Federal Reserve Preview: How the Fed could drown markets while trying not to rock the boat

- The Federal Reserve will likely leave its policy unchanged in its last pre-election decision.

- New forecasts will likely show better employment outcomes after upbeat figures for August.

- Sensitive markets may react with a drop to the lack of imminent action.

"My only question is, who is our bigger enemy, Jay Powell or Chairman Xi?" – President Donald Trump's rant against his appointee to lead the world's most powerful central bank still echoes, despite improving relations. The Fed will likely leave its policy unchanged – and try not to rock the boat – in its last decision before the elections.

Officials at the bank clarified that there is no urge for additional stimulus at this point – especially as the economic recovery remains on track. The unemployment rate surprisingly dropped to 8.4% in August and despite a slowdown in the fall of jobless claims, the trend remains promising.

Source: FXStreet

The focus on labor is not coincidental. Federal Reserve Chairman Jerome Powell laid out a new policy framework in late August, namely focusing on full employment, even at the expense of letting inflation overheat. The message was that the Fed will leave low borrowing costs for longer – perhaps through 2025 according to Goldman Sachs.

However, the bank is unlikely to act in the short term. Vice-Chair Richard Clarida – one of the architects of the Fed's review – clarified that setting negative rates or controlling the yield curve are currently off the table. Moreover, the Washington-based institution is unlikely to hint any change before the vote – avoiding being seen as intervening by the candidates.

New dot-plot focus

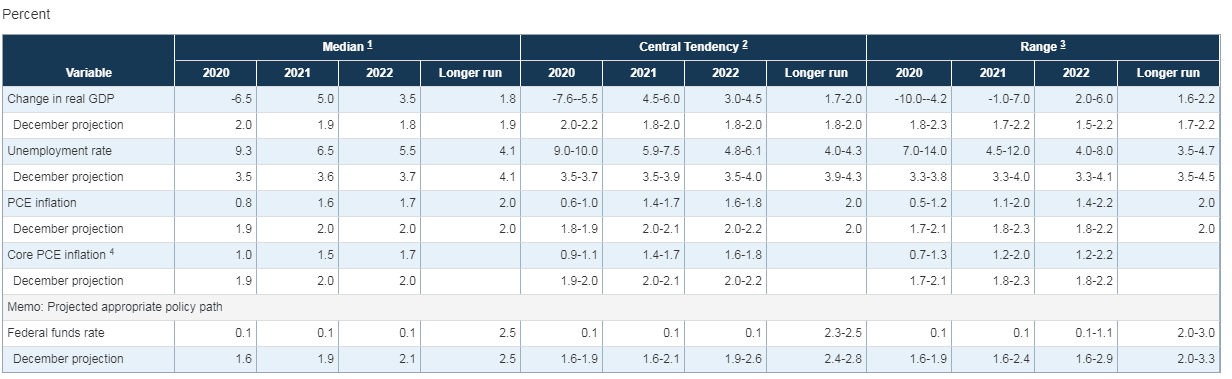

Nevertheless, the Fed unveils new growth, inflation, employment, and interest rate projections, known as the "dot plot." With borrowing costs set to remain at rock bottom for a few more years, and inflation deprioritized, markets will be watching unemployment and economic expansion forecasts.

The previous projections from the June meeting:

Source: Federal Reserve

The bank previously had doubts if the jobless rate would drop back to single digits by year-end – yet it has already happened, prompting an upgrade to the outlook. How will markets react? If the Fed foresees an ongoing downtrend in unemployment, that would imply a rate hike sooner than later – something that may worry markets. However, that may have a minor impact, as investors focus on the shorter term.

Growth is harder to estimate given the nature of the virus. The Fed will likely remain more cautious and foresee a slow return to pre-pandemic output levels – probably not before the end of next year. In this case,

If the Fed refrains from optimism on a return to growth, it means lower rates for longer, something that markets would cheer. On the other hand, investors may become more concerned about the bumpy road ahead. US equities – and especially high-flying tech-stocks – have suffered a downtrend correction, that may have yet to reach the bottom.

Fed pessimism combined with inaction and already sensitive markets could send stocks down.

In this particular case, the safe-haven dollar may find demand. The greenback has been under pressure throughout the summer and perceived hawkishness from the Fed would allow it to rise.

Powell will likely repeat his call on elected officials to do more. Republicans and Democrats have failed to provide further relief, six week after substantial measures have lapsed. Falling unemployment has allowed the GOP to feel more relaxed despite facing voters shortly.

The Fed Chair will find it hard to walk a fine line between calling for action and conveying a message of helplessness. Nevertheless, any request for others to do more could be seen as building the case for Fed inaction in the current touchy environment.

Conclusion

The Fed may attempt to remain out of the spotlight ahead of the elections, yet sensitive investors may rush to the exits at any sign of inaction.

More: What is behind the greenback comeback? Not only the NFP

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.