EUR/USD Price Forecast: United States inflation data hints at three rate cuts in 2025

EUR/USD Current price: 1.1736

- The European Central Bank kept benchmark interest rates on hold in its September meeting.

- The US Consumer Price Index showed inflation stood at 2.9% YoY in August.

- EUR/USD holds on to intraday gains above 1.1700, still misses directional strength.

The EUR/USD pair trades near an intraday high of 1.1746, after falling to a low of 1.1660 during European trading hours. The pair saw little action throughout the first half of Thursday, as market participants were waiting for first-tier events.

The first one was the European Central Bank (ECB), which announced its decision on monetary policy after a two-day meeting. As widely anticipated, the central bank left interest rates unchanged. Policymakers also presented fresh economic projections, with a downward revision to the growth forecast pushing EUR/USD towards the mentioned intraday low.

Things take a turn quickly as the United States (US) unveiled the August Consumer Price Index (CPI). The index rose to 2.9% year-on-year (YoY), as expected, while the core annual reading also met the forecast at 3.1%. On a monthly basis, however, the CPI rose 0.4% following the 0.2% increase recorded in July and was higher than the 0.3% anticipated by market players.

Additionally, the US reported that Initial Jobless Claims for the week ended September 6 edged sharply higher, up to 263K from the previous 236K and much higher than the expected 235K.

Poor employment figures and sticky inflation data took their toll on the US Dollar (USD), pushing it lower against all its major rivals as the figures fueled speculation that the Federal Reserve (Fed) will deliver interest rate cuts in the next three monetary policy meetings to a total of 75 basis points (bps) before year-end.

Friday will be lighter in terms of data releases, as Germany will publish the final estimate of the August Harmonized Index of Consumer Prices (HICP), expected to be confirmed at 2.1% YoY, while the US will offer the preliminary estimate of the September Michigan Consumer Sentiment Index. The report also includes one-year and five-year inflation expectations, which are interesting ahead of the Fed’s meeting next week.

EUR/USD short-term technical outlook

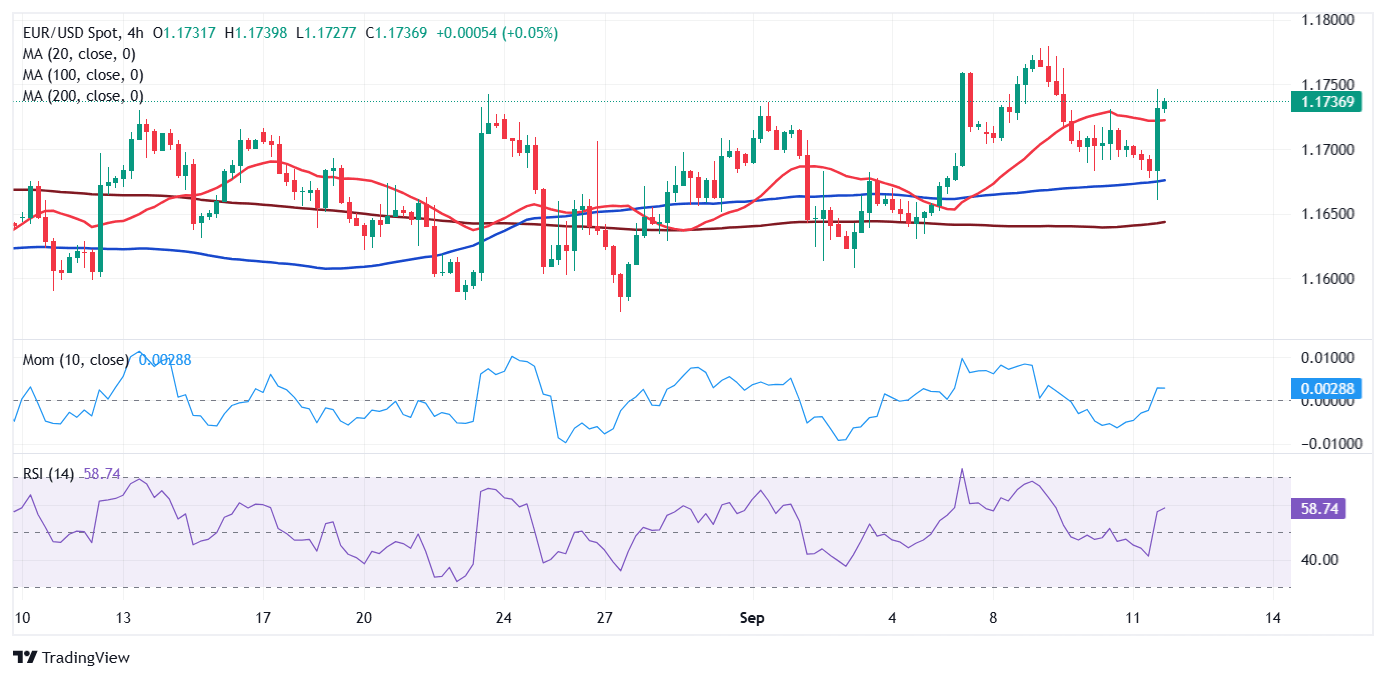

From a technical point of view, the daily chart for the EUR/USD pair shows it keeps trading within familiar levels, finding buyers after briefly piercing a flat 20 Simple Moving Average (SMA) currently at around 1.1670. At the same time, technical indicators head nowhere within neutral levels, reflecting the long-lasting range in the current price zone.

The near-term picture turned neutral. In the 4-hour chart, the EUR/USD pair established above a now flat 20 SMA, now providing near-term support in the 1.1720 area. The longer moving averages are directionless below the shorter one, in line with the absence of clear directional strength. Finally, technical indicators have turned flat at around their midlines, failing to provide clear directional clues.

Support levels: 1.1720 1.1670 1.1630

Resistance levels: 1.1775 1.1830 1.1880

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.