Eurozone services showing signs of life

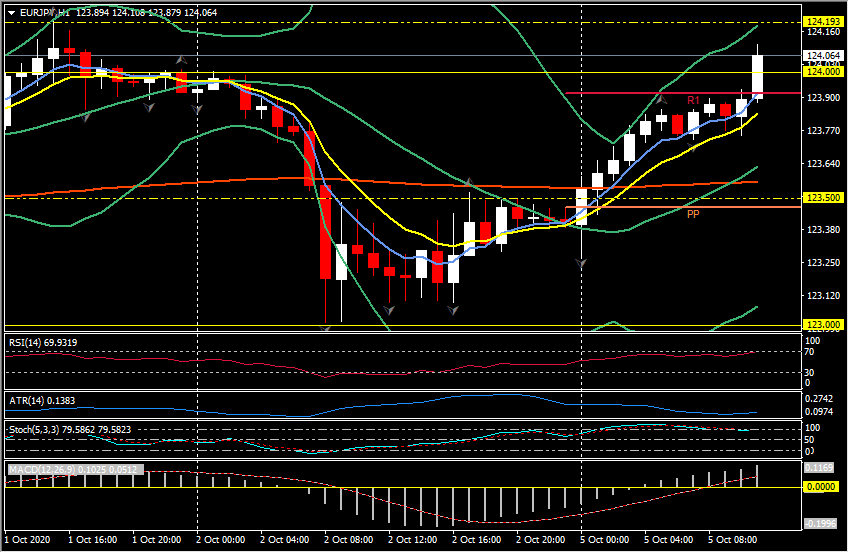

EUR/JPY, H1

Eurozone Services and Composite PMIs revised higher in the final reading for September. The former came in at 48.0, slightly stronger than the 47.6 reported initially, but still reflecting mild contraction in a sector that – even more than manufacturing – is feeling the tightening of virus restrictions amid the resurgence of new cases. Indeed, the numbers pretty much reflect virus developments.

The EUR ticked higher on the positive news, with EURUSD pushing to R1 at 1.1735, EURGBP moving down below 0.9060 and EURJPY breaching 124.00 to recover all of Friday’s losses and test towards Thursday’s high at 124.19.

Author

With over 25 years experience working for a host of globally recognized organisations in the City of London, Stuart Cowell is a passionate advocate of keeping things simple, doing what is probable and understanding how the news, c