- GDP expected to rise 9.4% in the third quarter after -11.4% in the second.

- Annual CPI and core CPI forecast to be unchanged at 0.2% and -0.3%.

- ECB fears for slowdown and recession sink euro to near three-month lows.

- Weaker than forecast EMU GDP will undermine euro.

The eurozone economy recovered from its pandemic closure in the third quarter but a second wave of infections and partial shutdowns in Germany and France have reignited fears that the 19-member monetary union and the 27-member EU may be headed for a second recession.

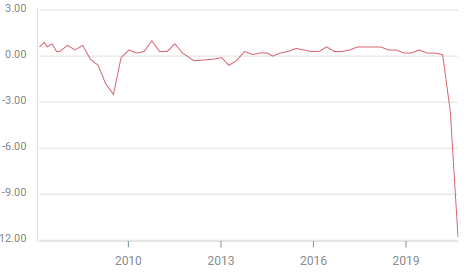

Gross domestic product (GDP), the most encompassing measure of economic activity, is projected to rise 9.4% on the quarter in July August and September after falling 11.4% in the lockdown marred second quarter and 3.6% in the first.

Inflation is expected to be unchanged with the annual consumer price index at 0.2% on the year in October and the core yearly rate at -0.3%.

Eurozone GDP (QoQ)

FXStreet

FXStreet

EU and shutdowns

Rising COVID-19 case rates in many European countries and their own, have prompted the French President Emmanuel Macron and the German Chancellor Angela Merkel to announce new partial closures of their economies in an effort to damp the spread of the virus.

Germany, the EU's largest economy, is expected to have its third straight negative quarter when the July to September GDP figures (YoY) are released on Friday at -5.3%, following -2.2% in Q1 and -11.3% in Q2.

Germany has not had two consecutive negative quarters since the financial crisis and recession of 2008 and 2009 when it suffered five negative quarters in a row (Q4 2009-Q4 2010).

France the second largest economy is forecast to return to expansion in the third quarter at 15.4% (YoY) after two -13.8% and -5.3% in the first six months of the year.

If the closures are prolonged or extended to larger portions of their economies France and the EU would likely see a second recession beginning in the fourth quarter and Germany a year of negative growth.

ECB and the EU economy

The European Central Bank left its policy rates and bond purchase program untouched at its meeting in Frankfurt on Thursday.

It was President Christine Lagarde's pessimistic assessment of the eurozone economy in her press conference afterwards and the likelihood that the bank will have to increase its economic support in December that sent markets hurrying to the safety of the US dollar.

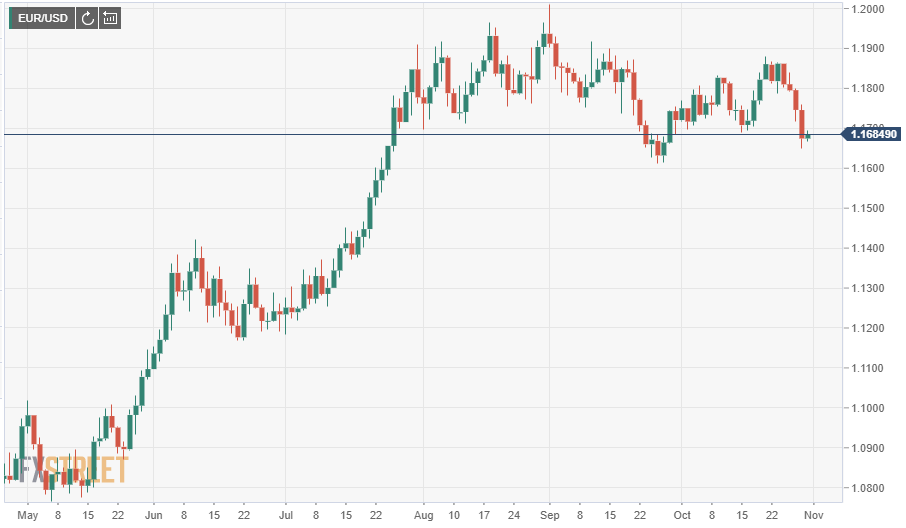

The euro closed at 1.1674 on Thursday , its lowest finish since September 28 and is not just above the three-month low of 1.1632 set close of 1.1632. The greenback rose in all seven major pairs as markets grappled with the potential damage from the European closures and the rising viral counts in the United States.

Conclusion and the markets

Conclusion and the markets

Ms Lagarde has already warned markets that the EU economy is likely to slow enough in the fourth quarter to require additional monetary support. She also made it clear that national governments must raise their fiscal contributions if the economy is to weather the building pandemic impact.

That scenario is now front and center for the euro.

If third quarter GDP is weaker than forecast it will confirm Ms Lagarde's hypothesis and send the euro lower. If it is stronger, the fourth quarter will be worse. The euro can't win.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold rebounds to $2,320 as US yields turn south

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.