EUR/USD Price Forecast: Next on the upside comes 1.1570

- EUR/USD lost upside momentum on Wednesday, retesting the 1.1300 zone.

- The US Dollar regained composure, leaving behind part of the recent decline.

- As expected, the Federal Reserve left its interest rates unchanged.

The euro halted its rally on Wednesday, with EUR/USD receding toward the 1.1300 region amid a revitalised US Dollar.

Indeed, the US Dollar Index (DXY) made a U-turn and reversed three straight days of losses after the Federal Reserve (Fed) matched the broad consensus and left its interest rates unchanged, while alleviated concerns on the US-China trade effervescence also contributed to the improved sentiment around the Greenback.

US-China rhetoric returns, politics boost the Euro

Despite renewed optimism on the US-China trade front, investor reaction was measured following news of a meeting between US and Chinese officials on Saturday.

In fact, market participants appeared sceptical of the latest diplomatic gestures, viewing them as recycled rather than substantive. Risk appetite held up, suggesting the bar for trade-related headlines to move markets meaningfully remains high.

Domestically, euro sentiment got a boost from political developments. The appointment of F. Merz as German Chancellor following two rounds of voting added a layer of stability and optimism to the eurozone outlook.

Fed and ECB policy paths diverge... sharply?

The Federal Reserve (Fed) and European Central Bank (ECB) are drifting further apart on policy.

The Federal Reserve left interest rates unchanged on Wednesday, as expected, but flagged rising risks to both inflation and employment in the months ahead. In its statement, the Fed said the economy “continued to expand at a solid pace,” attributing a weaker first-quarter print to a spike in imports as consumers and businesses moved to front-run new tariffs.

In addition, Fed Chair Jerome Powell said the US economy remains solid but flagged growing uncertainty, adding that future rate decisions could include cuts or a pause depending on incoming data.

Meanwhile, the ECB delivered a 25bp rate cut last month, bringing its benchmark rate to 2.25%, and struck a clearly dovish tone in its guidance. Markets are now pricing in another cut as soon as June, widening the gap between the two central banks and clouding the euro’s medium-term prospects.

Speculative flows stay Euro-positive

Despite dovish ECB signals, positioning data show market participants still favouring the euro. CFTC figures as of 29 April revealed net long positions rising to a multi-month high of 75.8K contracts. Open interest also surged past 730K—levels last seen in September 2024. However, commercial hedgers remained net short by 131K contracts, signalling continued caution among corporate players.

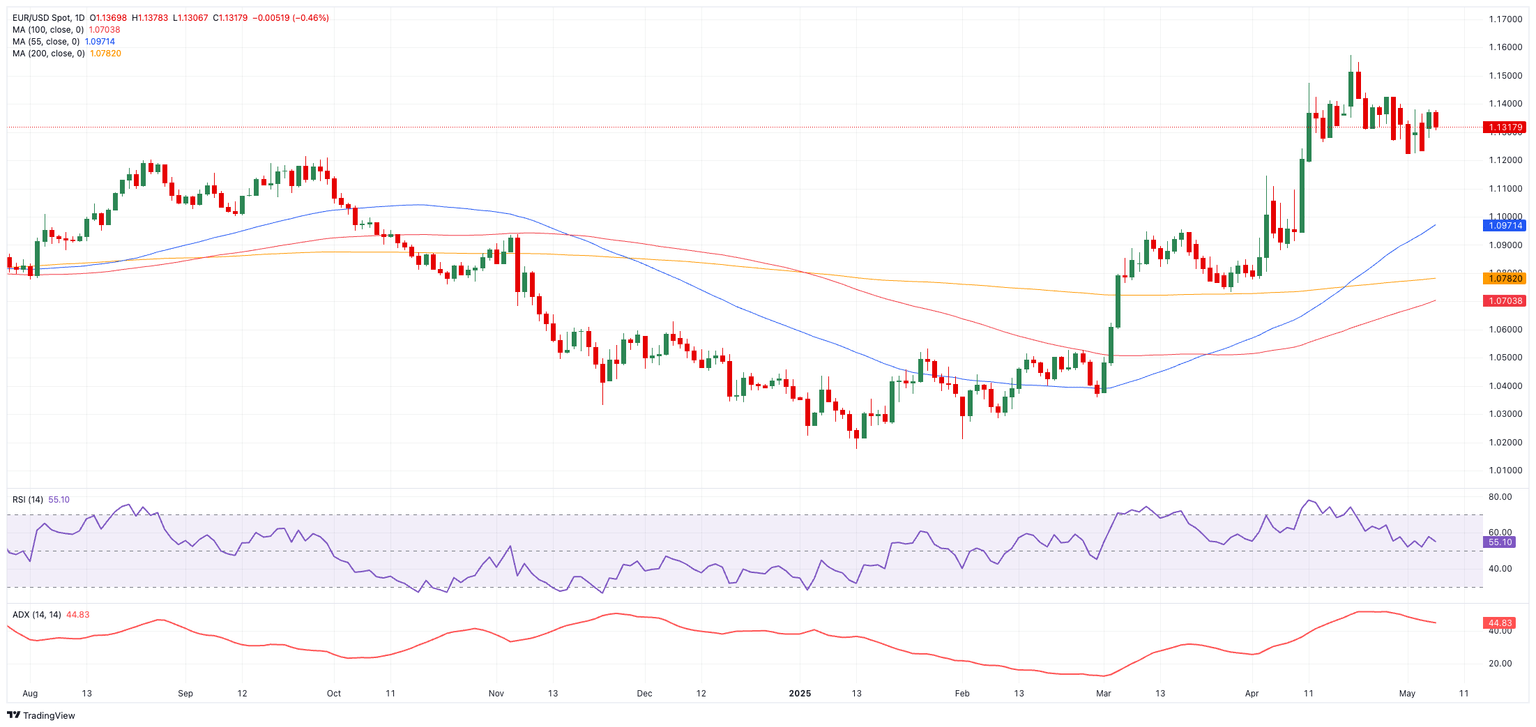

Technical outlook: Resistance capping gains—for Now

EUR/USD is pushing up against strong resistance at its 2025 high of 1.1572 (April 21), with the 1.1600 psychological barrier and the October 2021 peak at 1.1692 next in focus.

Support levels, conversely, are well-defined, starting with the interim 55-day SMA at 1.0978, followed by the 200-day SMA at 1.0787 and the March low at 1.0732 (March 25).

Momentum indicators point to further upside. The Relative Strength Index (RSI) remains elevated near 58, while the Average Directional Index (ADX) near 46 suggests a strong underlying trend is still in play.

EUR/USD daily chart

Outlook: Euro faces crosscurrents from policy and politics

With policy divergence deepening and geopolitical narratives back in play, EUR/USD may remain reactive to both data and headlines. The coming days are likely to bring heightened volatility, particularly as traders digest central bank signals and weigh shifting expectations around growth, inflation, and trade.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.