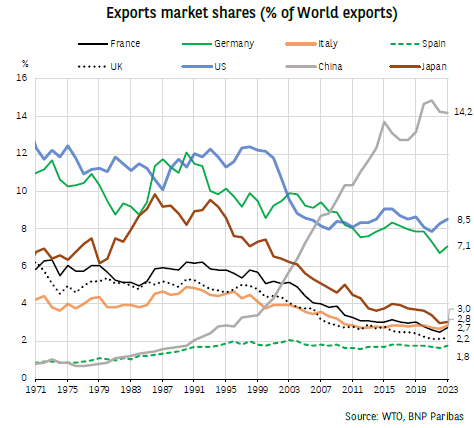

Export market share: Is Germany heading towards a more pronounced slump?

Europe is experiencing a losing trend in market share, due to the growth of other producers (Japan in the 1980s, China subsequently). In Germany, it even increased after the Covid-19 pandemic (-0.7 points in 2023 compared to 2019). The German chemical industry has been hit hard by rising energy prices and increasing competition from China and the US. Its automotive industry (which accounted for 17% of its exports in 2023) is suffering directly from Chinese competition.

By comparison, other European countries have lost market share to a lesser extent in recent years. France underwent significant deindustrialisation from 2000 to 2010 and is now less vulnerable to foreign competition on its residual strengths (aeronautics, luxury). A positive aspect for Europe is that it has recovered its position of a leading supplier of goods and services to the United States as a result of trade tensions between the US and China.

On the US side, after a fairly significant decline in the first half of the 2000s, the United States managed to stabilise its market share at a level close to the one it had 20 years ago (at 8.5% in 2023). This performance is linked to its high R&D expenditure (high technology), as well as other competitive advantages (development of the oil sector and energy prices, in particular). This effort enabled the United States to overtake Germany again in 2010.

After ramping up in the 1990s and joining the WTO in 2001, China continued to develop its positions (+2.5 points between 1990 and 2001, then +6 points over the next decade, +3 points between 2010 and 2019 and +1 point in 2023 compared to the pre-Covid period). Today, the country aims to avoid the «flying geese» dynamic Japan has experienced: take-off, with market share increasing as the country gained its competitive advantage (1970-85), hovering when it reached a peak (1985-95), before landing when other more competitive countries began to nibble into its market share. Although Chinese growth has shown signs of slowing lately, it is maintaining its dominant positions (industrial metals, electrical and electronic equipment) and, above all, is acquiring new ones, in particular through the China 2025 ramp-up strategy.

Author

BNP Paribas Team

BNP Paribas

BNP Paribas Economic Research Department is a worldwide function, part of Corporate and Investment Banking, at the service of both the Bank and its customers.