EUR/USD: The sell-off on the dollar is similar to the sell-off on the yen last week [Video]

![EUR/USD: The sell-off on the dollar is similar to the sell-off on the yen last week [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/EURUSD/colorful-euro-banknotes-3397150_XtraLarge.jpg)

EUR/USD

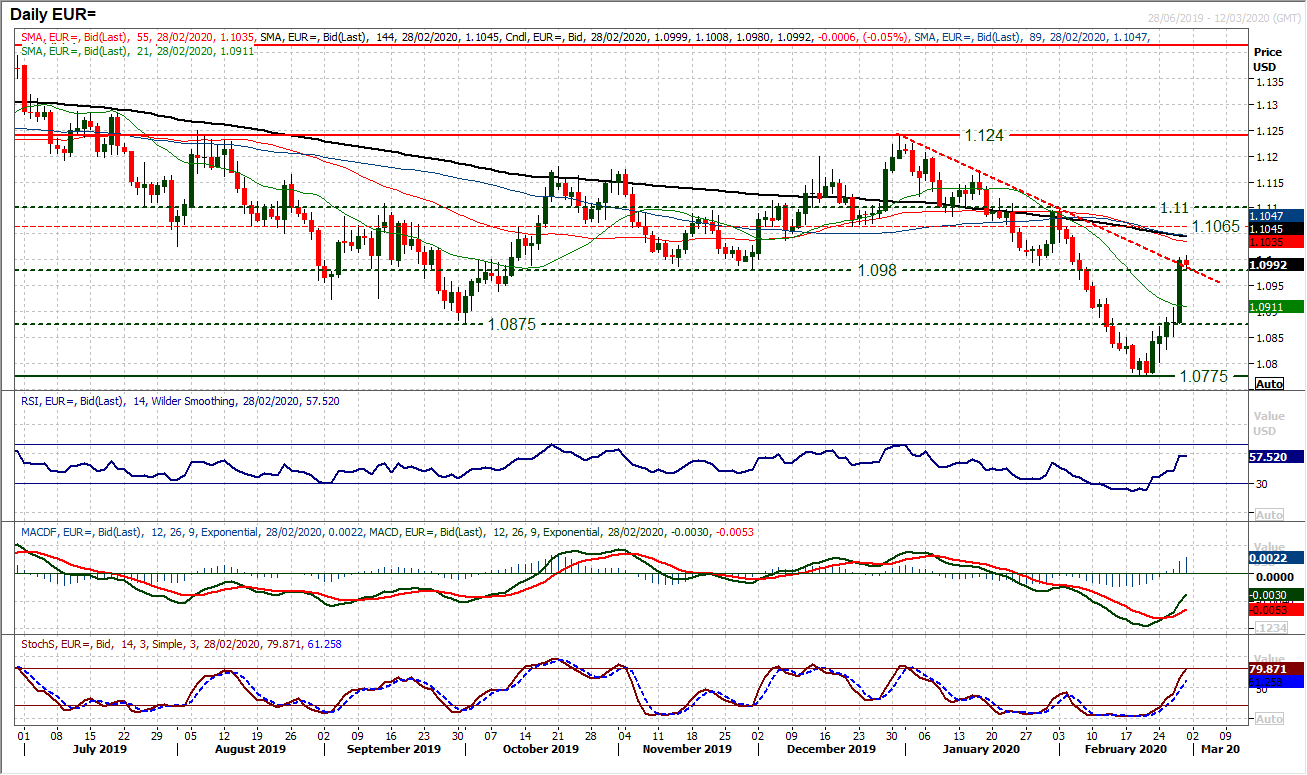

The euro was already engaging a technical recovery, but the gains seen in yesterday’s session would have surprised even the more positive of traders. Adding +118 pips on the session was the biggest one day rise on EUR/USD since January 2019. The technical rally accelerated through key resistance at $1.0980 and also broke an eight week downtrend. With RSI into the high-50s, MACD and Stochastics accelerating higher, the bulls are in control, for now. However, we would caution backing against the dollar for too long here. The sell-off on the dollar is similar to the sell-off on the yen last week, a move which quickly unwound. We have been seeing a technical rally on EUR/USD as counter-trend and a move which is likely to be short term in duration. The move has gone further than we anticipated, but technically, the outlook is still corrective on a medium term basis. Old resistance is at $1.1065/$1.1100 with falling moving averages overhead. A move above $1.1100 which is a lower high, would change the outlook, but this is still likely to be a short term rebound that hits the buffers once more. Initial support at $1.0965.

Author

Richard Perry

Independent Analyst