First light news: RBA rate decision and October US JOLTS data on deck

Price action on Monday adopted a tentative stance ahead of the Fed’s rate decision tomorrow; the S&P 500 shed 0.4% despite remaining near record highs, whilst the Dow dropped over 200 points. In the FX space, the USD Index was all but unchanged (+0.1%), while US Treasury yields rose across the curve, with the 10-year benchmark rising 3 bps to 4.17%.

RBA rate announcement ahead

At 3:30 am GMT today, the RBA will deliver its final rate announcement for the year. Ultimately, I see little to tempt the RBA to depart from market pricing: expected to hold at 3.60%. As such, with no economic projections at this meeting, the central bank’s forward guidance will be worth monitoring.

You may recall that RBA Governor Michele Bullock struck a hawkish tone regarding inflationary pressures and ‘policy consequences’ last week, signalling a more aggressive stance. This aggressiveness has been observed in the rates market – investors have now priced out any chance of cuts, with hikes on the table as early as mid-2026. The shift in rate pricing was largely due to inflation recently coming in stronger than expected.

I feel the biggest surprise here would be the RBA overlooking what the market is pricing in: rate hikes. This could trigger short-term downside in the AUD, with the move emphasised should the central bank suggest policy cuts in the future.

US JOLTS data eyed

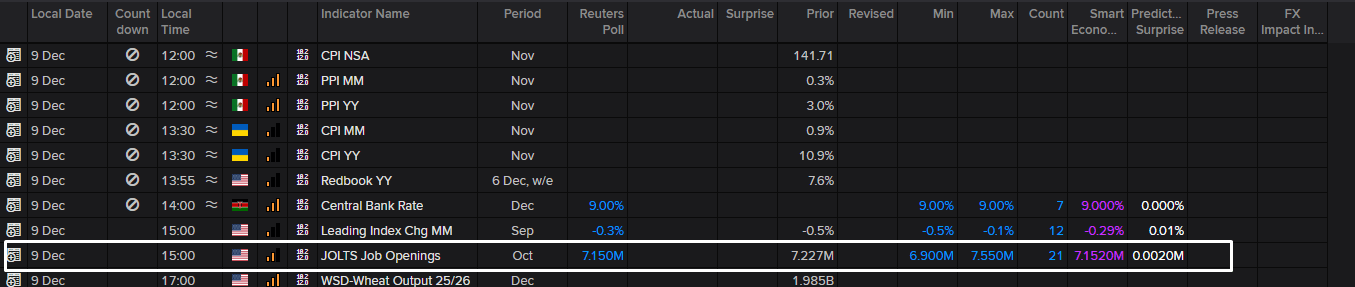

With the US government shutdown in the rearview mirror, and the data fog beginning to lift, the other risk event I will be watching today is the US October JOLTS Job Openings data at 3:00 pm GMT. As shown by the LSEG calendar below, the median expectation is 7.15M (down from 7.23M in September). The estimate range is between a high of 7.55M and a low of 6.90M.

I do not see this print materially altering the Fed’s decision to cut rates tomorrow.

If the data comes in much lower than expected, the USD could dip. However, a soft print is unlikely to change rate pricing by much more than already implied; therefore, USD downside will likely be short-lived.

Yet, a much higher-than-expected number – one that breaches the upper estimate high of 7.55M – will likely prompt a USD bid and could open the door for a short-term scalp long. Nevertheless, as I noted, this will unlikely change the Fed’s decision.

The Fed seldom defies market expectations. So, with a rate cut baked in, attention will be on the Fed’s SEP – particularly the ‘dot-plot projections’ – and language from the Fed Chair Jerome Powell.

Author

Aaron Hill

FP Markets

After completing his Bachelor’s degree in English and Creative Writing in the UK, and subsequently spending a handful of years teaching English as a foreign language teacher around Asia, Aaron was introduced to financial trading,