EUR/USD Price Forecast: holding ground ahead of central bankers’ words

EUR/USD Current price: 1.1659

- A slew of Federal Reserve speakers will entertain investors in the American afternoon.

- The US government shutdown continues, absent data becoming a norm.

- EUR/USD holds on to modest intraday gains, bullish potential limited.

The EUR/USD pair trades around 1.1650 early in the American session on Thursday, holding on to modest intraday gains. The US Dollar (USD) remains pressured amid United States (US) political and trade woes, as the federal government remains on pause, while trade negotiations with China came to a halt.

The absence of relevant macroeconomic US data due to the US government shutdown shifts the focus to central bank speakers. European Central Bank (ECB) and Federal Reserve (Fed) officials will participate in different public events throughout the day, and their words will be scrutinized in search of clues on what can happen in the upcoming monetary policy meetings. Despite the ongoing chaos, speculative interest maintains solid bets on a Fed interest rate cut coming in the October meeting.

On the data front, the Eurozone published the August Trade Balance, which posted a seasonally adjusted surplus of €9.7 billion. As for the US, the Philadelphia Fed Manufacturing Survey printed at -12.8 in October, sharply down from the previous 23.2

EUR/USD short-term technical outlook

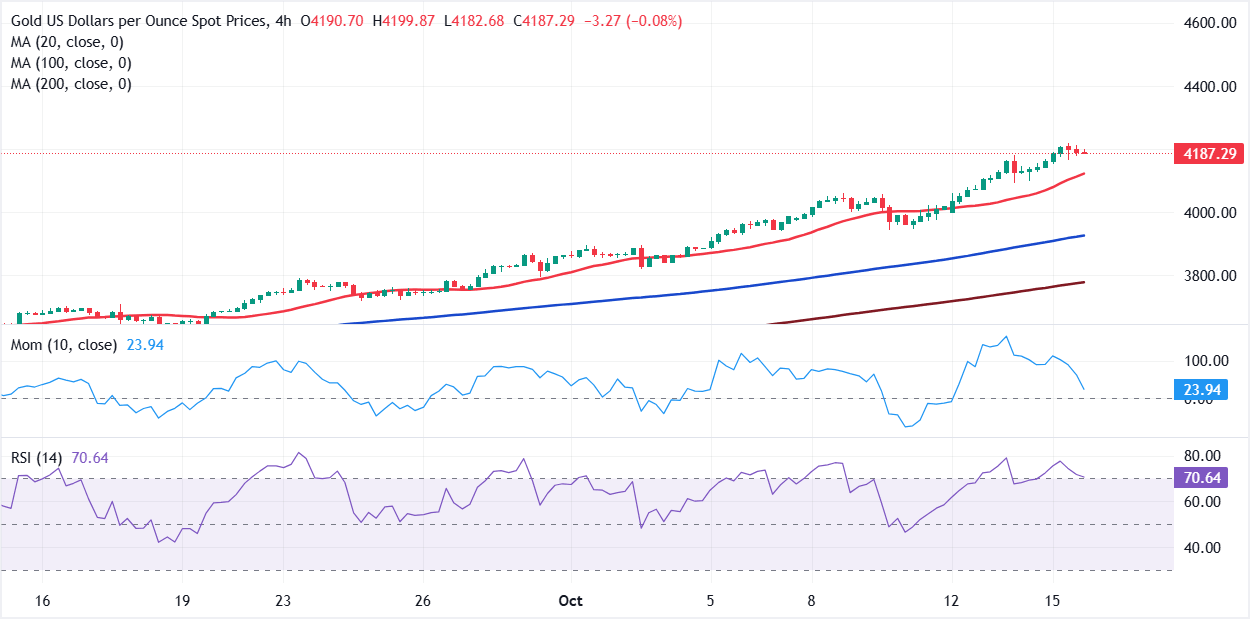

From a technical perspective, EUR/USD is posting a second consecutive higher high and higher low in its daily chart, but there are no other signs of a potential bullish extension. The pair is stuck around a mildly bullish 100 Simple Moving Average (SMA), while below a bearish 20 SMA, providing resistance at around 1.1680. Other than that, the Momentum indicator is retreating within negative levels after testing its 100 line, while the Relative Strength Index (RSI) indicator advances modestly at around 47, limiting the odds for a steeper recovery.

The 4-hour chart for the EUR/USD pair showed it topped around a bearish 100 SMA, currently at 1.1675. At the same time, the 20 SMA maintains its upward slope below the current level, reflecting the latest advance rather than suggesting additional gains ahead. Finally, technical indicators hold within positive levels, butare turning south with uneven strength.

Support levels: 1.1620 1.1585 1.1540

Resistance levels: 1.1680 1.1710 1.1745

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.