EUR/USD: The bear is on its way

EUR/USD has continued being bearish on the daily chart. After having a rejection at a Double Top resistance, the price has breached the neckline level as well. Thus, the price may head towards the South with more selling pressure. Let us have a look at the daily chart.

Chart 1 EUR/USD Daily Chart

The price produced an engulfing daily candle right at the resistance where it had a rejection earlier. Thus, it was very much on the card that the price would come at the neckline level. It did and continued its bearish journey by making a breakout at the neckline level. The daily chart trader may want to wait for consolidation and a bearish reversal candle at the neckline level to go short on the pair. If that happens, the pair may remain bearish for a few days. It may find its next support at the level of 1.0950 if things go according to this calculation.

Let us observe the H4 chart.

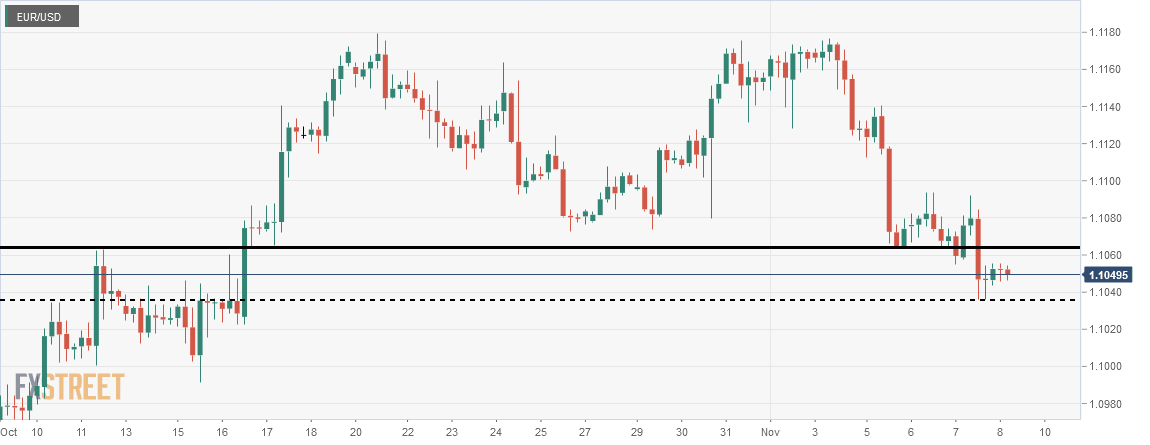

Chart 2 EUR/USD H4 Chart

The H4 chart shows that the price is on consolidation. The level of 1.1050 holds the price on the H4 chart as of writing. It may not be able to hold the price. The price was about to make a breakout but went back into the previous support. However, if it produces an H4 bearish reversal candle along with a breakout at 1.1035, the H4 sellers may go short on the pair. The chart suggests that the level of 1.1065 may be tested by the price. It may hold the price and produce the bearish momentum that the H4 traders have been waiting to get.

Let us find out what the H1 chart suggests.

Chart 2 EUR/USD H1 Chart

The H1 chart suggests that the level of 1.1060 may be the flipped resistance. The price made an explicit breakout at that level earlier. As of writing, the price is adjacent to the level. An H1 bearish reversal candle, along with a breakout at the level of 1.1035, may attract the H1 traders to drive the price towards the South.

The daily chart is bearish but may take some time to make a stronger bearish move. The H4 and the H1 chart look very good for the sellers, though. If they remain bearish for the whole day today, the weekly candle is going to close as a bearish engulfing candle, which may make the sellers have the upper hand in the next week.

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and