EUR/USD Price Forecast: Sellers maintain the pressure ahead of Powell’s words

EUR/USD Current price: 1.1527

- The German ZEW survey on Economic Sentiment missed expectations in October.

- Federal Reserve Chair Jerome Powell is due to speak in the American afternoon.

- EUR/USD trades in a well-limited range, the risk skews to the downside.

The EUR/USD pair trades with a soft tone on Tuesday, hovering a handful of pips above a multi-week low of 1.1542. The US Dollar (USD) benefits from a persistent dismal mood, the latter driven by the continuation of the United States (US) government shutdown and fresh trade tensions between the US and China.

The lack of relevant US macroeconomic data due to the federal stalemate exacerbates the negative market sentiment, as the Federal Reserve (Fed) monetary policy meeting looms. Just two weeks ahead of the October decision, the US seems on its way to skipping the release of critical employment and inflation data.

At the same time, the latest tensions between Washington and Beijing fuel demand for safety. China's Ministry of Transport announced special port fees on US ships on Tuesday, claiming the decision safeguards the legitimate rights and interests of the Chinese shipping industry, while ensuring fair competition in international shipping.

Data-wise, Germany released the October ZEW survey, which showed Economic Sentiment in the country rose by less than anticipated, up to 39.3 from the previous 37.3. Economic Sentiment in the EU shrank from 26.1 in September to 22.7, while the assessment of the current situation in Germany dropped to -80 from the previous -76.4.

In the American afternoon, Fed’s Chair Jerome Powell is due to participate in a moderated discussion about the economic outlook and monetary policy at the National Association for Business Economics Annual Meeting, in Philadelphia.

EUR/USD short-term technical outlook

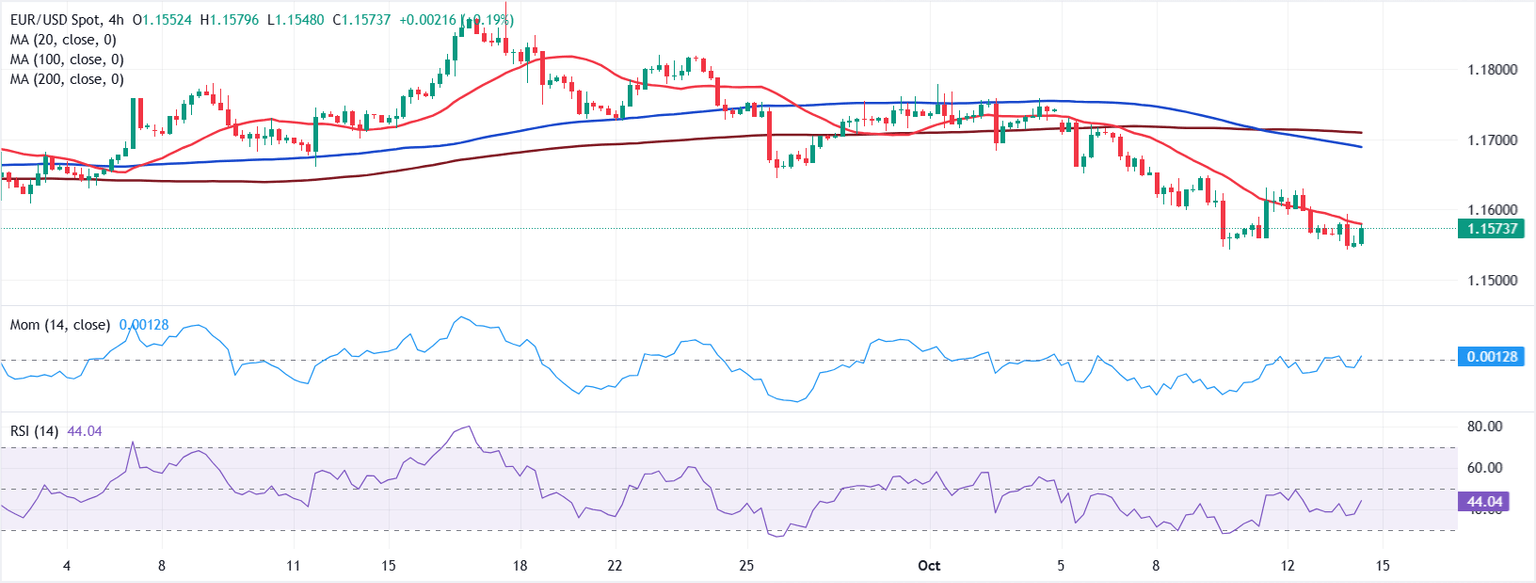

From a technical perspective, EUR/USD is bearish. The daily chart for the pair shows it remains inside a well-limited range, but also that it posted a lower low and a lower high. The pair continues to trade below the 20 and 100 Simple Moving Averages (SMAs), with the shorter SMA gaining downward momentum above the longer one. Technical indicators, in the meantime, head nowhere, but remain within negative levels.

The 4-hour chart shows that a bearish 20 SMA caps the upside for the EUR/USD pair, currently at around 1.1590. At the same time, a bearish 100 SMA is crossing below a flat 200 SMA, both far above the current level and supporting the bearish trend. Finally, technical indicators have recovered from their recent lows, aiming higher yet within negative levels, not enough to support a near-term recovery.

Support levels: 1.1540 1.1500 1.1460

Resistance levels: 1.1590 1.1630 1.1670

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.