Euro edges lower despite stronger German business confidence

The euro is slightly lower on Wednesday. In the European session, EUR/USD is trading at 1.0685, down 0.16%.

German shows signs of optimism

Germany’s Ifo Business Climate index rose to 89.4 in April, up from a revised 87.9 in March and above the market estimate of 88.9. The index is still in negative territory (100 separates pessimism from optimism) but there are signs of optimism that the eurozone’s largest economy may have bottomed out.

The reading marked a third straight increase, which in the past has indicated that the German economy has turned a corner.

Business confidence is now at its highest level since May 2023, boosted by falling inflation and the expectation that the European Central Bank will soon cut interest rates. The German economy is by no means out of the woods yet but the improvement in business confidence is an encouraging sign.

Eurozone PMIs – Services up, manufacturing down

Eurozone and German PMIs for April painted a mixed picture of economic activity, with services improving while manufacturing took a step backwards. The eurozone services PMI improved to 52.9, up from 51.5 in March and above the market estimate of 51.8. The manufacturing PMI fell from 46.1 to 45.6, shy of the market estimate of 46.5.

The German services PMI showed a return to growth after eight straight declines, climbing from 49.8 to 53.3, above the market estimate of 50.6. This is another sign of improvement in the German economy, although manufacturing remains mired in contraction.

Will ECB deliver a series of cuts?

The ECB has signaled that it will start to lower interest rates in June but what happens afterwards is less clear. ECB President Lagarde hasn’t stated what the central bank has planned after June. Some Governing Council members have been more upfront and said they support further cuts before the end of the year. Some members have said they are comfortable with three rate cuts this year but the markets aren’t sure that the ECB will be that aggressive and are no longer fully pricing in three rate cuts this year.

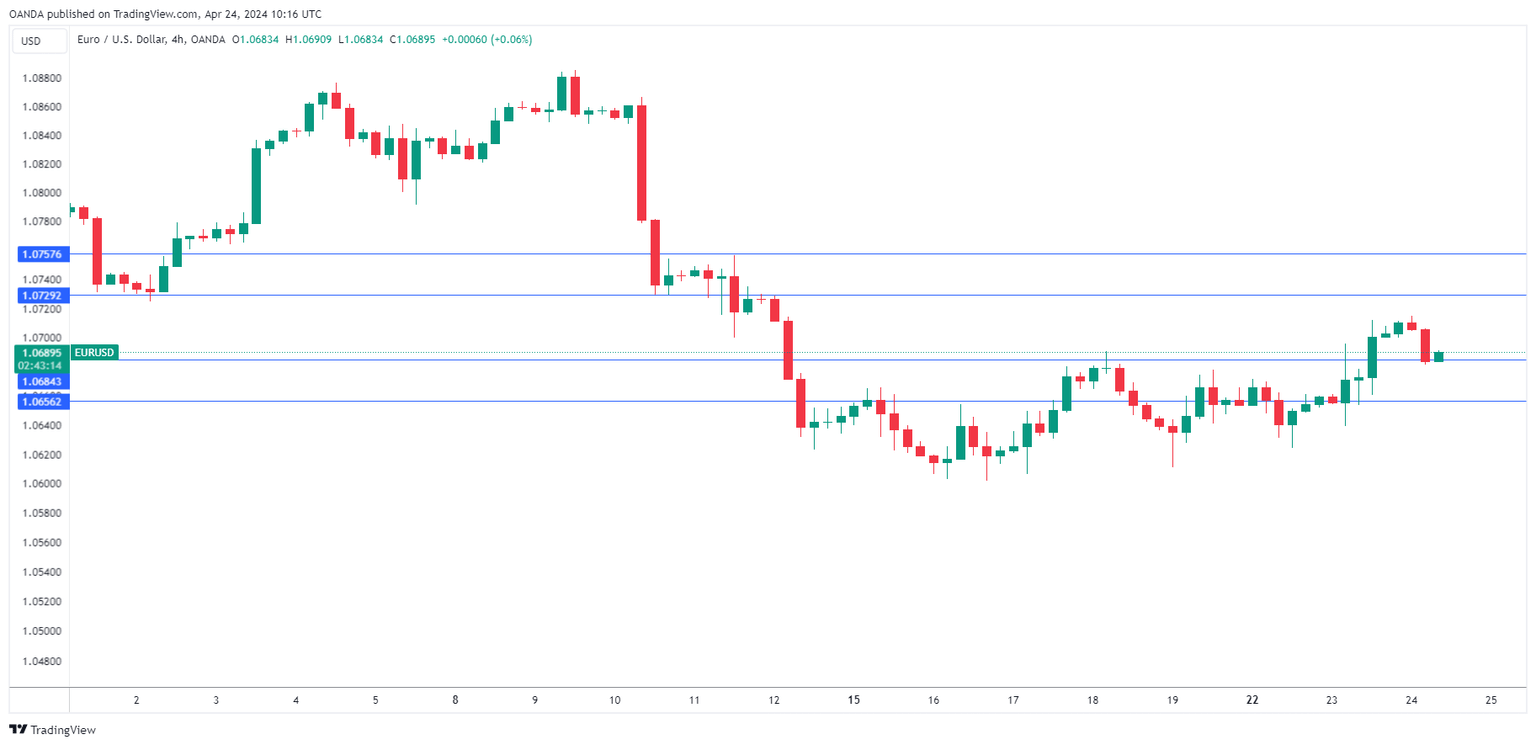

EUR/USD technical

-

There is resistance at 1.0729 and 1.0757

-

EUR/USD is testing support at 1.0684. Below, there is support at 1.0656

Author

Kenny Fisher

MarketPulse

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth Fisher’s daily commentary covers a broad range of markets including forex, equities and commodities.