European Natural Gas surges as renewed Russia tensions reshape the winter risk landscape

European Natural Gas has entered December with a dramatic shift in tone. Prices have broken decisively above key resistance levels as geopolitical tension with Russia reappears just as the winter demand cycle begins to intensify. The move is not simply a reaction to colder weather or routine seasonal dynamics. It reflects a deeper change in the market’s perception of risk, driven by strategic pressure points that have resurfaced across the European energy system.

For months the narrative in European gas markets was one of comfort. Storage levels were high, LNG flows were stable and early winter forecasts appeared moderate. The market traded in narrow ranges and volatility was subdued. That period is now over.

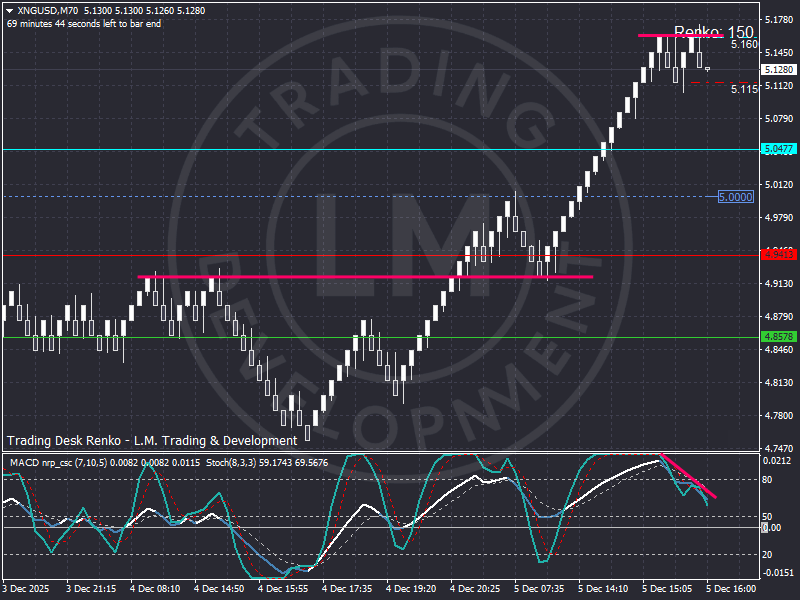

The sudden acceleration in XNGUSD, clearly visible on the Renko chart, shows a market that has shifted from calm to alertness. The rally from the 4.86 region to above 5.15 dollars is sharp, controlled and visibly driven by an external catalyst. That catalyst comes from the geopolitical sphere, where Russia has once again introduced uncertainty into the European energy conversation.

Russia reactivates winter pressure at a strategic moment

Although pipeline flows into Europe have collapsed since 2022, Russia still retains considerable influence over the European gas system. This influence no longer comes from physical deliveries but from the ability to disrupt expectations and inject uncertainty at critical moments of the winter cycle.

In late November and early December Russian officials signaled that they may review the routing and prioritization of LNG exports. These comments were subtle but deliberate. They appear at a time when Europe is heavily dependent on flexible LNG cargoes and when spot markets are extremely sensitive to changes in expected flows. Even without direct action, the suggestion that Russian cargoes could be redirected toward Asia or delayed due to political considerations is enough to shift sentiment.

Alongside these signals, several NATO member states have reported increased Russian presence and surveillance around critical offshore infrastructure, including LNG terminals, power cables and data links in the Baltic and North Atlantic regions. These activities do not imply imminent disruption, but they reinforce the perception that Europe’s energy security remains exposed to non commercial risk.

The timing is meaningful. Winter is approaching, inventories are beginning to draw and the European system is transitioning from comfort to vulnerability. Introducing uncertainty at this moment increases the market’s sensitivity to geopolitical catalysts.

Europe holds strong inventories but remains structurally exposed

European storage levels entering December remain high by historical standards, yet this does not guarantee stability. Storage works as a buffer, not as a shield. It moderates the impact of shocks but does not eliminate the consequences of disruptions or extreme weather.

The deeper vulnerability lies not in inventory levels but in infrastructure and logistics. The European gas system relies on a network of LNG terminals, regasification facilities, transshipment hubs and maritime routes that must operate smoothly through the winter. Any disruption in this chain, whether through adverse weather, technical failures or hostile activity, can create sharp short term imbalances.

Ports in the Netherlands, Belgium and the United Kingdom are already experiencing congestion due to winter scheduling. Several LNG tankers have been forced to slow or adjust arrival windows. These disruptions are minor individually but relevant when combined with geopolitical tension. Europe is no longer insulated from global LNG flows. It is fully integrated and therefore exposed to global risk.

This winter’s risk profile is not a repetition of 2022 or 2023. It is a new configuration in which Europe remains well supplied on paper but vulnerable in real time because the system must remain uninterrupted for months. Market participants have begun to price this fragility, and the recent price action reflects this adjustment.

United States LNG anchors global supply but faces winter constraints

The United States continues to provide the majority of incremental LNG supply to Europe. Production is strong and liquefaction plants are running at high utilization. However, even the US system faces seasonal constraints. Weather disruptions across the Gulf Coast, temporary maintenance schedules and congestion in shipping lanes can limit short term output.

Furthermore, discussions are resurfacing in Washington regarding the need to balance domestic gas prices with export commitments. While no policy change is expected in the near term, the narrative alone is enough to make global markets more sensitive to potential export limitations if domestic prices begin to rise.

These conditions do not threaten the broader supply picture, but they contribute to a winter environment where marginal disruptions matter greatly.

Asia’s role in shaping winter flows

Asian LNG buyers have returned to the market with firmer demand. Japan and South Korea have been actively rebuilding winter supply lines, and China’s utilities have increased spot procurement following colder weather forecasts. The result is a widening premium between JKM and European hubs.

This premium incentivizes some cargoes to divert away from the Atlantic basin. The shift is modest for now, but it adds another layer of tension to a market already influenced by geopolitical uncertainty.

Asia does not need to dramatically increase demand to affect Europe. It only needs to tighten the global balance at the margin. Combined with Russia’s signals and Europe’s infrastructure challenges, the effect is amplified.

Renko structure shows an impulsive breakout with early signs of momentum fatigue

The technical picture on XNGUSD confirms the strength of the current move. The Renko chart shows a powerful rally from the 4.86 support zone, slicing through the 4.93 barrier and breaking above the psychological 5.00 level with no hesitation. The acceleration continued until price met resistance around 5.16 dollars, where the sequence of white bricks began to compress.

The chart captures three important elements.

First, the breakout above 5.00 dollars was clean and decisive. This level had acted as an equilibrium zone for several sessions, and overcoming it signaled a shift from consolidation to trend.

Second, the cluster around 5.15 dollars reveals the first area where sellers have shown resistance. Price has not rejected sharply, but momentum has slowed, indicating that the market is evaluating the next catalyst.

Third, the oscillator shows a clear bearish divergence. While price made higher bricks, the stochastic readings turned downward, forming a lower high. This divergence does not imply reversal on its own, but it signals that the rally may pause or retrace modestly before the next directional move.

Critical levels to monitor include the 5.00 threshold, which now acts as major support, and the 5.16 region, which remains the key resistance. A break above 5.16 dollars would likely invite another leg higher, driven by geopolitical developments or stronger winter demand. A drop below 5.00 dollars would suggest that the market is easing short term risk premium but not invalidating the broader trend.

Why this winter is shaped more by geopolitics than supply

The core message of this market phase is simple. Natural Gas is not rallying because of scarcity. It is rallying because the geopolitical environment has become more sensitive, and Europe’s energy system remains structurally exposed.

The convergence of three forces explains the price behavior.

The first force is Russia’s renewed willingness to influence sentiment through strategic communication and increased activity near critical infrastructure.

The second force is Europe’s heavy dependence on LNG flows that must remain uninterrupted throughout winter.

The third force is the return of Asian competition for cargoes at a moment when global supply chains face seasonal stress.

Together, these forces create a winter environment where geopolitical signals carry more immediate impact than traditional supply and demand metrics.

Conclusion

Natural Gas has entered a new phase of the winter cycle, one defined not by shortages but by geopolitical tension and infrastructure sensitivity. The sharp rally in XNGUSD reflects the market’s repricing of risk as Russia reintroduces uncertainty into a system that cannot afford disruption.

The Renko structure highlights the momentum of this shift. The breakout above 5.00 dollars is technically significant and the early divergence near resistance suggests the market is awaiting confirmation from the next geopolitical or weather catalyst.

This winter will not replicate past crises, but it will test the resilience of Europe’s LNG supply chain and the stability of its energy security architecture. The coming weeks will show whether the recent surge is the beginning of a broader upward phase or a response to a temporary spike in geopolitical pressure.

Author

Luca Mattei

LM Trading & Development

Luca Mattei is a market analyst focusing on FX, metals, and macroeconomic trends. He develops trading tools for retail and professional traders, coding indicators and EAs for MT4/MT5 and strategies in Pine Script for TradingView.