EUR/USD Price Forecast: Market players keep waiting for a catalyst

EUR/USD Current price: 1.1229

- European Central Bank officials optimistic about inflation, concerned about US-inspired uncertainties.

- Federal Reserve speakers will flood the news wires during American trading hours.

- EUR/USD holds on to modest weekly gains, turning neutral in the near term.

The EUR/USD pair trades around 1.1230 on Tuesday, holding on to weekly gains amid persistent US Dollar (USD) weakness, although lacking a clear catalyst to extend its advance.

At the same time, easing fears are having a limited impact on the USD. The better tone of global equities suggests investors are reading beyond Moody’s decision to downgrade the United States (US) government’s credit rating last Friday. Despite the shock, other rating agencies, such as Fitch, have already downgraded it in the last couple of years amid mounting US debt.

Across the pond, the focus was on European Central Bank (ECB) officials. President of Central Bank of the Netherlands Klaas Knot noted that the central bank’s projections are likely to show lower inflation for this year and the next, but added the longer-term outlook remains uncertain. Also, ECB Executive Board member Isabel Schnabel said that disinflation is on track but added that tariffs may pose upside inflation risks over the medium term.

The American session brings some Federal Reserve (Fed) speakers, and little on the data front, although the Eurozone (EU) will release May Consumer Confidence, foreseen at -16 after posting -16.7 in the previous month.

EUR/USD short-term technical outlook

From a technical point of view, the daily chart for EUR/USD pair offers a limited bullish scope. The pair retreated from a bearish 20 Simple Moving Average (SMA) for a second consecutive day, currently providing dynamic resistance at around 1.1275. The 100 and 200 SMAs remain far below the current level, with the longer one pretty much flat, reflecting decreased long-term upward momentum. Finally, technical indicators have turned flat between negative and neutral levels, not enough to confirm an upcoming slide.

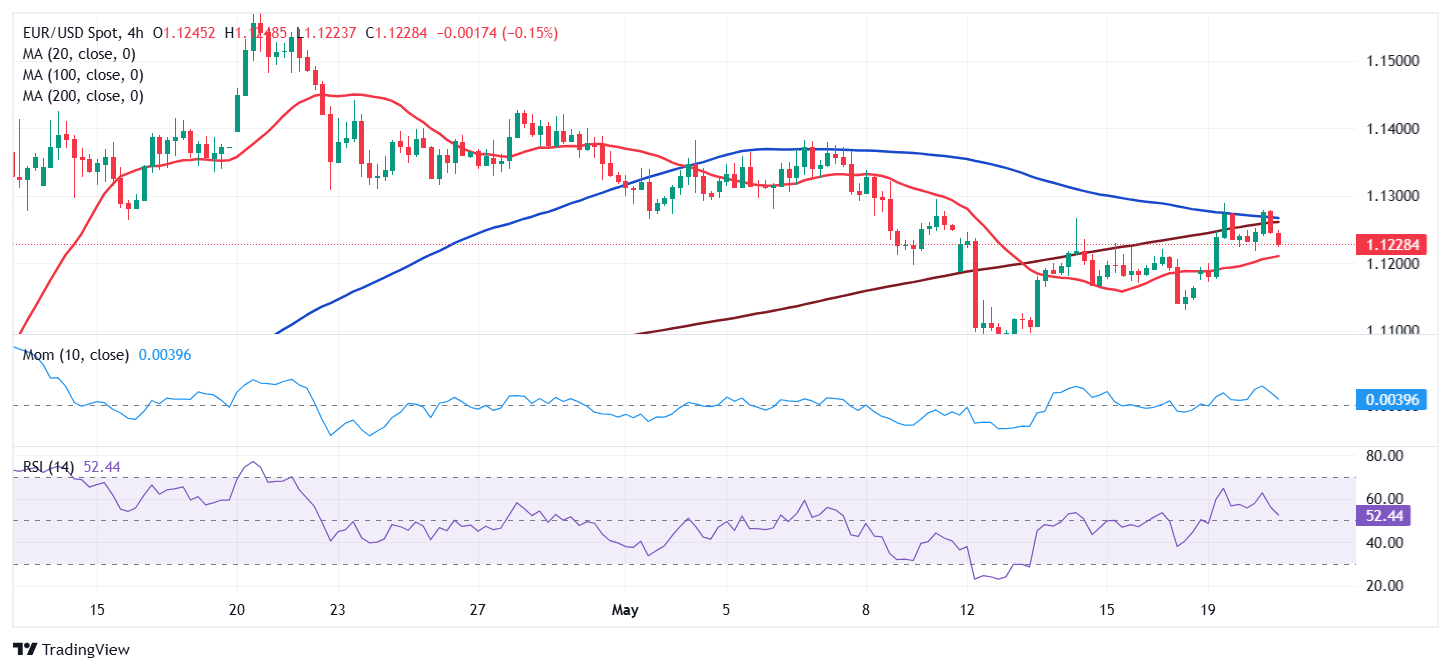

In the near term, and according to the 4-hour chart, EUR/USD turned neutral. Converging 100 and 200 SMAs provide dynamic resistance at around 1.1270, while the 20 SMA heads nowhere, a handful of pips below the current level. At the same time, the Momentum indicator hovers directionless around its 100 line, while the Relative Strength Index (RSI) indicator aims lower at around 52, failing to provide clear directional clues.

Support levels: 1.1200 1.1165 1.1130

Resistance levels: 1.1275 1.1320 1.1360

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.