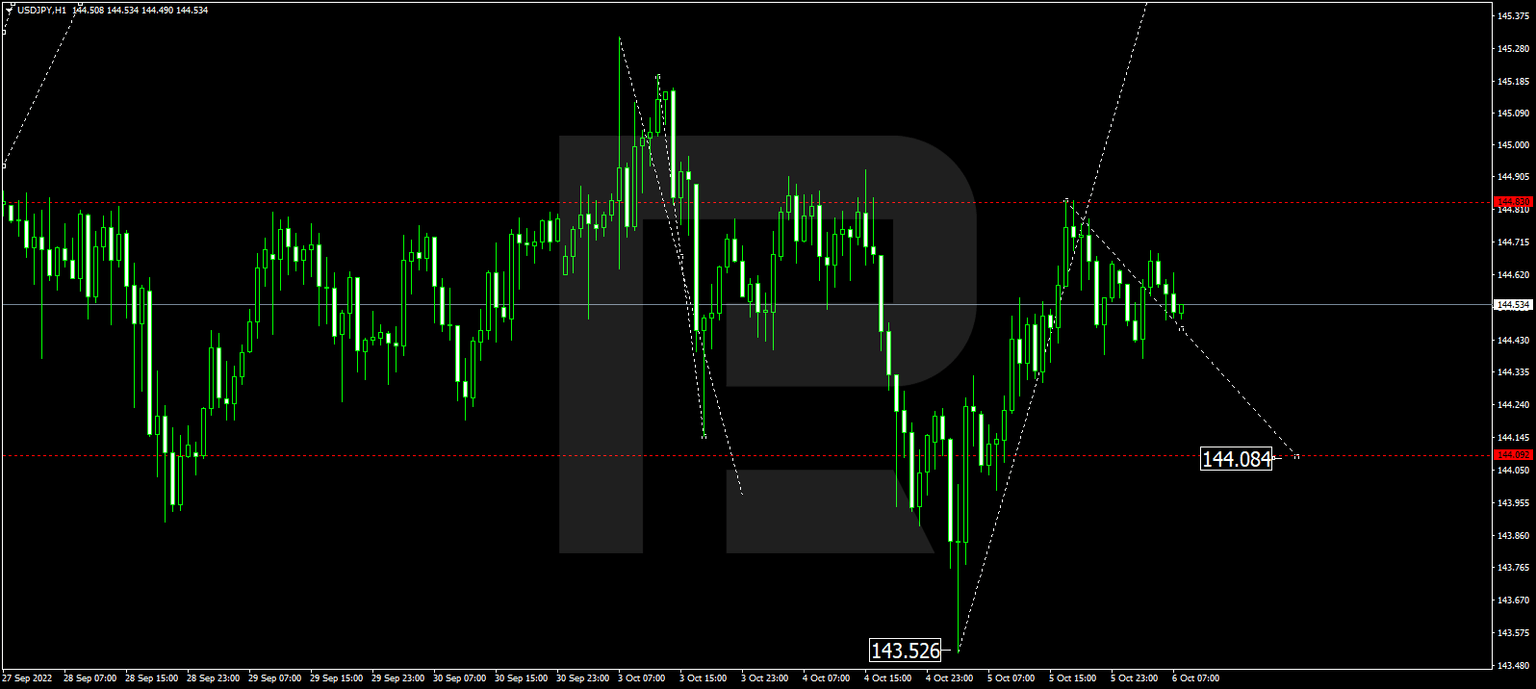

USD/JPY, “US Dollar vs Japanese Yen”

Having completed the ascending wave at 144.80, USDJPY is expected to resume falling to break 144.06 and then continue trading downwards with the target at 143.50.

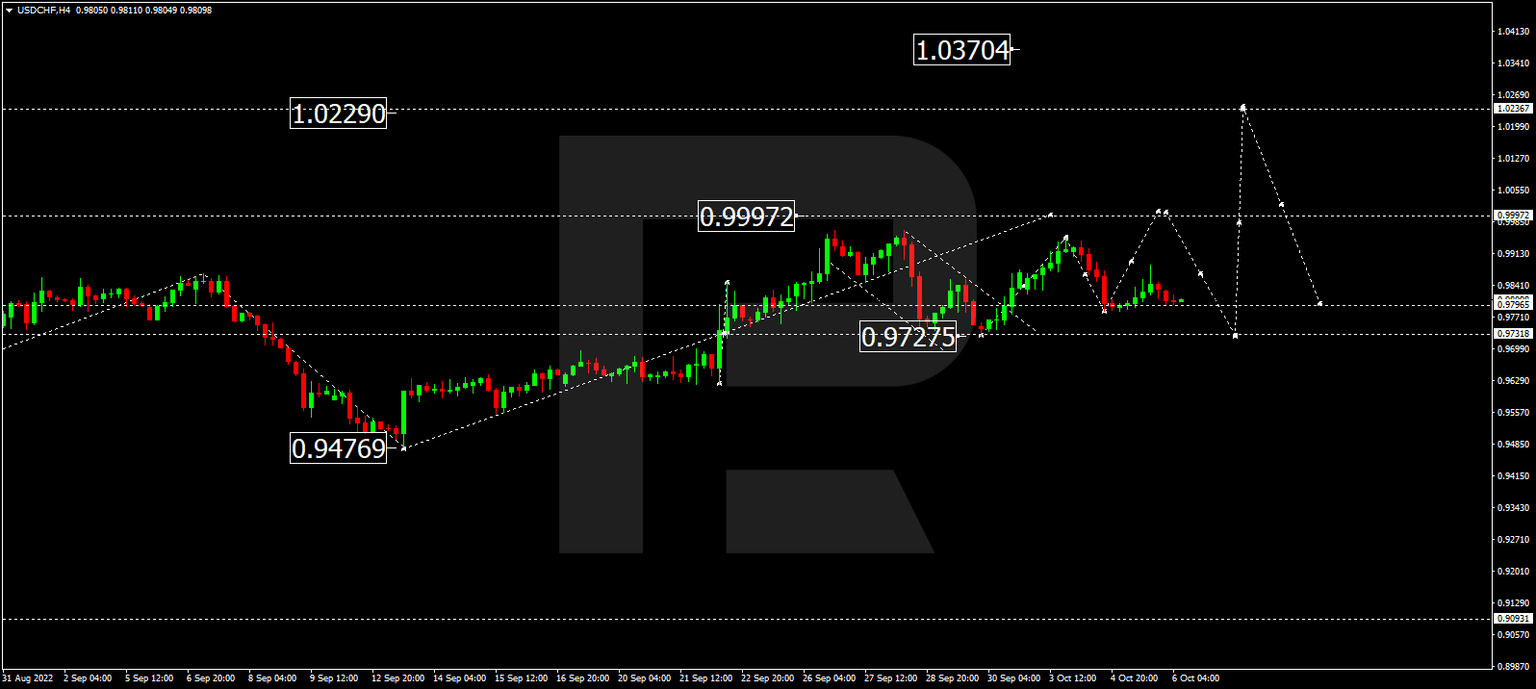

USD/CHF, “US Dollar vs Swiss Franc”

USD/CHF is consolidating above 0.9797. Possibly, the pair may form one more ascending wave to reach 0.9999 and then start a new decline with the target at 0.9700.

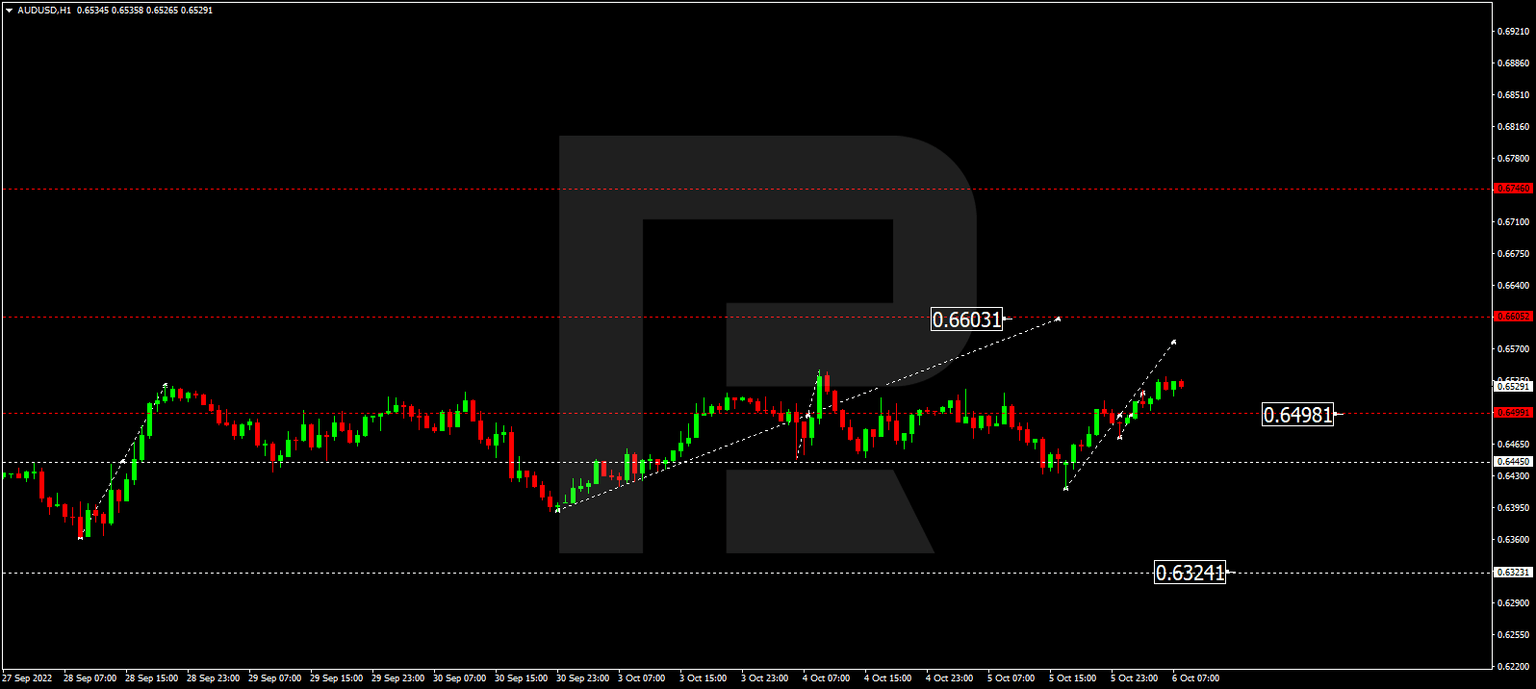

AUD/USD, “Australian Dollar vs US Dollar”

AUD/USD is still consolidating around 0.6500. Possibly, today the pair may grow to reach 0.6600 and then resume trading downwards with the target at 0.6400.

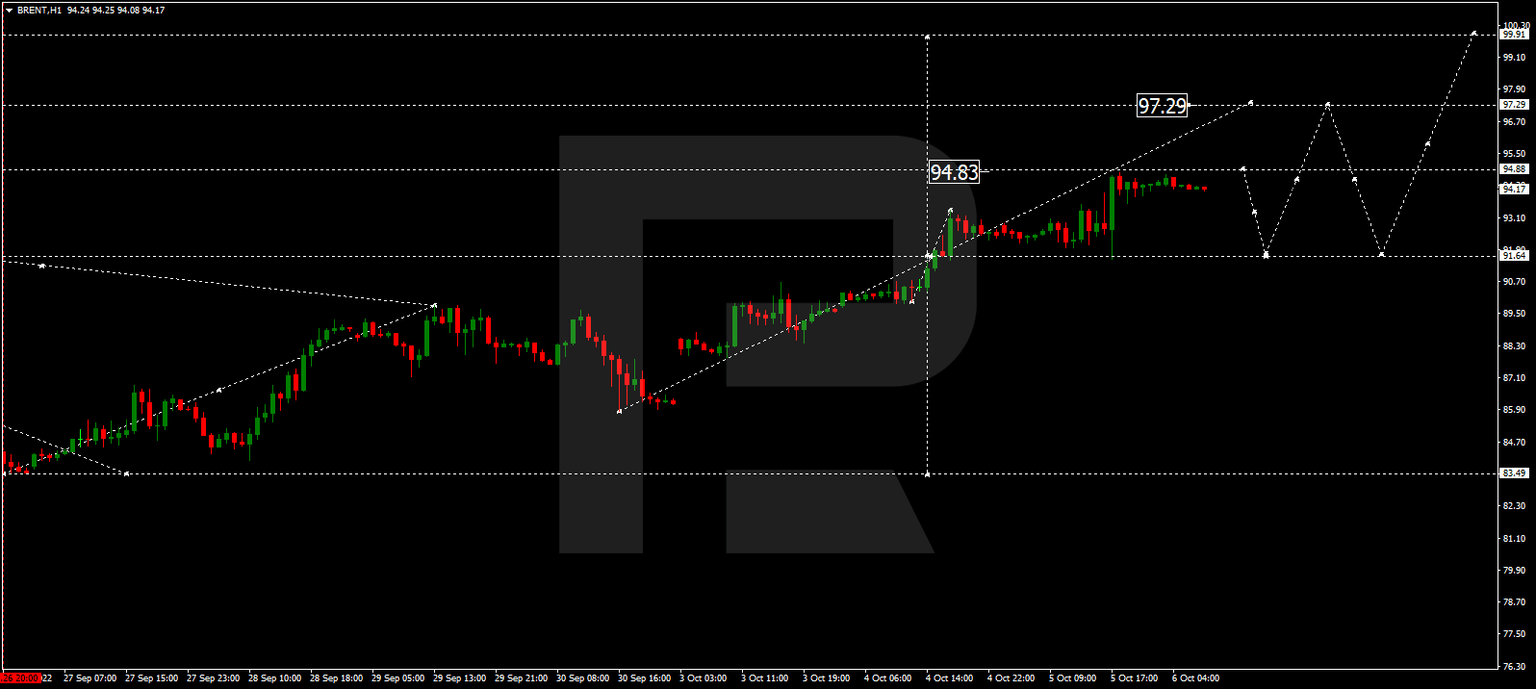

Brent

After finishing the ascending wave at 94.76, Brent is forming a new consolidation there. Possibly, the asset may break the range to the upside and resume growing towards 95.00, or even extend this structure to reach the short-term target at 97.30.

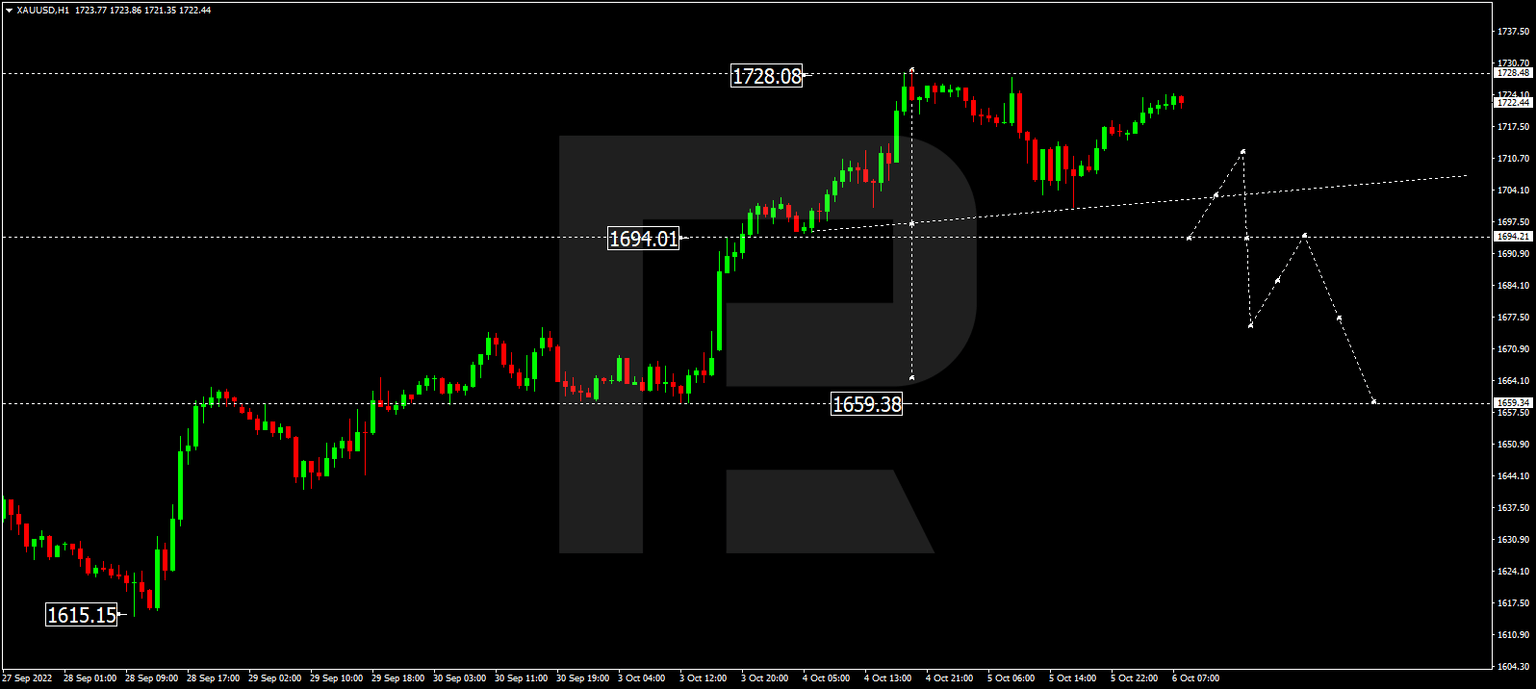

XAU/USD, “Gold vs US Dollar”

After completing the descending wave at 1700.44 along with the correction up to 1722.22, Gold is expected to form a new descending structure to break 1694.22 and then continue trading downwards with the target at 1660.00.

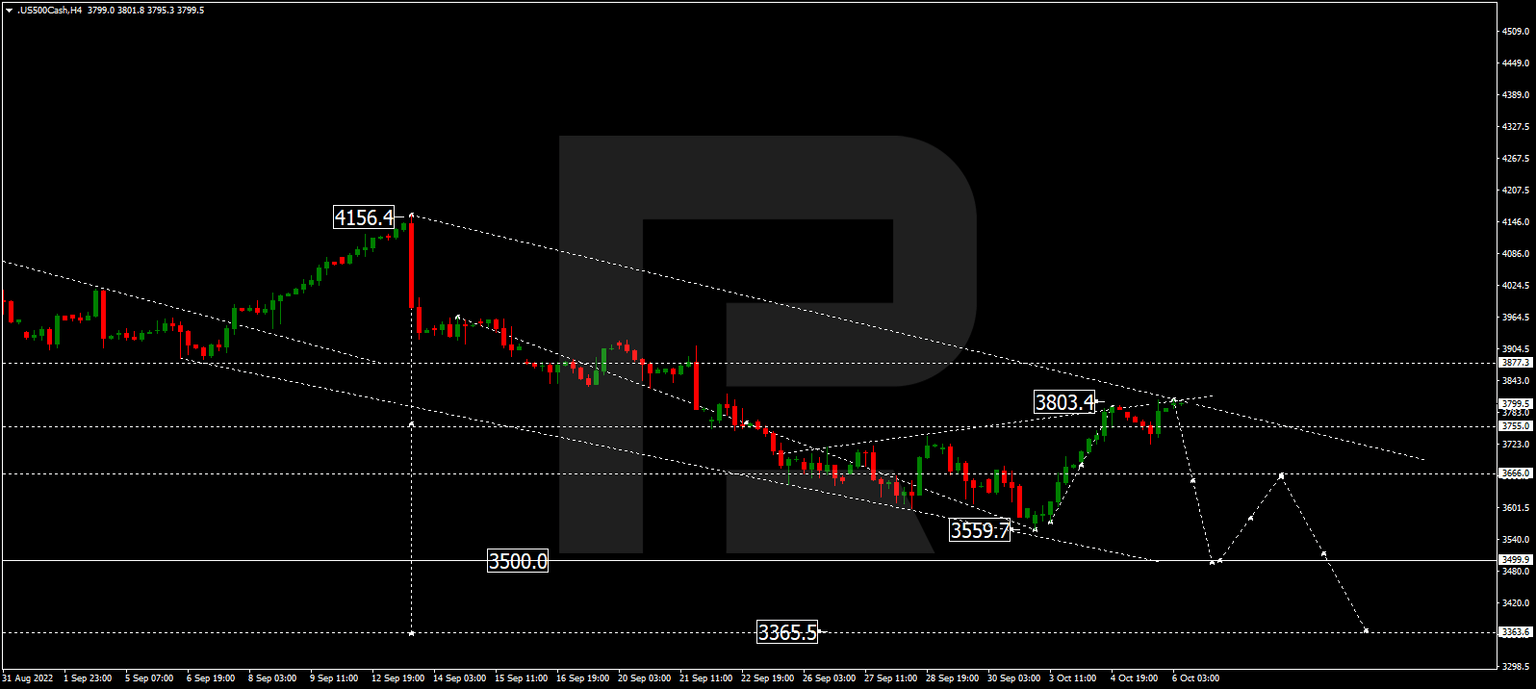

S&P 500

Having finished the ascending wave at 3800.0, the S&P index is expected to start a new decline to break 3666.6 and then continue falling with the short-term target at 3500.0.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.