EUR/USD Weekly Forecast: Trouble in the United States government not enough to take down optimism

- The United States ran out of funding, resulting in furloughs and data cancellation.

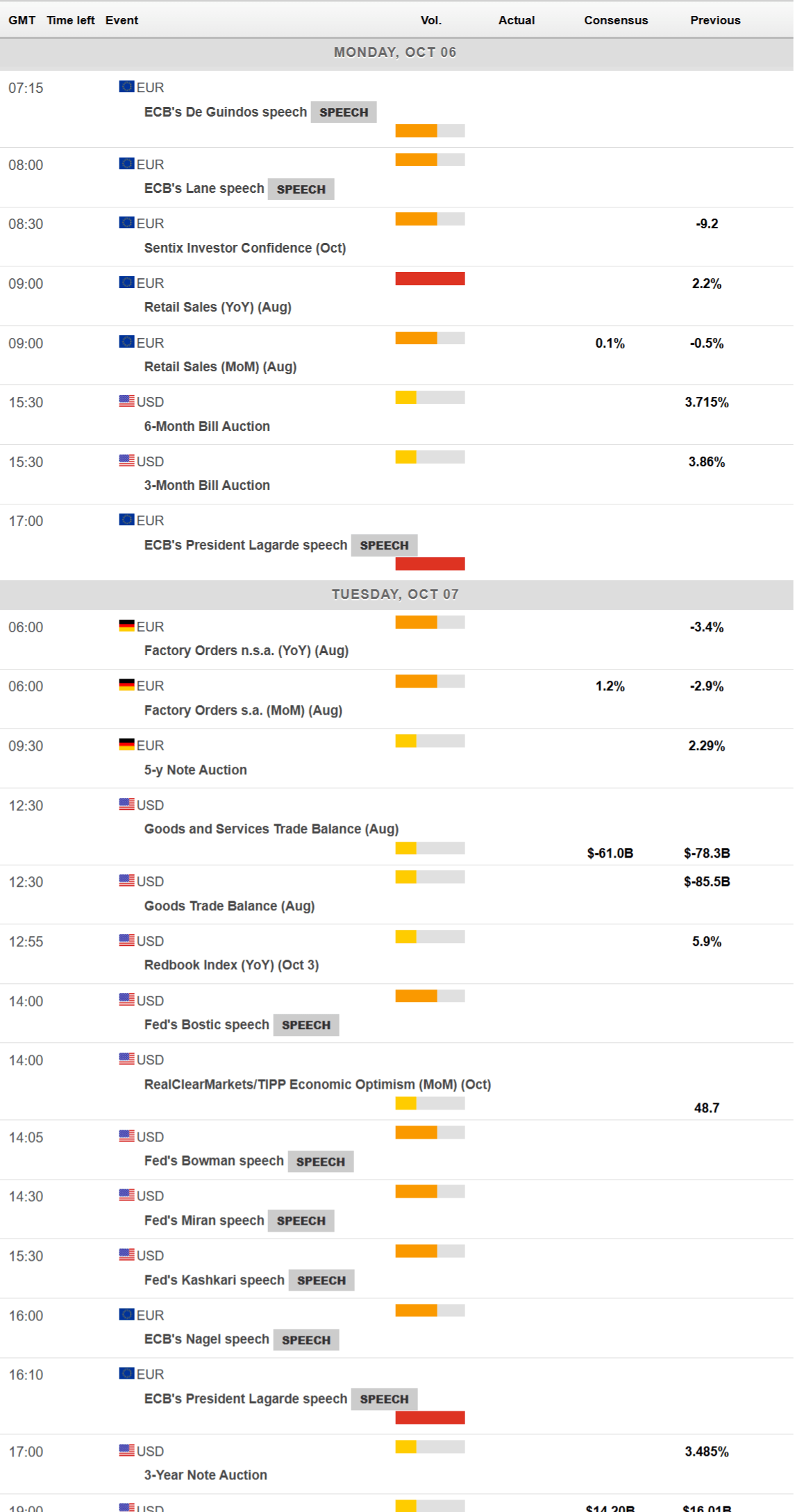

- The European macroeconomic calendar will gain relevance in the upcoming days.

- EUR/USD keeps trading within familiar levels, losing upward momentum but without signs of an imminent slide.

The EUR/USD pair ends the week around the 1.1750 level, having been stuck in a range since early August. Dismissing the peak towards the 2025 high at 1.1918 reached in mid-September, the pair has shown no signs of life.

US government shutdown

The United States (US) shutdown took centre stage at the beginning of the new month. The US federal government ran out of funding before the end of the fiscal year for the first time in seven years, with the latest shutdown taking place under President Donald Trump’s first mandate. It was also the longest one, as it lasted thirty-five days.

A tug of war between Senate Republicans and Democrats over healthcare spending ended in failure to pass a funding bill. Congress negotiations and voting have been extensive throughout the second half of the week, but ended nowhere near a deal.

The shutdown has multiple consequences: On the one hand, the government has furloughed tens of thousands of workers across the country, with a third of the White House staff sent home. Many other federal workers could be laid off in the upcoming days.

On the other hand, the shutdown implies that key federal agencies, such as the Bureau of Labor Statistics (BLS), the Bureau of Economic Analysis (BEA) and the Census Bureau, suspended the collection and distribution of data, although private organizations continued publishing as usual. As a result, most US critical employment figures have not been out.

US weakening labor market

Before the shutdown, the BLS reported that the number of job openings on the last business day of August stood at 7.22 million, according to the JOLTS Job Openings report. The figure followed the 7.2 million openings reported for July and came in above the market expectation of 7.2 million.

Additionally, there were plenty of privately prepared reports hinting at a softening labor market. The ADP Employment Change report showed that the private sector lost 32,000 jobs in September, much worse than the 50,000 new jobs anticipated by market participants. At the same time, the August reading was revised to minus 3,000 compared to the previous estimate of a 54,000 increase. Finally, the Challenger Job Cuts report showed that US-based employers announced 54,064 job cuts in September, a 37% drop from the 85,979 cuts announced in August.

Other than that, the Conference Board reported that the US Consumer Confidence Index fell to 94.2 in September, down from a revised 97.8 in August, and below the 97.0 anticipated by market players.

Also, the Institute for Supply Management (ISM) published the September Purchasing Managers’ Indexes (PMIs). The manufacturing figure came in slightly better than anticipated, printing at 49.1 in September vs expectations of 49 and the previous 48.7. The Services PMI released on Friday showed that activity in the sector declined to 50 from 52 in August. This reading came in below the market expectation of 51.7.

Against all odds, market players remained optimistic, as speculative interest understood these numbers as higher odds for Federal Reserve (Fed) interest rate cuts, to the point that, according to the CME Fed Watch Tool, there is zero chance of an on-hold decision in October and December.

Meanwhile, mixed comments from Fed officials help keep the US Dollar (USD) seesawing between familiar levels. Federal Reserve (Fed) Bank of Dallas President Lorie Logan delivered some hawkish comments that temporarily boosted the Greenback. Logan urged caution on interest rate cuts, citing inflation is running above target and trending higher. Furthermore, Logan noted that the labor market is “only gradually slowing,” and that it remains “fairly balanced,” despite recent discouraging data.

European data backs the European Central Bank's on-hold path

European Central Bank (ECB) President Christine Lagarde spoke at the Bank of Finland's International Monetary Policy Conference on Tuesday, and noted that inflation risks remain quite contained, adding the central bank is well placed to respond if the risks to inflation shift or if new shocks emerge that threaten the ECB's target. Lagarde also repeated that the Eurozone economy is coping with US tariffs better than previously expected.

Inflation-related figures backed her words, as the Eurozone released the preliminary estimate of the September Harmonized Index of Consumer Prices (HICP), which rose at an annualized pace of 2.2%, as expected. Germany’s HICP was slightly higher than anticipated, up at an annualized pace of 2.4%, higher than the 2.2% anticipated and the previous 2.1%. The monthly index printed at 0.2%, surpassing expectations of 0.1%.

At the same time, the Eurozone released the September Economic Sentiment Indicator, which improved to 95.5 from a revised 95.3.

What to expect next

The US government shutdown is likely to continue until mid-October, when the military and federal pay runs out. Until then, lawmakers will have no rush to clinch a deal, which means more data will be canceled and uncertainty will remain. Nevertheless, as long as market players believe the Fed will remain on the loosening path, markets seem comfortable.

In the upcoming days, the focus will shift to Fed speakers and any hint they can deliver on monetary policy. Additionally, the Federal Open Market Committee (FOMC) will release the Minutes of the September meeting on Wednesday. Finally, the preliminary estimate of the October Michigan Consumer Sentiment Index will be out on Friday.

The Eurozone will release the October Sentix Investor Confidence index and August Retail Sales on Monday, while different ECB officials, including President Christine Lagarde, will be on the wires throughout the week.

EUR/USD technical outlook

The weekly chart for the EUR/USD pair shows that it holds within a well-defined range, failing to find a clear direction since early August. Still, the same chart shows the pair develops above all its moving averages, with a bullish 20 Simple Moving Average (SMA) providing relevant support at around 1.1634. At the same time, the 100 SMA extends its advance above a flat 200 SMA, although far below the shorter one. Meanwhile, the Momentum indicator eased towards its midline, reflecting the lack of buying interest rather than suggesting an upcoming decline. The Relative Strength Index (RSI) indicator supports this view, consolidating near overbought levels.

On a daily basis, the EUR/USD pair is neutral. Technical indicators are seesawing around their midlines without clear directional strength, while selling interest rejects advances throughout the week around a flat 20 SMA in the 1.1750 price zone. The 100 SMA, in the meantime, grinds higher with limited strength at around 1.1615, acting as an inflection point.

EUR/USD will find strong resistance initially around 1.1830, with a break above the level exposing the year peak in the 1.1920 area. Further advances could result in a test of the 1.2000 mark. Below the 1.1610 - 1.1630 area, on the other hand, the downward momentum is likely to increase, with interim support at 1.0450 ahead of the July low at 1.1391.

Risk sentiment FAQs

In the world of financial jargon the two widely used terms “risk-on” and “risk off'' refer to the level of risk that investors are willing to stomach during the period referenced. In a “risk-on” market, investors are optimistic about the future and more willing to buy risky assets. In a “risk-off” market investors start to ‘play it safe’ because they are worried about the future, and therefore buy less risky assets that are more certain of bringing a return, even if it is relatively modest.

Typically, during periods of “risk-on”, stock markets will rise, most commodities – except Gold – will also gain in value, since they benefit from a positive growth outlook. The currencies of nations that are heavy commodity exporters strengthen because of increased demand, and Cryptocurrencies rise. In a “risk-off” market, Bonds go up – especially major government Bonds – Gold shines, and safe-haven currencies such as the Japanese Yen, Swiss Franc and US Dollar all benefit.

The Australian Dollar (AUD), the Canadian Dollar (CAD), the New Zealand Dollar (NZD) and minor FX like the Ruble (RUB) and the South African Rand (ZAR), all tend to rise in markets that are “risk-on”. This is because the economies of these currencies are heavily reliant on commodity exports for growth, and commodities tend to rise in price during risk-on periods. This is because investors foresee greater demand for raw materials in the future due to heightened economic activity.

The major currencies that tend to rise during periods of “risk-off” are the US Dollar (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Dollar, because it is the world’s reserve currency, and because in times of crisis investors buy US government debt, which is seen as safe because the largest economy in the world is unlikely to default. The Yen, from increased demand for Japanese government bonds, because a high proportion are held by domestic investors who are unlikely to dump them – even in a crisis. The Swiss Franc, because strict Swiss banking laws offer investors enhanced capital protection.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.