EUR/USD Weekly Forecast: European Central Bank decision, US Nonfarm Payrolls report coming next

- The European Central Bank will meet on Thursday, and rate cuts are priced in.

- The focus in the United States will be on employment data ahead of the Nonfarm Payrolls report.

- The EUR/USD pair's long-term perspective turned neutral after spending three weeks below 1.0900.

The EUR/USD pair spent most of the week within familiar levels, partially due to the lack of relevant macroeconomic data throughout the first half of the week and partly amid comments from different Federal Reserve (Fed) officials. American policymakers kept putting efforts into cooling down hopes for interest rate cuts, keeping markets in risk-averse mode. Across the pond, European Central Bank (ECB) representatives maintained their willingness to trim interest rates in June, but warned a July cut is far from granted.

But financial markets got some interesting clues beyond central banks’ well-known messages. The focus was on inflation-related figures, which helped EUR/USD to near the 1.0900 threshold by the end of the week.

Inflation supporting central banks’ stances

Germany reported that the Harmonized Index of Consumer Prices (HICP) rose 0.2% MoM, meeting expectations, while the annual HICP increased 2.8%, accelerating from the previous 2.4% and above the market’s estimate of 2.7%. Also, the Eurozone HICP rose more than anticipated in May, as the annual figure resulted at 2.6%, higher than the previous 2.4%.

Finally on Friday, the United States (US) unveiled the April Personal Consumption Expenditures (PCE) Price Index. Most readings matched previous readings and forecasts, with annual inflation holding steady at 2.7%. On a positive note, the Bureau of Economic Analysis reported monthly inflation was up 0.3%, as expected, but the core reading was slightly below expected.

US April PCE inflation brought modest relief to financial markets, but make no mistake. Such numbers fall way short of twisting Fed officials’ hands. A rate cut in the United States before September is still out of the table.

European Central Bank rate cut coming

Things can turn more interesting next week as the June ECB meeting arrives: The central bank will announce its decision on Thursday, and markets are eagerly awaiting confirmation of the monetary policy loosening process. The Governing Council is expected to cut 25 basis points (bps) for every one of the main refinancing operations, the deposit facility and the marginal lending facility. The latest Eurozone inflation figures support the case. It is worth adding the decision has been long ago priced in, but that does not mean financial markets won’t react to the announcement.

The rate cut itself could send the Euro roughly 100 pips down against the US Dollar as an initial reaction. The following movements will depend on ECB President Christine Lagarde's words and policymakers' views, as reflected by the accompanying statement. Whatever they anticipate for the future, or not, could determine the Euro’s trend for the next week. The Fed, however, will meet just one week later, on June 12, which means speculative interest will quickly move into building expectations for such even after the ECB’s decision is made.

Busy United States docket

Meanwhile, the US calendar will be flooded with employment-related figures. The country will release the April JOLTS Jobs Openings report on Tuesday, the May ADP survey on private job creation on Wednesday and Challenger Job Cuts alongside weekly unemployment figures on Thursday. All the readings come as an anticipation of the Nonfarm Payrolls (NFP) report to be out on Friday. The Unemployment Rate stood at 3.9% in April, and market players will be looking for signs of a loosening labor market.

Other than that, the US will release the ISM Manufacturing PMI on Monday and the ISM Services PMI on Wednesday.

EUR/USD technical outlook

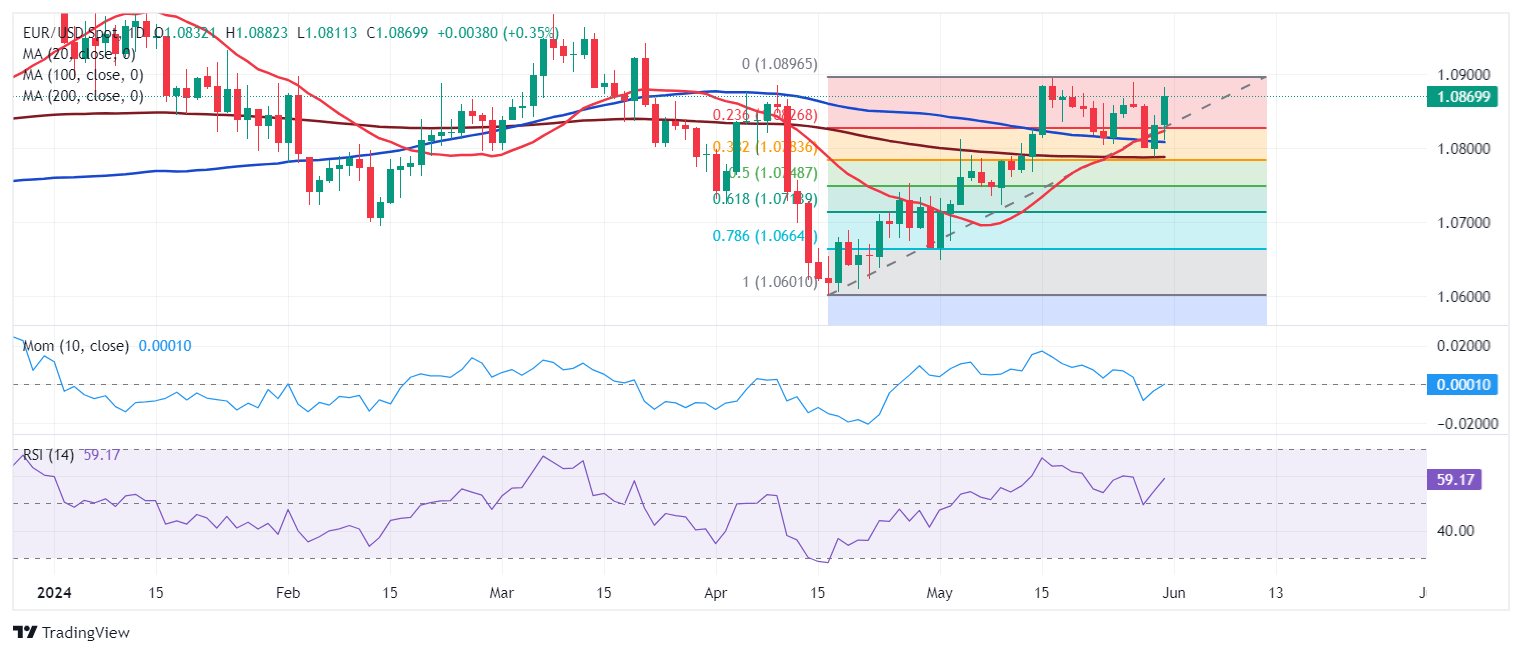

The EUR/USD pair has been trading below 1.0900 for a third consecutive week, confined to a quite limited range. The pair has remained below the level since mid-March, establishing a 2024 low at 1.0600 in April. The recovery from the latter has been tepid and painful ahead of June central banks’ announcements.

As a result, the weekly chart offers a neutral stance. EUR/USD keeps hovering around a flat 20 Simple Moving Average (SMA), currently at around 1.0810. At the same time, the pair is midway between flat 100 and 200 SMAs, with the shorter one providing dynamic support at around 1.0640. Technical indicators, in the meantime, head nowhere around their midlines, reflecting the absence of directional momentum.

The EUR/USD pair’s daily chart shows that it met buyers at around 1.0782, the 38.2% Fibonacci retracement of the latest bullish run measured between 1.0600 and 1.0894. Overall, the pair is bullish, as it is developing above all its moving averages, with the 20 SMA maintaining its bullish slope after crossing above the longer ones, which anyway remain directionless. Finally, technical indicators have bounced from around their midlines and aim higher with limited strength, still signaling buyers are in the driver’s seat.

A break through the higher end of the range should encourage bulls and push EUR/USD towards the 1.0980-1.1000 region. Once beyond the latter, the advance can continue towards the 1.1120 price zone.

The aforementioned Fibonacci support level should contain declines and keep attracting buyers to maintain bullish hopes alive. Below it, however, the pair can fall initially towards the 1.0700 price zone before attempting a test of the year low.

ECB FAQs

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy for the region. The ECB primary mandate is to maintain price stability, which means keeping inflation at around 2%. Its primary tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

In extreme situations, the European Central Bank can enact a policy tool called Quantitative Easing. QE is the process by which the ECB prints Euros and uses them to buy assets – usually government or corporate bonds – from banks and other financial institutions. QE usually results in a weaker Euro. QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The ECB used it during the Great Financial Crisis in 2009-11, in 2015 when inflation remained stubbornly low, as well as during the covid pandemic.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the European Central Bank (ECB) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the ECB stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Euro.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.