Fault lines open up in the US economy

Fault lines widening in US data,

US Wages

Remain stubbornly firm above pre-Covid rates of growth.

THIS IS IMPORTANT: There is now clear evidence of a wages-inflation spiral having gotten underway.

This is exactly the economic worst case scenario and suggests my already alarming forecasts for Fed rate hikes may well be exceeded. We could see a Fed Funds Rate of above 2% this year.

BREAKING NEWS: Australian Building Permits rose 3.6% last month, but this is after collapsing a staggering 13.6% previously. A disappointing rebound, if any at all to speak of. Down 10% over the past two months.

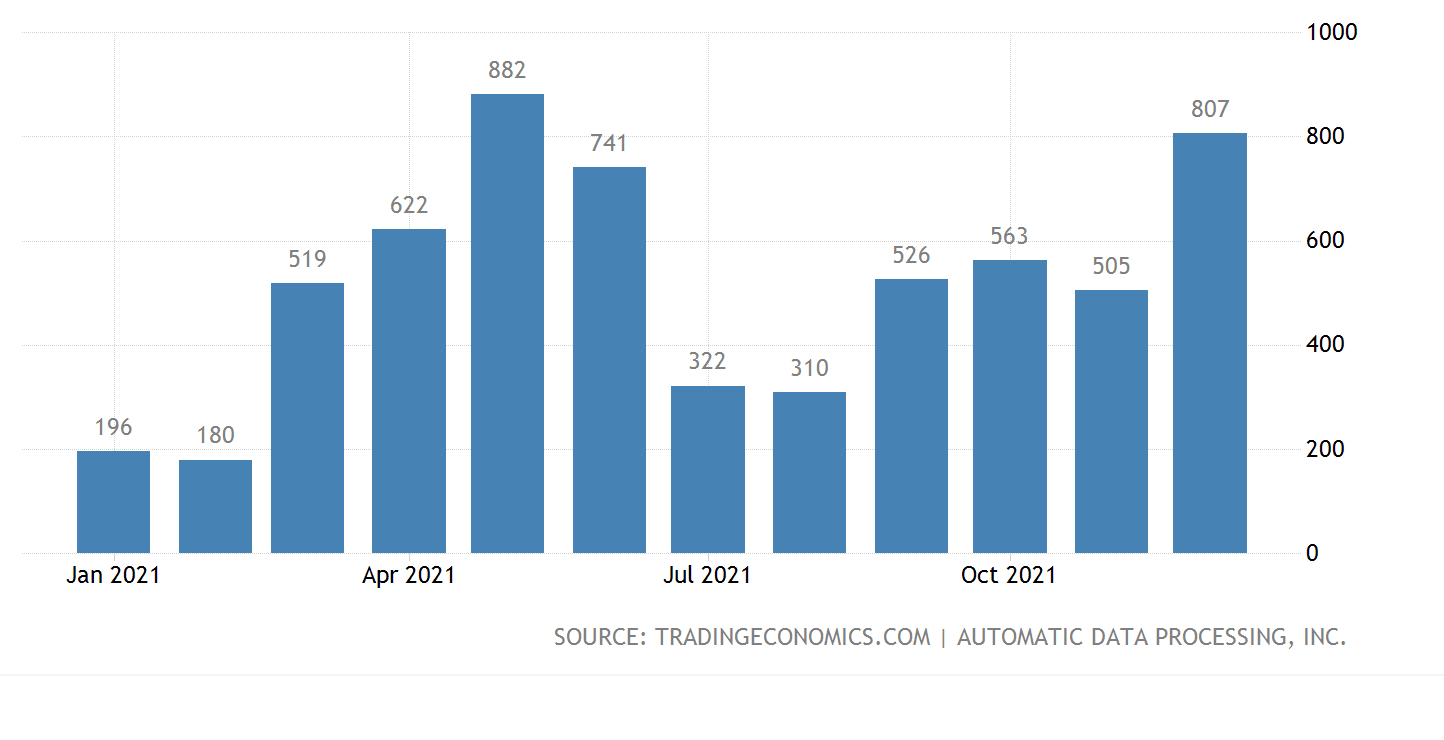

US Jobs Growth

Sinking fast. We have to understand that the flow through effects of Omicron will be substantial. While we can look to a shorter time horizon that Delta, it is still of a degree that can cause further permanent damage to the US economy.

US Consumer Credit

The problem here, is that this may well represent Americans going into greater debt just to tread water. Consumer credit growth has remained stubbornly firm above pre-Covid normal levels and could even be headed to a new high.

US Un-employment

There may be jobs on offer, but few seem that interested. The impact of Covid has been profound in terms of how people want to mange their lives going forward. If they have the finances, why not stay home and sidestep most of the danger of this period. The improvement in the un-employment number is good to see, not quite back to pre-Covid but close. Yet, it is how it is more about the withdrawal of workers that is troubling.

Euro Area Inflation

We have seen a massive shift in upward momentum over the past year. This may begin to wane at some time, but considerable damage is already in place.

Author

Clifford Bennett

Independent Analyst

With over 35 years of economic and market trading experience, Clifford Bennett (aka Big Call Bennett) is an internationally renowned predictor of the global financial markets, earning titles such as the “World’s most a