EUR/USD Price Forecast: Tepid buying keeping the pair afloat

EUR/USD Current price: 1.1482

- US markets will remain closed in observance of Juneteenth National Independence Day.

- European Central Bank officials keep hinting at the end of the loosening cycle.

- EUR/USD holds in a tight range with a near-term neutral technical stance.

The EUR/USD pair recovered from an intraday low of 1.1446, currently trading at around 1.1480. The US Dollar (USD) surged in the aftermath of the Federal Reserve (Fed) monetary policy announcement, as US officials were mostly hawkish. The USD also found support in market fears amid mounting tensions between Iran and Israel, coupled with increased odds for a United States (US) intervention.

Wall Street closed mixed on Wednesday, with only the Nasdaq Composite being able to post a modest advance of 25 points. US markets are closed on Thursday in observance of Juneteenth National Independence Day, which also means the local macroeconomic calendar will remain empty.

Earlier in the day, the focus was on European Central Bank (ECB) policymakers, as multiple officials were on the wires. On the one hand, France Francois Villeroy de Galhau said that need to remain alert and agile in all of their next meetings, adding “"Return to normal monetary policy is a very positive step; nevertheless, in still abnormal times, it does not necessarily mean an end to the journey."

On the other hand, Bundesbank President Joachim Nagel noted the ECB is now in the neutral territory of monetary policy, yet clarifying policymakers will do what they consider necessary. Finally, he added that the price-stability mission is “more or less” accomplished.

Comments from ECB officials failed to impress, as they aligned with what President Christine Lagarde had anticipated following the latest central bank meeting — that the rate cut cycle is coming to an end.

EUR/USD short-term technical outlook

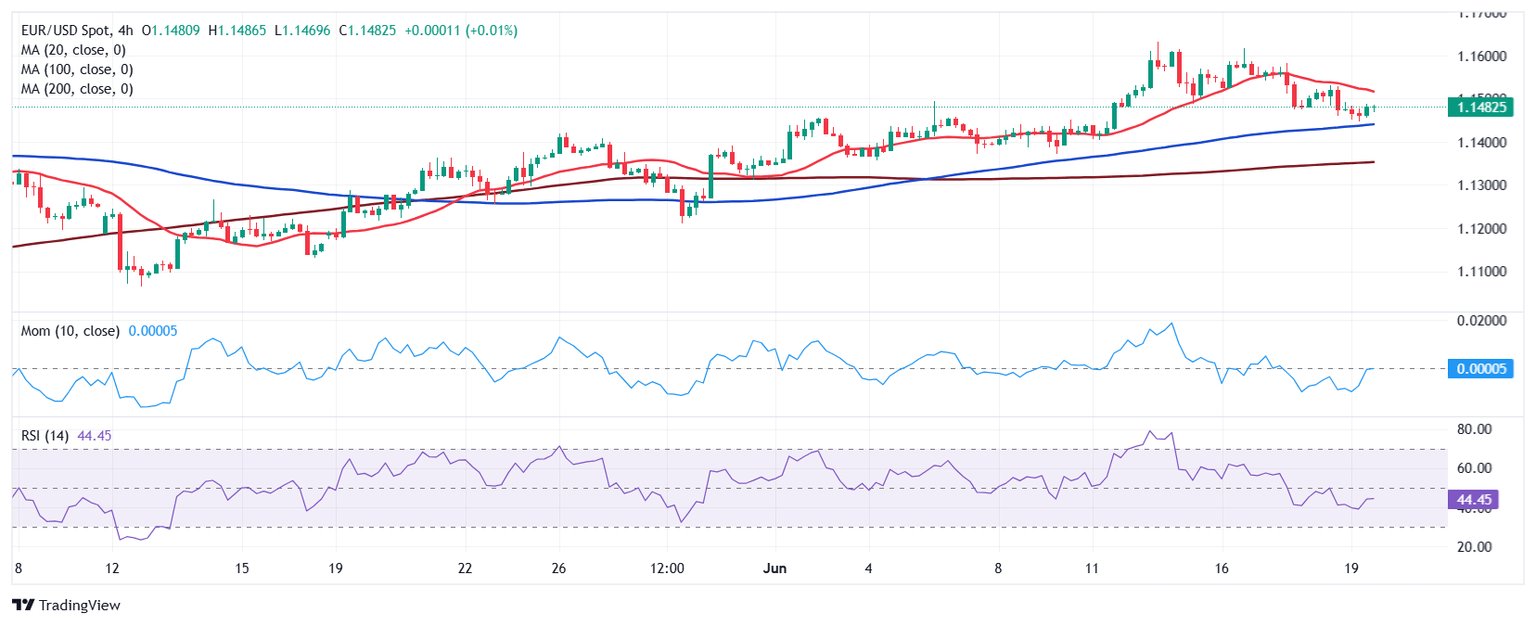

From a technical point of view, the daily chart for the EUR/USD pair shows it trades around the opening for a second consecutive day, but also that it posted a lower high and lower low, which usually skews the risk to the downside. At the same time, the pair holds above all its moving averages, with a bullish 20 Simple Moving Average (SMA) providing dynamic support at around 1.1425. Technical indicators, in the meantime, turned flat within positive levels, suggesting selling interest remains scarce.

The near-term picture is neutral. The 4-hour chart shows EUR/USD remains above its 100 and 200 SMAs, while the 20 SMA keeps heading south above the current level. Finally, technical indicators remain directionless, reflecting the ongoing consolidative range.

Support levels: 1.1425 1.1380 1.1335

Resistance levels: 1.1530 1.1580 1.1620

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.