European Central Bank Preview: Small chance President Christine Lagarde delivers a hawkish message

- The European Central Bank is expected to hike benchmark rates by 75 bps.

- European policymakers expected to juggle controlling inflation without slowing economic growth further.

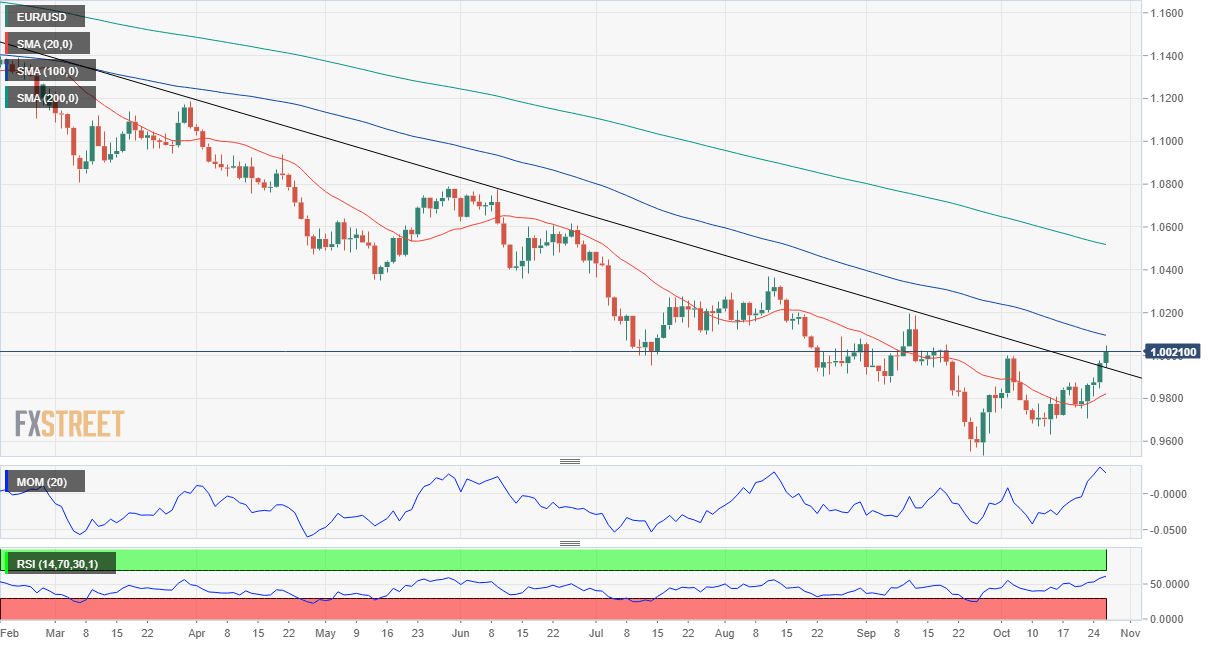

- The EUR/USD pair has recovered above parity ahead of the critical event.

The European Central Bank (ECB) will announce its monetary policy decision next Thursday, and President Christine Lagarde and Co are expected to finally capitulate on their cautious approach to quantitative tightening. Given that the Consumer Price Index (CPI) in the Old Continent keeps reaching record highs, the European central bank will have to grab the bull by the horns and proceed with another 75 bps. The Deposit Facility rate now stands at 0.75%, and the Main Refinancing Rate at 1.25%.

President Lagarde's cautious approach to monetary policy has ended with every single ECB meeting this year read as dovish by speculative interest. Indeed, the ECB started the tightening cycle in July, when the central bank hiked its main benchmark rates by 50 bps, followed by one 75 bps hike in September. Back then, Lagarde warned it could be a one-off, initially supported by European policymakers noting that large rate hikes would not be the norm in the short term.

Hot inflation and tepid growth

However, and up to these days, pressures on the main sources of inflation, energy and food, have not abated. On the contrary, the energy crisis triggered by Moscow’s invasion of Ukraine has pushed the CPI to a record high of 10.9% YoY in September 2022, with food prices rising even higher amid increased fuel and plastic costs.

The Western world has massively sanctioned Russia by cutting off imports from the country, with the latter interrupting gas provisions to Europe. That resulted in skyrocketing energy prices and a boost for the already high CPI. Also, the European Union banned imports of polymer products back in July, used to make plastic packaging.

The ECB stated in September that it “expects to raise interest rates further because inflation remains far too high and is likely to stay above target for an extended period.” Policymakers significantly revised up their inflation projections and inflation is now expected to average 8.1% in 2022, 5.5% in 2023 and 2.3% in 2024.

Meanwhile, the euro area faces a “substantial slowdown in economic growth,” as the statement reads, and the central bank downwardly revised its growth figures, with the economy seen expanding by 3.1% in 2022, 0.9% in 2023 and 1.9% in 2024.

That means that European policymakers are, like all of their overseas counterparts, trapped between a rock and a hard place. Rising inflation coupled with an economic downturn and spiced with aggressive rate hikes is a burden for households and businesses that so far, has only been worsening.

The ECB has to choose whether to maintain an aggressive monetary policy, risk a steeper economic downturn, or go with a moderate stance, which could have no real impact on inflation in the near term. Furthermore, several central banks have delivered several massive rate hikes, which, so far, did not make a dent on soaring inflation.

EUR/USD possible reaction

The EUR/USD pair is on the loose ahead of the release amid an American Dollar sell-off. The pair trades above parity after plummeting to a multi-decade low of 0.9535 earlier in October, as opposed to the ECB, the US Federal Reserve is foreseen slowing the pace of tightening after hiking rates by another 75 bps in November.

If the ECB delivers a modest 50 bps rate hike, EUR will likely fall back below the 1.0000 threshold, with a critical support level at a daily descendant trend line coming from this year's high at 1.1494, now in the 0.9940 price zone. A pullback to the area followed by a quick recovery should confirm an interim bottom in the pair and hint at more gains ahead.

On the other hand, if the ECB actually pulls the trigger by 75 bps but confirms it will slow the pace of tightening from now on, the risk for EUR/USD will also skew to the downside.

Finally, the central bank needs to hike by 75 bps and deliver a hawkish message to provide an additional boost to the pair that could send it beyond 1.0100/20 in the near term. September monthly high comes at 1.0197, an unlikely level to reach post-ECB. Nevertheless, an extension beyond it in the upcoming days should further confirm the end of the bearish trend.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.