FOMC Minutes Preview: Dollar selling opportunity? Doves set for a comeback after hawkish meeting

- The FOMC Meeting Minutes tend to counter the tone set in the meeting.

- Contrary to the original hawkish message, doves may have the upper hand in the document.

- Lower rate hike expectations may weigh on the dollar, boosted by strong US data.

The decision giveth, the minutes taketh away – while protocols from the Federal Reserve's meeting minutes are tailored to send markets a message, they also have a clear record in surprising markets with a tone that is different from the messages conveyed at the post rate decision stance.

In September, November and December 2021, Fed Chair Jerome Powell was relatively dovish in official testimonies, public appearances, and press conferences referred to earlier. Hawks in the central bank made themselves heard in various interviews but seemed to fade to the shadows around the Fed's decisions.

However, those hike-happy officials leaped back to the forefront in the meeting minutes, supporting a faster pace of rate increases a quicker beginning to tapering bond buys – or a faster end to that process. This time, the same logic may apply, but in favor of the doves.

Meeting Minutes background

The upcoming release refers to the January 26 2022 meeting, in which Powell expressed surprisingly hawkish views. He refused to rule out raising rates by a double dose of 50 bps in March, left the door open to hiking borrowing costs at every meeting, and also allowed for a fast sell-off of bonds the bank accumulated.

Since then, data has supported his views. The economy gained 467,000 jobs in January, triple the early estimates and inflation hit yet another 40-year peak at 7.5% YoY last month.

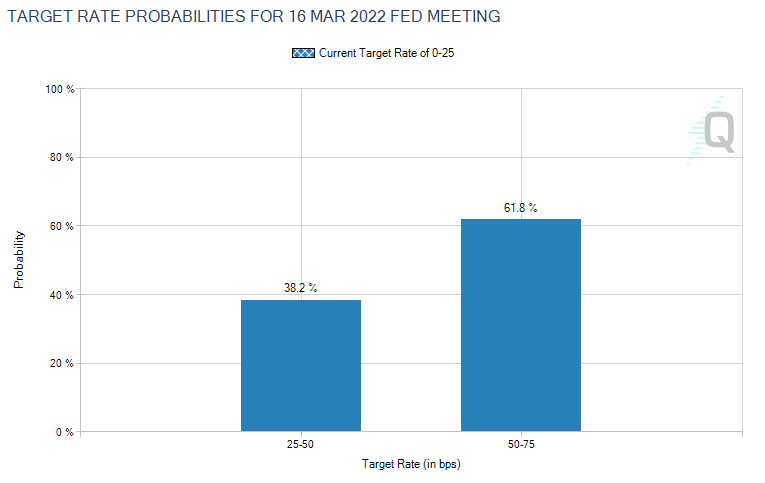

That has been enough to convince markets that a double-dose rate hike has better chances than a standard 25 bps move in March. Here is what bond markets reflect:

Source: CME

However, some of his colleagues – such as Atlanta Fed President Raphael Bostic – have been playing down the chances of a 50 bps rate move in March. Even St. Louis Fed President James Bullard – at the extreme end of the hawkish spectrum – does not see an initial strong move as a necessity.

That implies markets are overpricing the Fed's rate hike cycle. The meeting minutes could reflect a calmer stance. Such a more data-dependent approach would push expectations lower and drag the greenback down with it.

Final thoughts

Apart from the Fed's tendency to balance its message in the minutes, the world's most powerful central bank is also mindful of what happens on Wall Street. While taking the froth out of tech stocks could be seen as a much-needed repricing, a broad bear market s undoubtedly something the Fed would like to avoid. That is another reason to send a soothing message.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.