EUR/USD Price Forecast: Sellers aim to challenge weekly lows

EUR/USD Current price: 1.1663

- French PM resignation and US government shutdown keep markets in cautious mode.

- Multiple Federal Reserve officials will be on the wires during the American afternoon.

- EUR/USD builds downward momentum as political woes undermine the mood.

The EUR/USD pair trades with a soft tone on Tuesday, not far from its weekly low at 1.1651. The Euro (EUR) remains pressured by French political woes, after the recently appointed Prime Minister Sébastien Lecornu resigned shortly after announcing his cabinet. The French massive debt has cost the nation five PMs in roughly two years, and as time goes by, a solution to the crisis seems further away.

Meanwhile, the United States (US) government shutdown continues. The American Congress has been unable to agree on a funding bill on Monday, despite US President Donald Trump's warnings on upcoming massive federal layoffs. As a result, demand for safety continues, pushing Gold into record highs and supporting the US Dollar (USD) in the near term.

Data-wise, there has been little to care about. Germany published August Factory Orders, which fell by 0.8% worse than the 1.4% advance expected but better than the revised -2.7% posted in July.

Without US data scheduled, investors will be paying extra attention to Federal Reserve (Fed) speakers, spread throughout the session. Policymakers are split on how fast to cut rates, and the upcoming Federal Open Market Committee (FOMC) Minutes scheduled for Wednesday may shed some extra light on what to expect for the October meeting.

EUR/USD short-term technical outlook

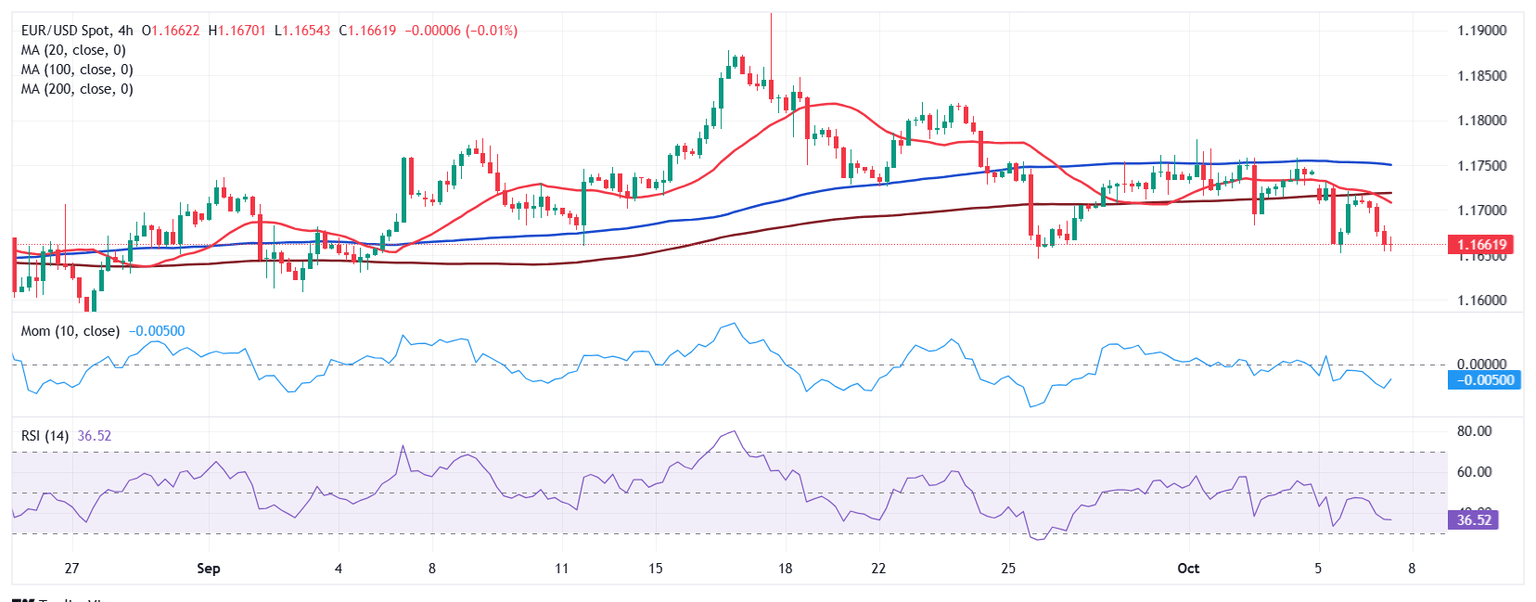

From a technical point of view, the EUR/USD pair trades at the lower end of its recent range, and the daily chart shows that the risk skews to the downside, with technical indicators holding well below their midlines and gaining downward traction. At the same time, a directionless 20 Simple Moving Average (SMA) caps advances at around 1.1740, while a mildly bullish 100 SMA acts as support in the 1.1620 area.

The 4-hour chart shows that EUR/USD is likely to extend its slide as technical indicators head firmly south, nearing oversold readings, while it develops below all its moving averages, with the 20 SMA extending its slide below a now flat 200 SMA, both far above the current level and in line with lower lows ahead.

Support levels: 1.1650 1.1620 1.1590

Resistance levels: 1.1710 1.1745 1.1780

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.