Forecasting the upcoming week: PMIs loom large, talking about trade talks to continue

The US Dollar (USD) grappled with slippery highs throughout this week, catching a bid on risk-off market flows fueled almost entirely by political headlines from the Trump administration and then slowly bleeding those gains away through the back half of the trading week. President Donald Trump continues to rail against the Federal Reserve’s (Fed) decision not to do what he wants on interest rates, even as he sits atop what is arguably the best-performing economy globally. Key inflation metrics, which include things like imported goods, sparked fresh tariff caution this week, while other inflation measures, which specifically exclude imported goods, still bolstered investor confidence.

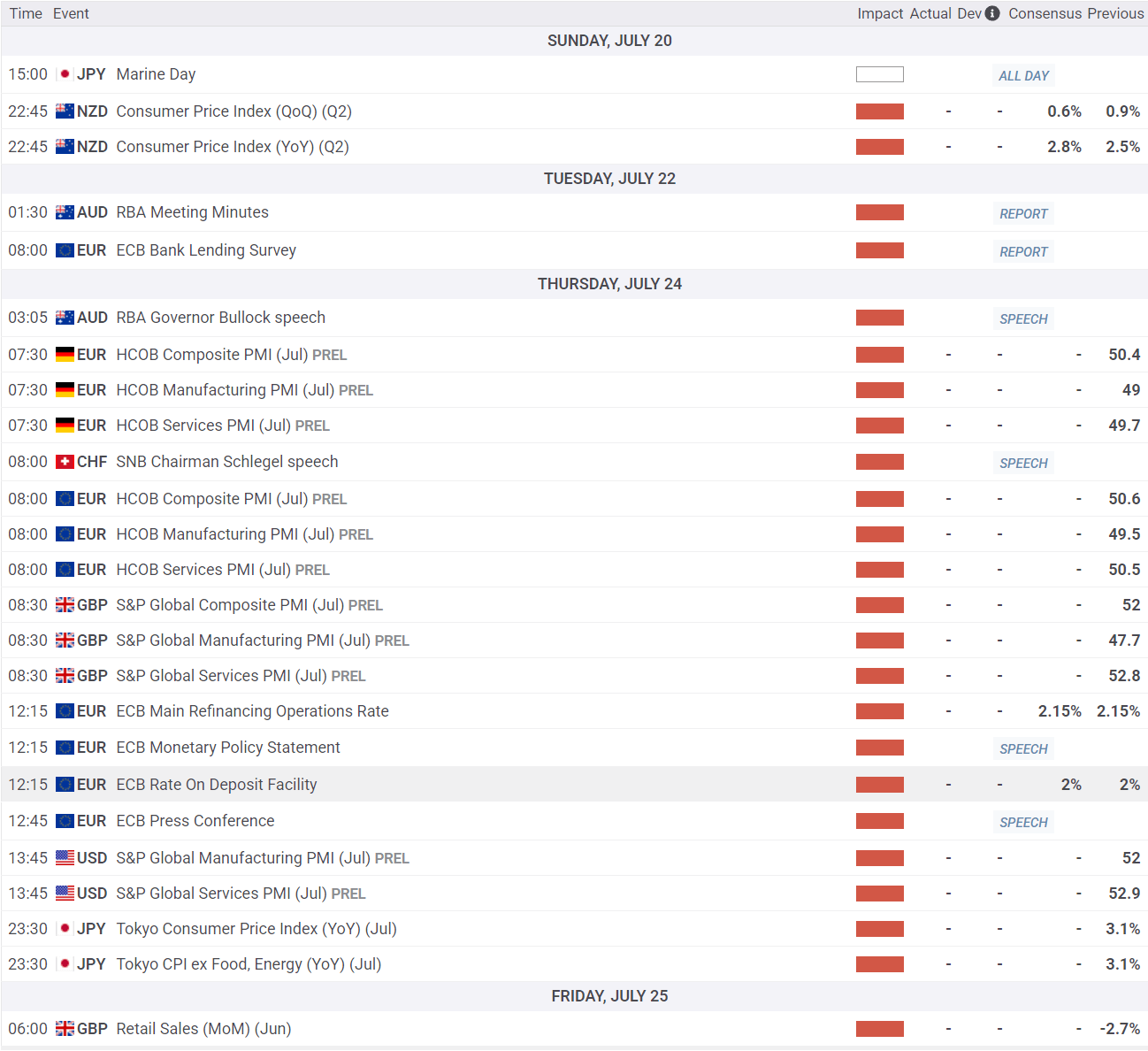

PMIs, central banks, and tariff talk likely

The US Dollar Index (DXY) flubbed a bullish reach for the 99.00 handle after running into resistance from the 50-day Exponential Moving Average (EMA) near 98.75. However, enough leftover topside momentum kept the DXY above the 98.00 level to wrap up the week. After a week of heavy-hitting yet positive-to-middling economic data, investors will be getting a bit of a breather on the economic data front. That is, until Thursday’s rolling release schedule of global Purchasing Managers Index (PMI) figures.

EUR/USD traders put a pin in losses this week, with the Euro (EUR) catching a technical bounce from the 1.1600 handle and ending Friday’s trading near where it started the week, chugging along near 1.1650. The latest European Central Bank (ECB) Bank Lending Survey will be publish on Tuesday, followed by a one-two punch of pan-EU PMI figures and the ECB’s latest rate call, both slated for Thursday. The ECB, still battling a lopsided economy and facing deep trade threats from the United States' (US) constantly changing tariff proposals, is expected to keep its main refinancing operations rate at 2.15% and its overnight rate at 2.0%.

GBP/USD caught its own technical bounce, pinging a rising trendline drawn from multi-year lows in January. Cable is trapped in a chart squeeze between rising technical support and a flattening 50-day EMA near 1.3470, and Pound Sterling (GBP) bidders are going to need a little bit of help from Greenback sellers to muscle the pair back into the high side following a multi-week backslide.

USD/JPY has cracked the 200-day EMA at the 148.00 handle, crossing the key moving average for the first time since first falling below it back in February. Yen (JPY) traders continue to search for evidence that the Bank of Japan (BoJ) will accelerate interest rate hikes, and the BoJ continues to push back on expectations, despite inflation figures still holding above target levels in the long run. The latest round of Tokyo Consumer Price Index (CPI) inflation figures will release early next Friday, which last printed at 3.1% YoY.

AUD/USD caught its own technical bounce this week, rebounding off of the 50-day EMA just south of the 0.6500 handle. Aussie (AUD) traders will have the Reserve Bank of Australia’s (RBA) latest Meeting Minutes to look forward to, posting early on Monday, followed by another quiet week on the economic data docket. However, RBA Governor Michele Bullock will be speaking at a public event on Thursday, so Aussie traders can still hope to catch any hints on how the RBA is feeling about policy rates.

Key events coming up this week

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.