EUR/USD Price Forecast: Sideways for now, but for how long?

- EUR/USD faded Wednesday’s small advance and refocused on the downside.

- The US Dollar managed to regain the smile and clocked acceptable gains.

- Investors now turn their focus to Friday’s NFP for the month of August.

The Euro (EUR) slipped again on Thursday, drifting back toward 1.1630 against the US Dollar (USD), where it finally found some short-term support. The move came as the Greenback staged a recovery, with the US Dollar Index (DXY) erasing earlier losses to steady near 98.50.

That rebound was notable given the softer ADP jobs report, which showed just 54K new positions. Instead, traders chose to focus on a better-than-expected US Institute for Supply Management (ISM) PMI, which ticked up to 52.0 in August. A dip in US Treasury yields added to the Greenback’s choppy but upward bias.

Trade truce cools nerves, but tariffs still bite

Global trade tensions eased somewhat after Washington and Beijing extended their truce for another 90 days. President Trump delayed planned tariff hikes until November 10, while China promised reciprocal measures. Even so, the current tariff landscape remains heavy: United States imports of Chinese goods still face 30% levies, while Chinese duties of 10% on United States exports remain in place.

Washington also struck a deal with Brussels, slapping a 15% tariff on most European imports in exchange for the European Union (EU) rolling back duties on US industrial goods and opening its market further to American farm and seafood products. A possible reduction in car tariffs could follow, depending on new EU legislation.

France braces for a confidence test

Politics are adding to the mix in Europe. French Prime Minister François Bayrou faces a September 8 confidence vote on his budget plan. With opposition parties, ranging from National Rally to the Greens and Socialists, refusing to back him, his minority government looks fragile.

A defeat would leave President Emmanuel Macron with tough choices: replace Bayrou, keep him on as a caretaker, or risk snap elections.

Fed keeps markets guessing

The Federal Reserve (Fed) left rates unchanged at its last meeting. Chairman Jerome Powell flagged labour market risks but noted that inflation is still above target, keeping a September cut firmly in play.

The focus now shifts to Friday's Nonfarm Payrolls (NFP) report and next week's inflation data, both of which are crucial for the Fed's upcoming rate decision.

So far, investors have almost fully priced in a quarter-point rate cut at the September 16-17 gathering, while an extra cut could come in December.

ECB in no rush to ease further

The European Central Bank (ECB) struck a calmer note at its last event.

President Christine Lagarde described eurozone growth as “solid, if a little better”, signalling little urgency to adjust policy.

Markets currently see the ECB holding steady through 2025, with the first cut not priced until spring 2026.

Positioning: Traders lean into the Euro

Commodity Futures Trading Commission (CFTC) data showed non-commercial net longs in the Euro (EUR) rising to a four-week high just above 123K contracts in the week to August 26. At the same time, institutional net shorts also ticked up to 173.2K contracts, while open interest rose for a third straight week to around 842.2K contracts.

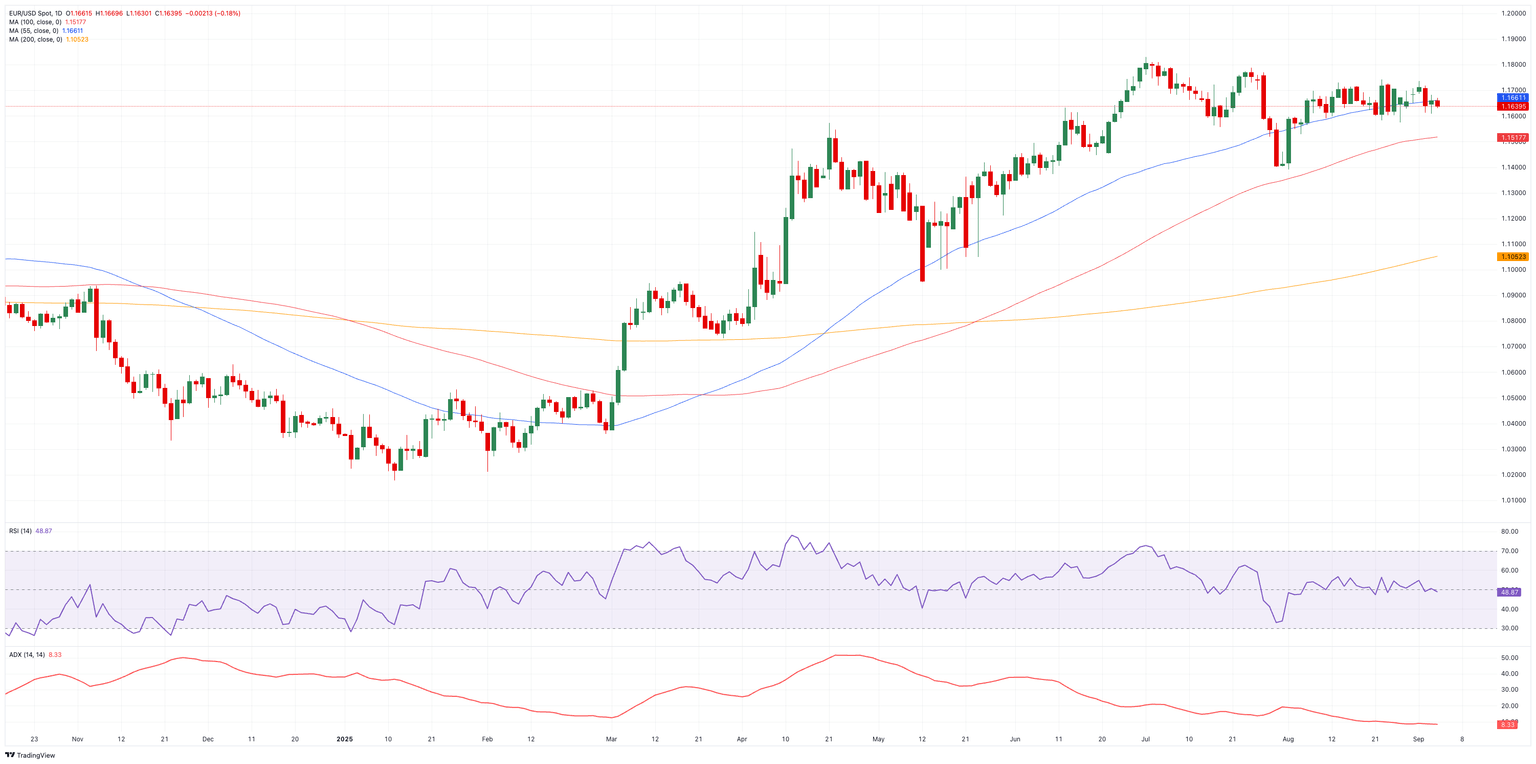

Technical view: EUR/USD stuck in its box

EUR/USD is still stuck in a large range between 1.1400 and 1.1800. The August high of 1.1742 (August 22) is the first level of resistance on the top side, followed by 1.1788 (July 24) and the 2025 ceiling at 1.1830 (July 1). A break higher would then show the September 2021 top at 1.1909, with the psychological 1.2000 barrier just out of reach.

On the downside, the first level of support is the 100-day Simple Moving Average (SMA) at 1.1523, followed by the August low at 1.1391 (August 1) and the weekly low at 1.1210 (May 29).

Momentum signs aren't giving us any help. The Relative Strength Index (RSI) has dropped below 50, which means that strength is waning. The Average Directional Index (ADX) is at 9, which means that the overall trend is still extremely weak.

EUR/USD daily chart

Outlook: The dollar is still in charge

For now, it appears that EUR/USD will stay within the current range. A breakthrough will require a clear reason, such new statistics from the US, a change at the Federal Reserve (Fed), or a change in the headlines about global trade. The US Dollar is still in charge till then.

ECB FAQs

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy for the region. The ECB primary mandate is to maintain price stability, which means keeping inflation at around 2%. Its primary tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

In extreme situations, the European Central Bank can enact a policy tool called Quantitative Easing. QE is the process by which the ECB prints Euros and uses them to buy assets – usually government or corporate bonds – from banks and other financial institutions. QE usually results in a weaker Euro. QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The ECB used it during the Great Financial Crisis in 2009-11, in 2015 when inflation remained stubbornly low, as well as during the covid pandemic.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the European Central Bank (ECB) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the ECB stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Euro.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.