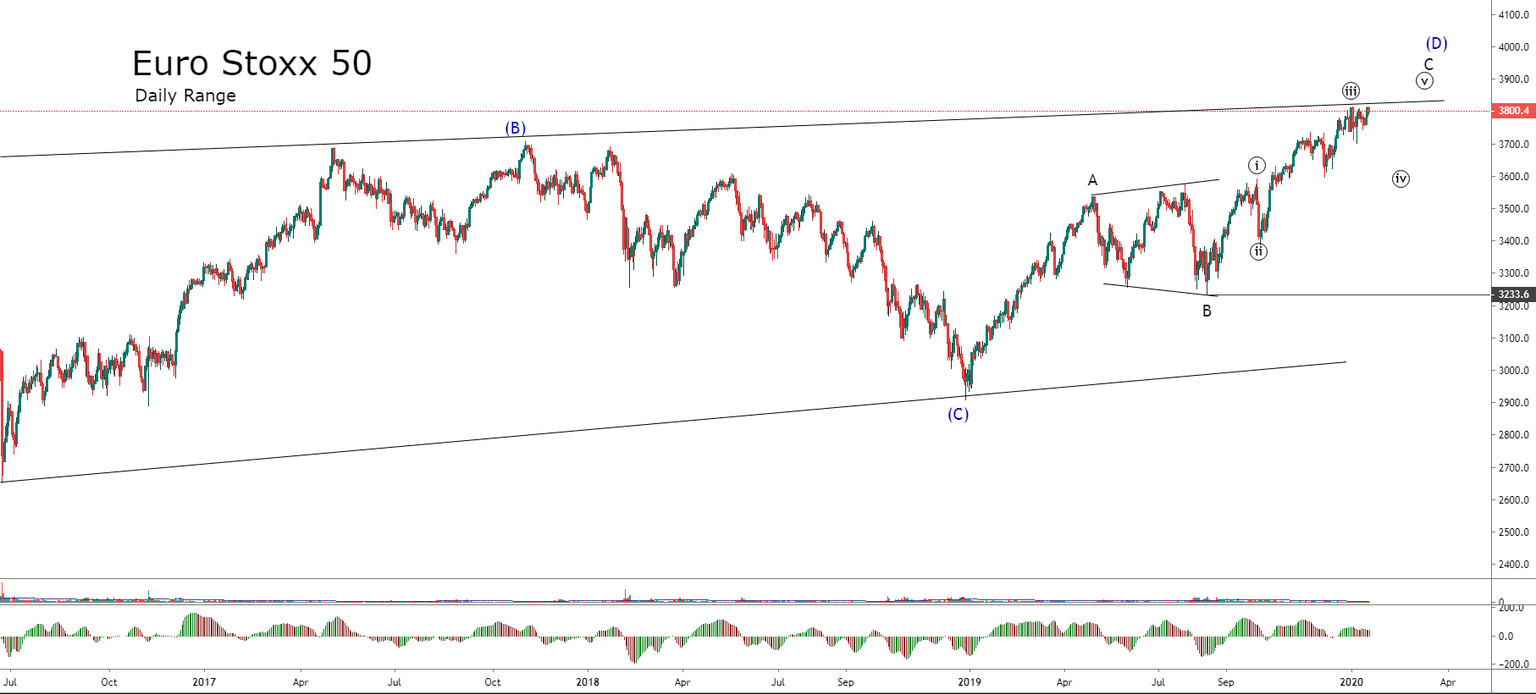

Euro Stoxx 50 Looks for a Short-term Low

The big picture of Euro Stoxx 50, exposes to the Pan-European index running at a potential long-term triangle formation in progress which could develop a new bearish movement soon.

According to the Elliott wave theory, the triangle pattern has five internal segments that hold three internal waves each one; it means a 3-3-3-3-3 sequence.

Currently, the Pan-European index moves in the top of the wave D of Intermediate degree labeled in blue of the triangle pattern. This structure, which seems incomplete, moves in the third internal segment as a wave C of Minor degree marked in green.

As known from the wave theory, wave C must progress in a five-wave sequence. In consequence, the current position suggests that Euro Stoxx 50 could make a retracement soon.

A sell position will trigger if the price drops and closes below 3,788.4 pts. Our conservative outlook foresees a potential first bearish target at 3,768.3 pts.

The downward continuation could drive to the Euro Stoxx 50 index to test the 3,749.1 pts until 3,722.3 pts.

The invalidation of our bearish scenario locates at 3,816 pts.

Trading Plan Summary

-

Entry Level: 3,788.4 pts.

-

Protective Stop: 3,816 pts.

-

1st Profit Target: 3,768.3 pts.

-

2nd Profit Target: 3,749.1 pts.

-

3rd Profit Target: 3,722.3 pts.

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and