FOMC preview: No change expected, as Trump looms large

The focus for financial markets will shift from US tech stocks to the FOMC meeting on Wednesday evening, when the Fed will announce its latest policy at 1900 GMT. This will be followed by a press conference, there will be no summary of economic projections or Dot Plot at this meeting.

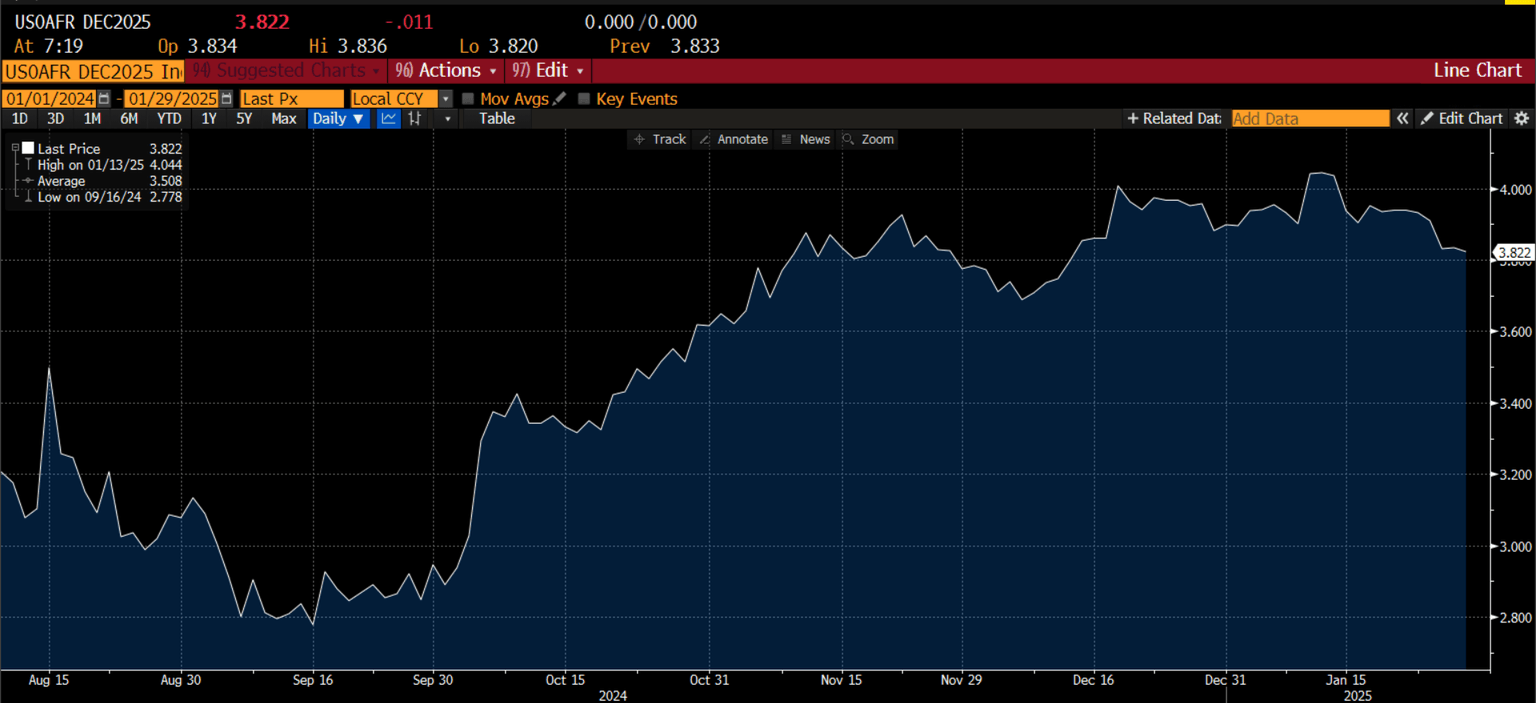

The market is pricing in virtually no chance of a rate cut at this meeting, and there is only a 45% of a single rate cut by the June meeting, according to the CME FedWatch tool. The market is expecting less than 2 rate cuts from the Fed this year, with interest rate expectations for 2025 mostly unchanged since the start of 2025. US interest rate expectations have been remarkably stable even though other central banks have seen bets on interest rate cuts increase in recent months.

Fed’s view on inflation is key for market reaction

December’s inflation report showed a moderation in inflation pressure at the end of last year, however, even this has not done much to budget Fed rate cut expectations. This could be due to inflation expectations. The University of Michigan inflation expectations measure has ticked higher at the 1-year horizon and remains above the Fed’s target rate for the longer term. 1-year US inflation expectations have been stuck above the 3% level since April 2024, they have ticked higher since the 50bp rate cut from the Fed in September. The Fed has stated that it wants inflation expectations to remain well anchored, so they may choose to tread a cautious path at this meeting.

New Fed members and the prospect of a shadow chair

This meeting will also see new voting members on the Committee, including Fed presidents for Chicago, Boston, St Louis, and Kansas City. This could see Fed members move away from the centre and towards the extremes. Although all members seem willing to keep rates on hold at this meeting, the future path of policy is less certain and there could be a higher percentage of dissenting voters. Added to this, before his inauguration, Donald Trump proposed a shadow Fed President to work along side Fed chair Powell. This position would hold no official power, it is designed to challenge and critique the Fed’s decisions, and the shadow chair would likely become the next chair after Powell’s term ends in May 2026. Although there has been no announcement of a shadow Fed chair since Trump became President, signs that the Fed will remain on a prolonged pause could irritate Trump enough to appoint one in the coming months. This may also increase uncertainty around future Fed policy.

Could the Fed soften their stance on rate cut expectations at this meeting?

Bloomberg’s Fed speak index has trended lower in the last three weeks, which suggests that Fed members have tended to sound more dovish in their speeches so far this year. This is a shift in their stance since September, when Fed members started to sound more hawkish. On balance the Fed is still sounding relatively hawkish, however, we will be watching to see if the Fed defy the economic data including strong labour market growth, expectations of strong GDP, and elevated inflation expectations, and softens its stance on the pace of future rate cuts.

US mid-caps and global stocks could be impacted by this meeting

If the Fed does soften its stance, then we expect an immediate market reaction, which could benefit the broader stock market and global risk sentiment. The slightest sign that the Fed could cut interest rates at a faster pace may trigger a rally in cyclical stocks and US midcaps, such as the Russell 2000. We also think a ‘dovish’ Fed could boost UK equities, since UK 10-year yields have a strong positive correlation with US 10-year Treasury yields of 77%. Thus, a dovish Fed could also help to lower borrowing costs for UK companies, which may boost UK stocks.

The Fed can’t save Nvidia from Chinese competition

The backdrop to this meeting has been a big sell off in US tech stocks as China’s DeepSeek AI model has upset the market status quo. China’s AI capability is a much larger threat to US tech stocks than the Fed. In recent years, mega cap US tech stocks have decoupled from the US economy, due to their massive global reach and their huge cash piles, which is why they have been mostly resilient to Fed policy changes. However, if big tech firms face competition from China, then huge revenues and profits may get eroded, and the level of interest rates may start to become a bigger influence on their stock market performance.

For now, we do not think that the Fed can save Nvidia from the prospect of enhanced competition from China. Instead, any shift in tone from the Fed could have a big impact on the equal weighted S&P 500, and the Russell 2000. Usually, the Fed also has a large impact on the FX market, however, in the current political climate, Trump’s tariff talk is most important driver of FX. Thus, if the Fed does soften its stance regarding the pace of rate cuts, dollar downside could be limited, and there may only be a small amount of scope for the euro and the pound to stage a recovery vs. the greenback later this week.

US interest rate expectations for December 2025 have been remarkably stable, which may have limited Dollar upside in recent weeks

Source: XTB and Bloomberg

Author

Kathleen Brooks

XTB UK

Kathleen has nearly 15 years’ experience working with some of the leading retail trading and investment companies in the City of London.