EUR/USD Price Forecast: Upbeat US data boost US Dollar demand

EUR/USD Current price: 1.1785

- United States weekly unemployment claims unexpectedly contracted last week.

- Market players keep digesting the latest Federal Reserve monetary policy decision.

- EUR/USD failed to retain the 1.1800 threshold and aims to challenge weekly lows.

The EUR/USD pair eases below the 1.1800 early in the American session on Thursday, as market players keep digesting the United States (US) Federal Reserve (Fed) monetary policy announcement. The Fed cut the benchmark interest rate on Wednesday by 25 basis points as expected, and hinted at two more interest rate cuts before the year's end through the dot-plot, or Summary of Economic Projections (SEP), also matching the market’s expectations.

However, policymakers still anticipate just one interest rate cut for 2026, and reaffirmed their cautious approach to rate cuts, slightly more hawkish than what the market would prefer. The US Dollar (USD) initially fell, but managed to end the day with gains, despite resurgent optimism among market participants.

The Greenback edged marginally lower throughout the first half of the day, but gained upward traction following the release of encouraging US employment data: Initial Jobless Claims for the week ended September 13 rose by 231K, better than the 240K anticipated and easing from the previous 264K. Also, the Philadelphia Fed Manufacturing Survey surged to 23.2 from the previous -0.3 while largely surpassing the expected 2.3.

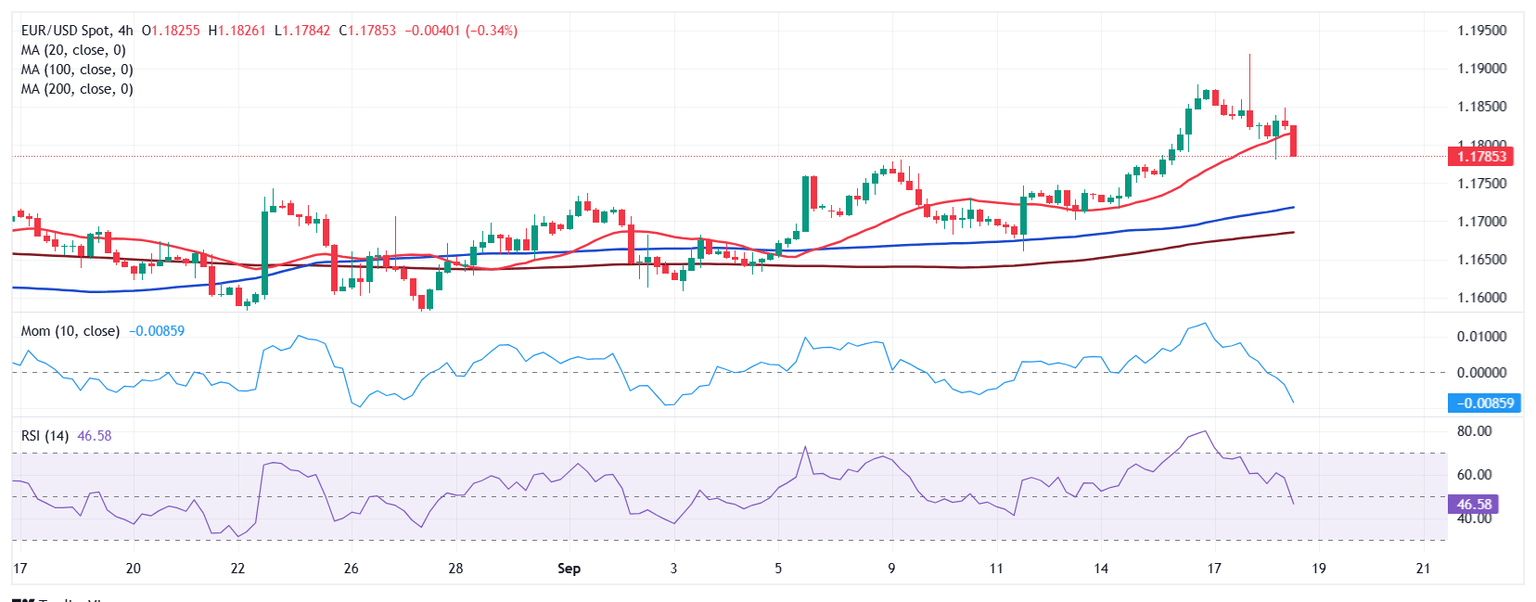

EUR/USD short-term technical outlook

The daily chart for the EUR/USD pair shows it trades in the red for a second consecutive day, but it is still far from bearish. Technical indicators turned south, but hold within positive levels, while EUR/USD develops above all its moving averages. The 20 Simple Moving Average (SMA) provides immediate support at around 1.1710, while the 100 SMA stands at around 1.1560 with a neutral-to-bullish slope.

The near-term picture hints at potential declines in the upcoming sessions. The 4-hour chart shows that the pair seesawed around a bullish 20 SMA before finally settling below it, now in the 1.1810 region. At the same time, technical indicators aim south within negative levels, hinting at lower lows ahead. Finally, the 100 and 200 SMAs aim modestly higher, far below the current level, limiting the mid-term bearish potential of EUR/USD.

Support levels: 1.1780 1.1740 1.1705

Resistance levels: 1.1810 1.1845 1.1890

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.