Eurozone Target2 economic imbalances soar, this money can't be paid back

Let's check in on Target2 balances in the Eurozone and who owes whom money.

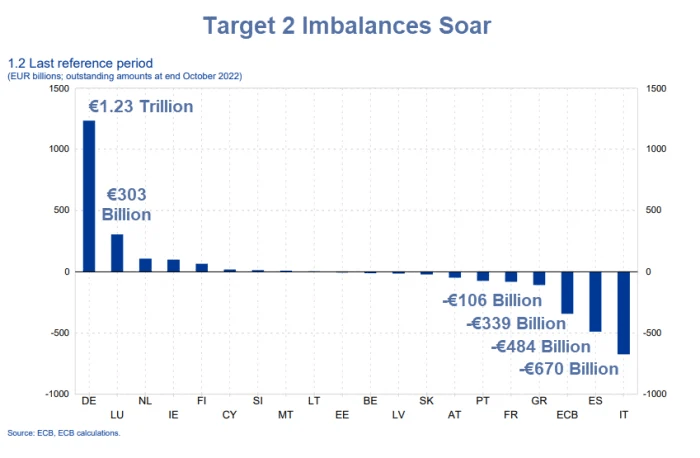

Target 2 balances from the ECB, numbers and caption by Mish

TARGET2 is the real-time gross settlement (RTGS) system owned and operated by the Eurosystem.

The Target2 Lead Chart is courtesy of the ECB. It shows Target 2 creditor and debtor nations.

Tatget2 is one of the fundamental flaws of the Eurozone.

Primary creditors and debtors

-

Target2 surpluses to the tune of €1.23 trillion continue to mount in Germany.

-

Tiny Luxembourg is somehow a €303 billion creditor.

-

The largest Target2 deficit nations are Italy at €670 billion, Spain at €484 billion, the ECB itself at €339 billion, and Greece at €106 billion.

The ECB's imbalance is related to its bond manipulation schemes to keep interest rates down in Italy, Spain, Greece, and the peripheral Eurozone countries in general.

Capital flight

Capital flight is one component of Target2 imbalances.

On the likely assumption that Italian banks are insolvent, no one in their right mind should have money in Italian banks.

Recall the capital controls imposed by the ECB on Greece and Cyprus after bank failures in those countries. Anyone who had money in a bank in Germany had full access to it. Anyone who had money in a Greek bank didn't.

It's increasing likely that corporations and wealthy individuals do not trust Italian banks, nor should they.

Unsecured debt

Unsecured debt is another component of Target2. The ECB assumption is that these debts will be paid back. No one explains how.

The ECB also treats all sovereign bank debt within the Eurozone as equal, and with no risk.

The market disagrees and so do I.

ECB vs Fed

In the US there is one Central Bank. There is a single 10-year government bond.

The Eurozone has the ECB to set interest rate policy, but each nation has its own central bank.

If all Eurozone sovereign debt was indeed equal, then 10-year yields in Italy and Germany would be the same.

Instead, the 10-year rates in Germany and Italy are 1.94% and 3.80% respectively. Huge country-to-country differences are despite massive intervention by the ECB to equalize rates.

Target2 is a kluge payment system that tries to make things fit but does not quite succeed.

It is difficult to say how much of the imbalances are capital flight, debt, and knock-on effects of ECB manipulations.

However, we can see the imbalances grow nearly every month, wondering when and how it finally matters.

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc