Fed pivot less likely after strong NFP, focus on CPI report and dot plot – Preview

-

A dovish pivot by the Fed is looking less likely at the June meeting.

-

Will Fed officials flag two or just one rate cut after strong jobs data?

-

CPI report will also be crucial on Wednesday (12:30 GMT).

-

Statement due at 18:00 GMT will be followed by press conference at 18:30 GMT.

One step forward, two steps back

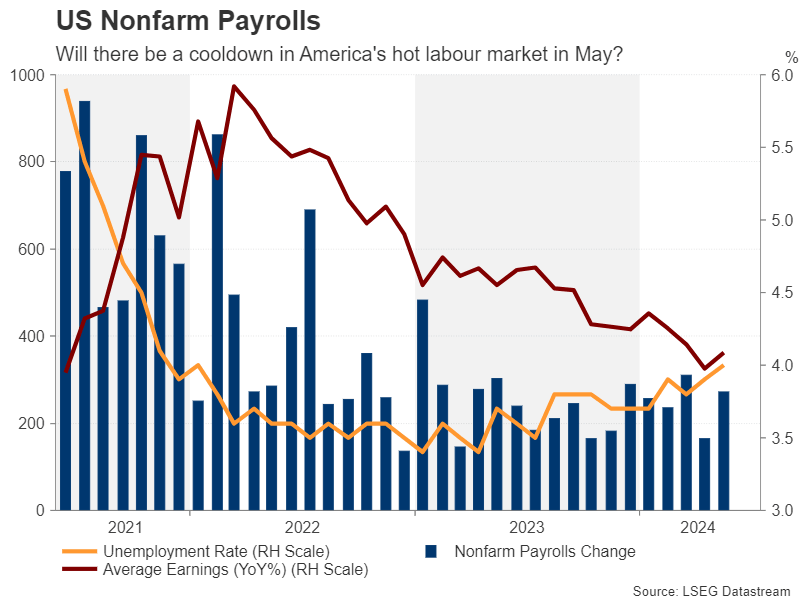

After a run of consistently hot data on inflation and the economy all year, it briefly seemed like the tide was turning for early rate cut hopes. The last two sets of inflation readings were somewhat soft, while recent growth indicators have been a bit patchy. But the optimism didn’t last long as Friday’s nonfarm payrolls report threw a spanner in the works, dashing expectations that the long-anticipated Fed pivot could come as early as the June policy meeting.

The Fed is now not only certain to keep interest rates unchanged on Wednesday, but it’s also likely to maintain its higher for longer stance. The May jobs report has given Federal Open Market Committee (FOMC) members little room to manoeuvre. A payrolls print of 272k is hardly a sign that the labour market or the economy as a whole are in trouble. The slight pickup in yearly wage growth is also slightly concerning.

Making sense of the data

The only ‘relief’ in the jobs numbers was the unexpected increase in the unemployment rate to 4.0%, which broke a 27-month streak of holding below that level. Usually, whenever the payrolls establishment survey diverges from the separate household survey that’s conducted to gauge the jobless rate, one of them tends to get revised.

Hence, policymakers will probably avoid trying to read too much into the data, but at the very least, the May figures have lessened the urgency for a dovish tilt. With the mixed data continuing to cast a cloud over the policy path, the Fed will not want to deviate much from its recent language in the statement.

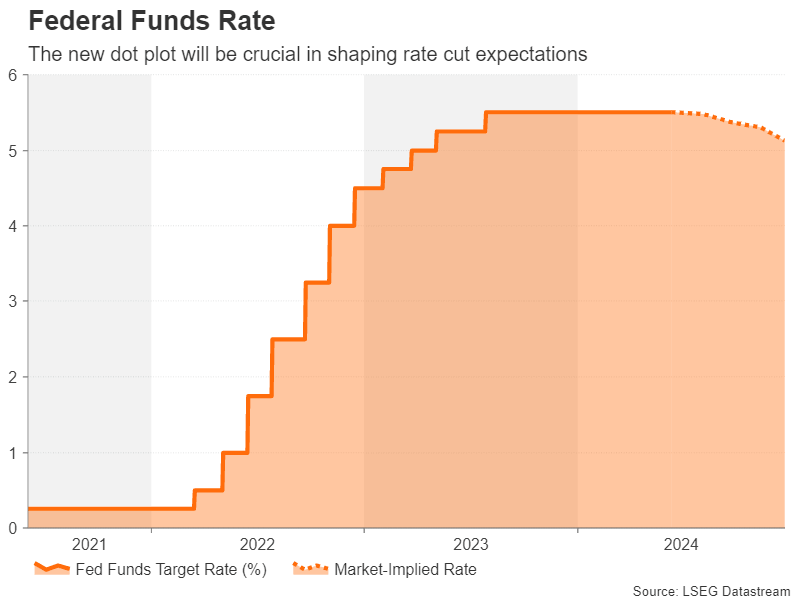

Dot plot: One vs two cuts

However, the central bank will also be publishing updated economic projections, including its famous dot plot. A number of Fed officials have hinted at just one rate cut this year so should the median dot plot point to a single 25-basis-point reduction compared to three in the March dot plot, that would be perceived as a hawkish signal. But if FOMC members pencil in two cuts, that would keep alive hopes of a September move.

At the moment, the odds seem to be swaying towards just one cut, while the markets are caught somewhere between one and two. The CPI numbers to be released earlier in the day could prove decisive for the tone of the statement as well as Chair Powell’s press conference, though they might come too late for influencing the dot plot.

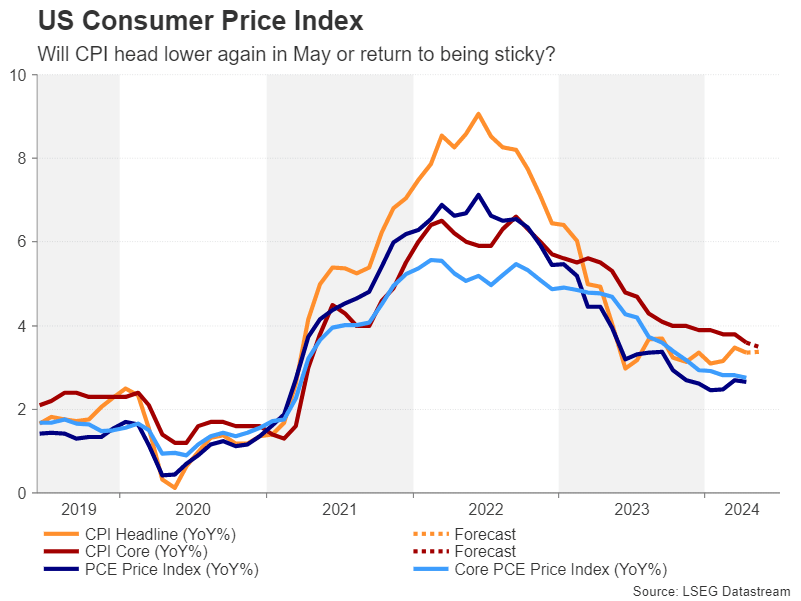

One eye on CPI

After easing to 3.4% y/y in April, headline CPI is forecast to have stayed unchanged in May, although the month-on-month print is expected to have moderated from 0.3% to 0.1%. It’s the opposite case for core CPI, with the month-on-month rate maintaining a 0.3% pace, but the annual rate is forecast to ease from 3.6% to 3.5%.

If the CPI figures are more or less in line with expectations, that would keep the Fed on its current path, which means a September cut is still possible but unlikely unless there’s a significant drop in inflation or a deterioration in the labour market over the summer.

Dollar bulls back in charge

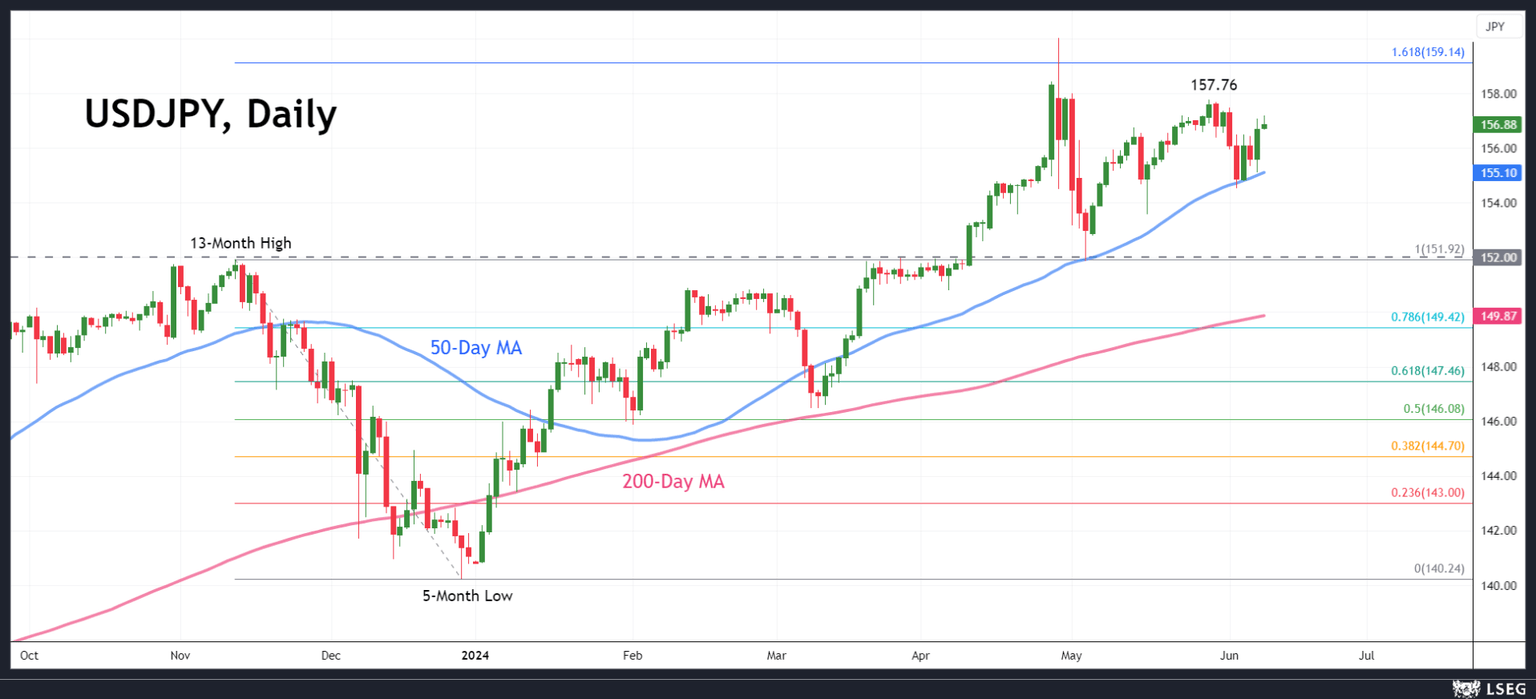

For the US dollar, a reaffirmation of ‘higher for longer’ would help to keep it on the front foot, although against the Japanese yen, investors should also keep an eye on the Bank of Japan policy decision due on Friday.

Last week’s strong ISM services PMI and robust payrolls readings aided the greenback to bounce off the 50-day moving average (MA) and climb back above 156.00 yen. A mostly hawkish outcome on Wednesday could push the pair above the May top of 157.76 before the 161.8% Fibonacci extension of the November-December downtrend comes into view at 159.14.

However, a dovish outcome could push the pair below the 50-day (MA), which would clear the way for a retest of the May low near the 152.00 level.

A lot can happen until September

In a nutshell, there’s a sizeable risk of both a dovish and hawkish surprise at the June meeting depending on how hot or soft the CPI stats are. However, in either scenario the Fed might prefer not to reveal much about its future course of action. After all, there’s still the July meeting to communicate a policy shift before September, not to mention the Jackson Hole symposium in August.

As tempting as it might be for Powell to drop some hints should he get asked to comment on last week’s ECB and Bank of Canada rate cuts, he’ll probably strike a balanced tone as he has done in recent public appearances.

For the markets, the biggest fear is stagflation. But the NFP report just slashed those risks, making a soft landing the base case once again and therefore a panic selloff on Wall Street from upbeat CPI data less likely.

Author

Mr Boyadjian graduated from the London School of Economics in 1999 with a BSc in Business Mathematics and Statistics. Following graduation, he joined PricewaterhouseCoopers in the Business Recoveries team, where he was responsibl