EUR/USD Price Forecast: Stuck in range ahead of Fed and ECB meetings

- EUR/USD fades its earlier move to multi-week tops near 1.1780.

- The US Dollar regained upside impulse in response to prevailing risk-off trade.

- The BLS revised down its payroll numbers by 911K to March 2025.

The Euro (EUR) gave back two days of gains on Tuesday, with EUR/USD sliding toward the 1.1720–1.1710 band. The pullback came as the US Dollar (USD) found fresh support on geopolitical jitters, even as markets continued to price in a 50 bps rate cut from the Federal Reserve (Fed) at next week’s meeting.

The US Dollar Index (DXY) rebounded from seven-week lows, reclaiming the 97.70 zone, helped by a bounce in US Treasury yields across the curve.

Trade tensions ease but tariffs still bite

Washington and Beijing agreed to extend their trade truce for another 90 days, giving markets some breathing room. President Trump delayed planned tariff hikes until November 10, and China pledged to hold off as well. Still, most levies remain in place: US imports from China face 30% tariffs, while Chinese goods entering the US carry a 10% charge.

Washington also reached a new trade deal with Brussels. The EU agreed to lower tariffs on US industrial goods and give wider access to American farm and fisheries products. In return, Washington slapped a 15% tax on most European imports. Car tariffs could be next in line to come down, depending on upcoming EU legislation.

French politics fuel uncertainty

In Europe, politics grabbed the spotlight. French Prime Minister François Bayrou lost a confidence vote on Monday and formally resigned to President Emmanuel Macron on Tuesday, reviving political uncertainty in the eurozone’s second-largest economy.

Fed keeps September cut in play

The Fed left rates unchanged at its last meeting, with Chair Jerome Powell noting risks in the labour market but pointing out that inflation is still running above target. That keeps a September cut firmly on the table.

The day’s standout data came from the Bureau of Labor Statistics (BLS), which said the economy added 911K fewer jobs in the 12 months through March than first estimated — a sign hiring was slowing even before Trump’s tariff push. Markets still expect a 25 bps cut at the September 16–17 meeting, though odds of a larger move are creeping higher.

ECB signals steady hand

The European Central Bank (ECB) struck a steady tone at its latest meeting. President Christine Lagarde described eurozone growth as “solid, if a little better,” hinting at little urgency to ease further. Markets expect the ECB to hold fire at its September 11 meeting and likely stay on pause through 2025, with the first cut not priced until spring 2026.

Traders trim Euro longs

CFTC data showed non-commercial net longs in the Euro easing to two-week lows near 119.6K contracts in the week to September 2. Institutional net shorts edged down to 171.3K, while open interest rose for a fourth straight week to around 846K contracts.

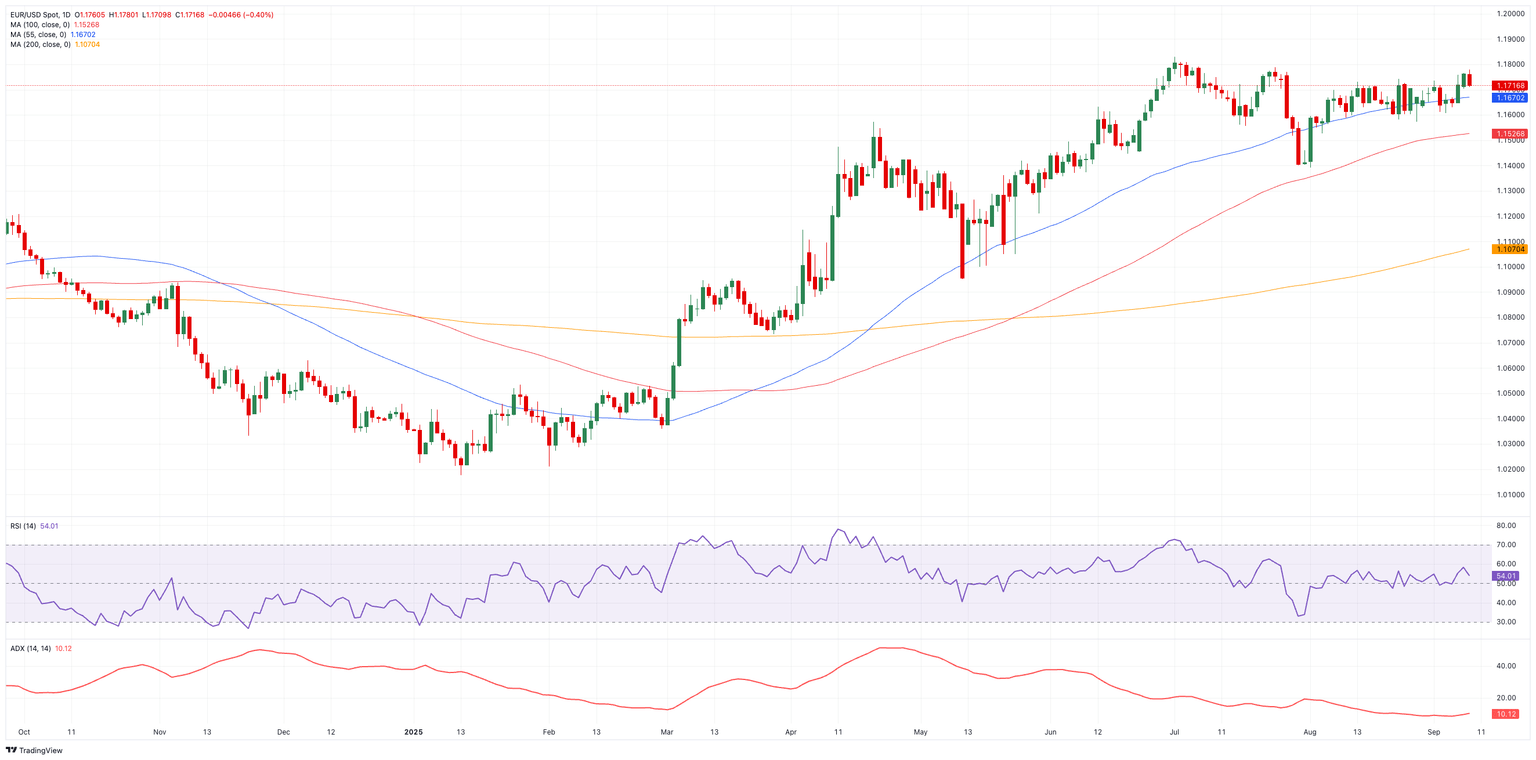

EUR/USD technical outlook

EUR/USD is still boxed into a broad 1.1400–1.1800 range. Resistance stands at the September high of 1.1779 (September 9), ahead of the weekly top at 1.1788 (July 24) and the 2025 ceiling at 1.1830 (July 1). A break higher could open the way to the September 2021 high at 1.1909, with the 1.2000 psychological level looming above.

On the downside, support is first seen at the short-term 100-day Simple Moving Average (SMA) at 1.1532, before the August base at 1.1391 (August 1) and the weekly low at 1.1210 (May 29).

Momentum signals are giving mixed messages: the Relative Strength Index (RSI) has eased back to 54, suggesting buyers are still in the game, while the Average Directional Index (ADX), just above 11, points to a trend that lacks real conviction.

EUR/USD daily chart

What’s next for EUR/USD?

For now, EUR/USD looks set to stay in consolidation mode. A breakout will likely need a fresh catalyst, whether from US data, a decisive Fed move, or another twist in Washington’s trade policy.

Employment FAQs

Labor market conditions are a key element to assess the health of an economy and thus a key driver for currency valuation. High employment, or low unemployment, has positive implications for consumer spending and thus economic growth, boosting the value of the local currency. Moreover, a very tight labor market – a situation in which there is a shortage of workers to fill open positions – can also have implications on inflation levels and thus monetary policy as low labor supply and high demand leads to higher wages.

The pace at which salaries are growing in an economy is key for policymakers. High wage growth means that households have more money to spend, usually leading to price increases in consumer goods. In contrast to more volatile sources of inflation such as energy prices, wage growth is seen as a key component of underlying and persisting inflation as salary increases are unlikely to be undone. Central banks around the world pay close attention to wage growth data when deciding on monetary policy.

The weight that each central bank assigns to labor market conditions depends on its objectives. Some central banks explicitly have mandates related to the labor market beyond controlling inflation levels. The US Federal Reserve (Fed), for example, has the dual mandate of promoting maximum employment and stable prices. Meanwhile, the European Central Bank’s (ECB) sole mandate is to keep inflation under control. Still, and despite whatever mandates they have, labor market conditions are an important factor for policymakers given its significance as a gauge of the health of the economy and their direct relationship to inflation.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.