EUR/USD Price Forecast: Immediate target emerges at 1.0900

- EUR/USD extended further its march north and approached 1.0900.

- The US Dollar kept its price action subdued amidst lower US yields.

- Inflation in the broader euro bloc remained sticky in October.

EUR/USD extended its weekly recovery on Thursday, marking its fourth consecutive daily gain and challenging the critical 200-day Simple Moving Average (SMA) around 1.0870, coming at shouting distance from the key 1.0900 barrier.

Meanwhile, the US Dollar’s (USD) rally lost further momentum, sponsoring the fourth daily decline in the US Dollar Index (DXY), which at some point revisited the area below the 104.00 level.

This upward move in EUR/USD coincided with extra weakness in US yields across the spectrum, in line with a modest pullback in 10-year German bund yields soon after reaching new highs around 2.45%.

In the meantime, expectations are building for a 25-basis-point rate cut by the Federal Reserve (Fed) next month, a view that was further reinforced by sticky PCE data in September and so-far firm readings from the US labour market, all prior to Friday’s crucial Nonfarm Payrolls (NFP).

According to the CME Group’s FedWatch Tool, there is almost full pricing for a quarter-point cut at the upcoming November 7 meeting.

In Europe, the European Central Bank (ECB) recently implemented a 25-basis-point rate cut on October 17, reducing the Deposit Facility Rate to 3.25%, in line with expectations. ECB officials have maintained a cautious stance on further rate decisions, emphasising the significance of upcoming economic data.

Within the ECB, opinions on further rate cuts vary. Earlier on Thursday, ECB President Christine Lagarde reiterated to a French newspaper that the bank expects eurozone inflation to sustainably reach its 2% target by 2025. Meanwhile, Governing Council member Fabio Panetta warned that the ECB should avoid reducing interest rates too cautiously, as this could cause inflation to drop excessively. At a banking conference in Rome, Panetta added that monetary conditions in the eurozone remain restrictive and suggested that further easing may be necessary.

Across the road, ECB board member Isabel Schnabel advocated for a gradual approach to monetary policy, opposing sharp rate cuts. She argued that inflation is unlikely to fall below the ECB’s 2% target, justifying a measured approach to rate adjustments. This stance contrasts with some policymakers from southern eurozone nations who are concerned that inflation may fall too low, possibly necessitating cuts below the neutral rate.

As both the Fed and ECB assess their next moves, EUR/USD’s trajectory will likely be shaped by broader economic conditions. With the US economy currently outperforming the eurozone, the USD may retain its strength in the short to medium term. Furthermore, a Trump victory in the upcoming US presidential election could further bolster the Greenback.

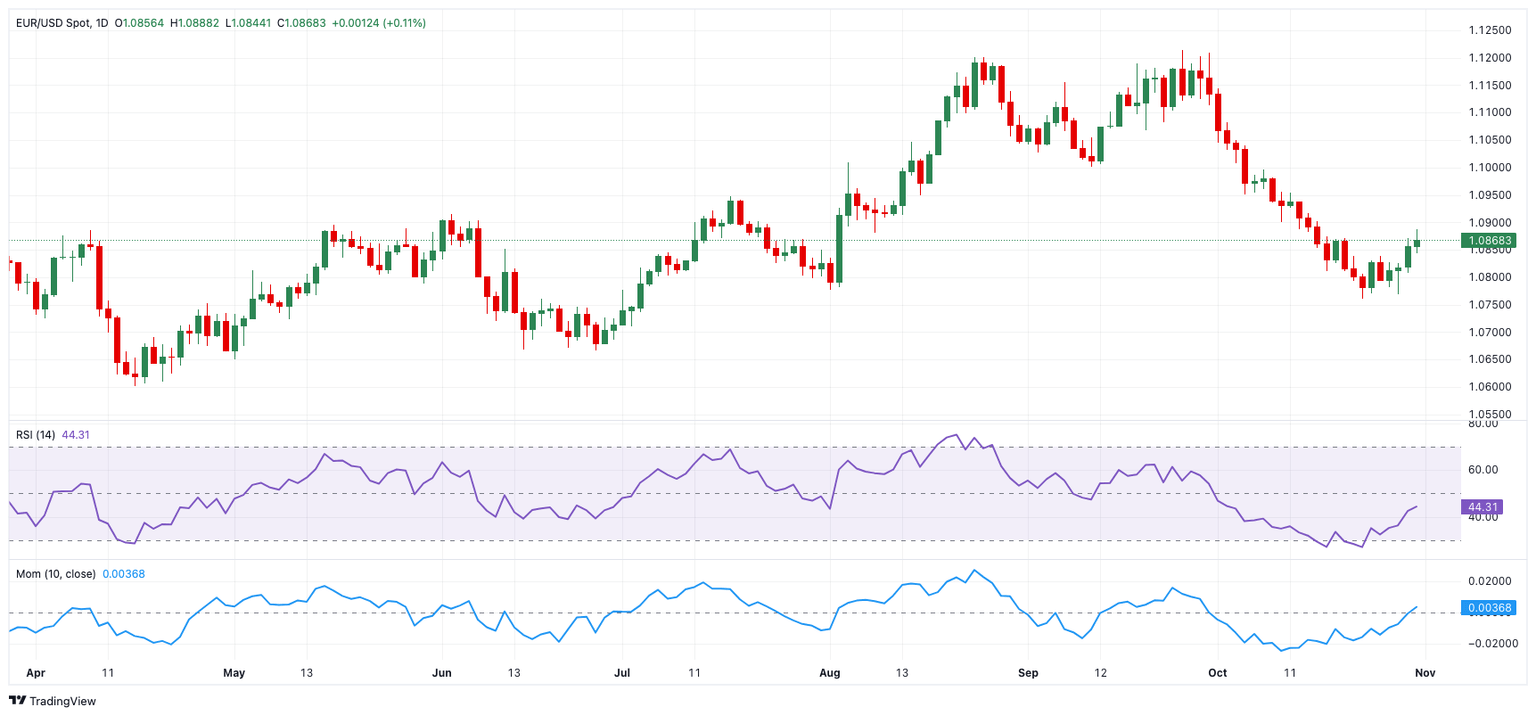

EUR/USD daily chart

EUR/USD short-term technical outlook

Extra gains may send EUR/USD to the weekly high of 1.0887 (October 31), ahead of the preliminary 100-day and 55-day SMAs at 1.0935 and 1.1019, respectively. The 2024 top of 1.1214 (September 25) comes ahead of the 2023 peak of 1.1275 (July 18).

On the downside, initial contention emerges at the October low of 1.0760 (October 23), ahead of the round level at 1.0700, and the June low of 1.0666 (June 26).

Meanwhile, if EUR/USD clears the 200-day SMA in a sustained manner, the pair's outlook should turn to positive.

The four-hour chart shows a continuation of the rebound. Against that, the initial support level is 1.0760, followed by 1.0666. On the plus side, the first barrier is 1.0887, followed by 1.0954 and 1.0996. The relative strength index (RSI) rose to around 60.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.