Forecasting the Upcoming Week: Fed in full view, it’s Powell’s time to shine

The US Dollar (USD) ended another week with small declines. The Greenback has been caught in a mild consolidation phase for the better part of five weeks, stuck in a volatile rut near 98.00. The global market’s full attention has been pivoting entirely into the Federal Reserve’s (Fed) upcoming rate call on September 17, and the widely anticipated start of the Fed’s next rate-cutting cycle is set to begin.

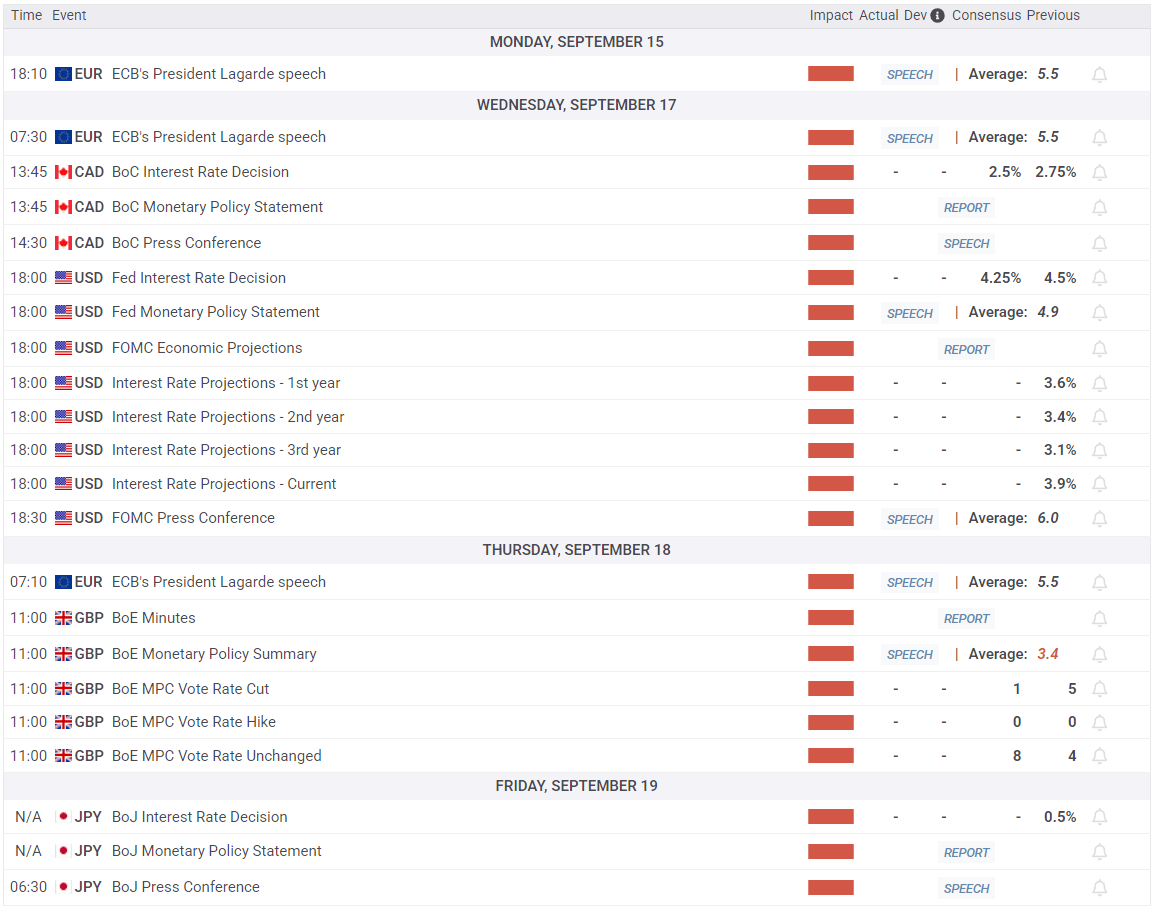

The US Dollar Index (DXY) has hit a near-term technical floor after churning its way into a slim 0.13% loss through the week, ending more or less where it started. The Fed’s next rate call, slated for next Wednesday, has the potential to be a real barn-burner calendar event: the Fed is widely expected to deliver the first of at least three quarter-point rate cuts on September 17. This Fed meeting will carry additional significance for markets, with an update to the Federal Open Market Committee’s (FOMC) Summary of Economic Projections (SEP) also on the docket. Investors will be looking closely to see if Fed policymakers agree with investor consensus that the Fed will deliver three straight rate cuts through the fourth quarter.

EUR/USD ended another week battling the 1.1700 handle, with bidders unable to drive meaningful momentum and bearish pressure similarly unable to find a firm foothold. The Euro (EUR) remains largely unchanged against the US Dollar since tapping the 1.1800 region at the end of June, and Fiber traders are waiting for some sort of meaningful shift to underlying market fundamentals. European Central Bank (ECB) President Christine Lagarde is due to make a smattering of appearances next week, but nothing meaningful is expected: Any and all non-Fed events through Wednesday will be immaterial to investors, and the ECB is already broadly locked into a holding pattern on interest rates until next summer.

GBP/USD found some slim gains this week, climbing four-tenths of one percent to end the week near 1.3565. Despite near-term gains, the Pound Sterling (GBP) remains firmly entrenched in recent technical levels, trading within its own four-week price range. Cable has recovered 3.2% from its six-week low near 1.3140, but still remains down above 1.6% from four-year highs posted ten weeks ago near 1.3790. The Bank of England (BoE) will be delivering its own interest rate decision next Thursday, but the Monetary Policy Committee (MPC) is broadly expected to vote overwhelmingly in favor of standing pat on interest rates, with only a single MPC holdout expected to vote for a rate cut.

Consolidation has been the name of the game for USD/JPY, and that trend is unlikely to get shaken out soon. The Dollar-Yen pairing has not meaningfully changed its stance on the charts for eight straight weeks, albeit with a brief test north of 150.00 at the tail-end of July. The Bank of Japan’s (BoJ) latest interest rate decision is due at the end of next week, but as with many of the world’s central banks, no movement on rates is expected. Markets continue to count the days and weeks waiting for the BoJ to eventually give up and begin raising interest rates, but so far BoJ policymakers have taken every excuse they can to keep rates as close to zero as they dare.

Gold prices continue to march up the charts, driving XAU/USD speculators into a frenzy as the yellow metal sets new all-time highs on what feels like a daily basis. XAU/USD has closed higher for four consecutive weeks, climbing around 10% from mid-August’s levels near $3,335. Gold prices have closed higher or flat for all but three of the last 17 straight sessions, and is up a stunning 40% since the start of the year. A faltering US economy may pose a boon for equity and risk markets looking for Fed rate cuts, but rising economic uncertainty is still creasing fresh worry lines into markets, keeping XAU/USD well bid heading into the last quarter.

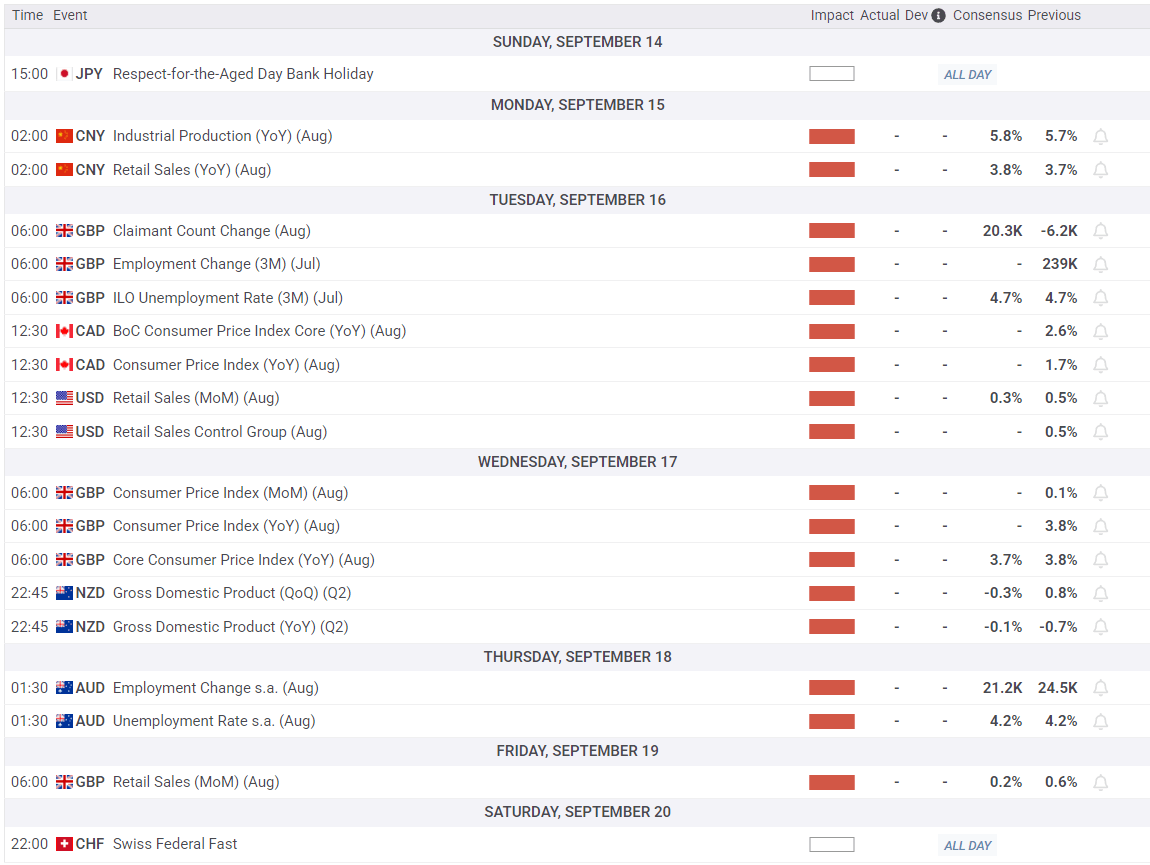

Key non-CB events this week

Central Bank event calendar

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.