EUR/USD Price Forecast: United States government shut down weighs on the US Dollar

EUR/USD Current price: 1.1745

- Political tensions in the United States undermine the market’s mood.

- The macroeconomic calendar is packed with US employment data this week.

- EUR/USD battles to overcome the 1.1750 level, trades with a neutral stance.

The EUR/USD pair trades at around 1.1750, recovering ground for a second consecutive day amid diminished demand for the US Dollar (USD). The market mood soured amid the lack of progress in the United States (US) Congress towards a funding bill. The government heads for yet another shutdown by midnight Wednesday if Democrats and Republican lawmakers continue in this stalemate.

Meanwhile, the macroeconomic calendar will be packed with US employment data, critical for the Federal Reserve (Fed). One of the associated risks of a government shutdown is the delay, and in some cases, the suspension of data collection and reporting. The upcoming Nonfarm Payrolls (NFP) report, scheduled for release on Friday, may not be ready in time, potentially resulting in additional risk-off sentiment across financial markets.

Other than that, the week will feature fresh German and Eurozone inflation updates, as both will publish the preliminary estimates of the Harmonized Index of Consumer Prices (HICP).

As of Monday, the EU released the September Economic Sentiment Indicator, which improved to 95.5 from a revised 95.3. The US will publish minor figures, August Pending Home Sales, and the September Dallas Fed Manufacturing Business Index. Also, multiple Fed speakers will hit the wires.

EUR/USD short-term technical outlook

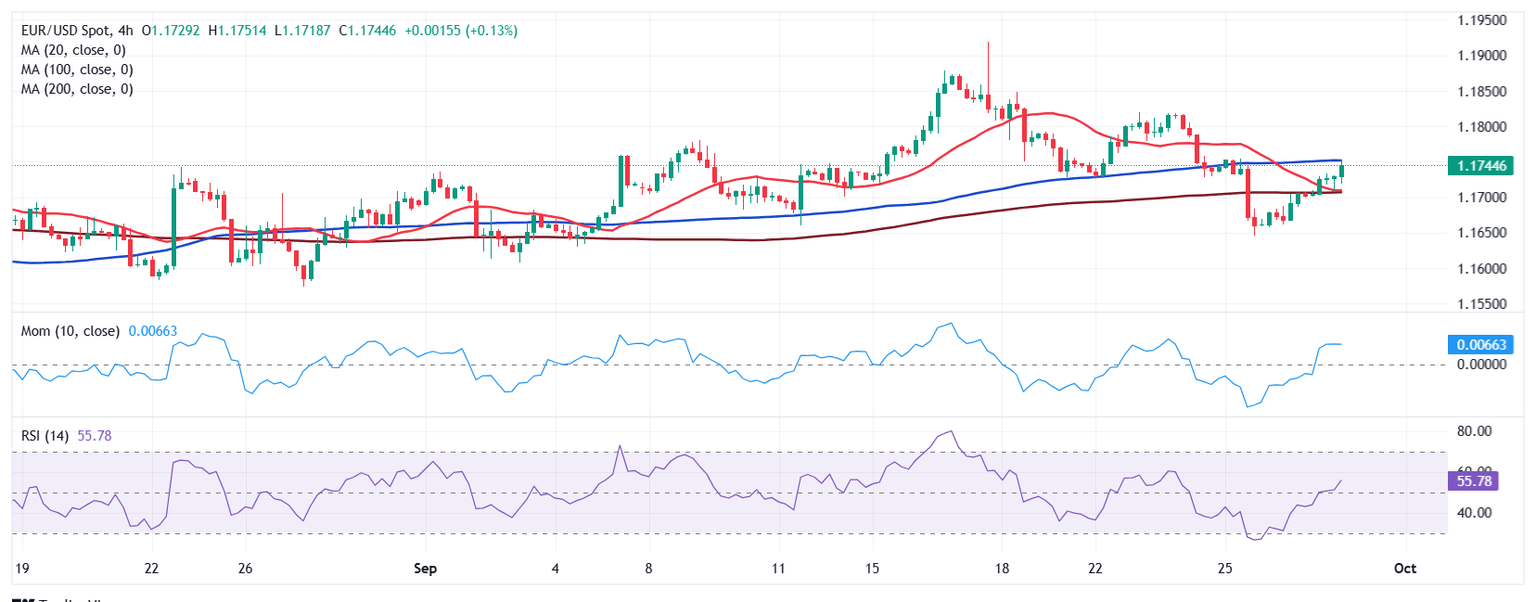

The EUR/USD pair pressures intraday highs but lacks momentum and seems mostly neutral. The daily chart shows the pair is struggling to overcome a flat 20 Simple Moving Average (SMA) while technical indicators aim modestly higher at around their midlines. Other than that, the pair remains well above the 100 and 200 SMAs, which keep the longer-term risk skewed to the upside.

The EUR/USD pair looks neutral-to-bullish in the near term. The 4-hour chart shows that it is finding sellers around its 100 SMA, while the 200 SMA at around 1.1690 provided intraday support. The pair is also developing above its 20 SMA, which is heading firmly south and is about to cross the longer one. Finally, technical indicators have barely overcome their midlines before losing directional strength, suggesting investors are unwilling to risk much more ahead of critical definitions.

Support levels: 1.1690 1.1650 1.1615

Resistance levels: 1.1750 1.1795 1.1830

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.