EUR/USD Price Forecast: Higher highs ahead amid US fiscal turmoil

EUR/USD Current price: 1.1325

- United States political and fiscal woes put the US Dollar in selling mode.

- The European Central Bank warned about the risks the economy faces.

- EUR/USD holds on to gains above 1.1300, needs fresh impetus to break higher.

The EUR/USD pair is firmly up for a third consecutive day on Wednesday, reaching the 1.1360 price zone during European trading hours amid persistent US Dollar (USD) weakness.

Tariffs and tax-related headlines coming from the United States (US) are taking their toll on the Greenback. On the one hand, tensions between Washington and China arose amid the US Warning companies against using AI chips made by Huawei. China’s Commerce Minister accused the US of “abusing export controls to suppress and contain China.” Additionally, US-Japan talks seem stuck as the latter demands that the US eliminate tariffs, while noting the country is in no rush to clinch a deal.

On the other hand, the US Congress started debating US President Donald Trump’s tax bill on Tuesday, aiming for tax cuts, which some analysts believe will increase the already skyrocketing government debt.

Across the pond, the European Central Bank (ECB) released the Financial Stability Review report, showing policymakers believe inventors might be underestimating the risk that the economy performs worse than expected, trade tensions escalate, or an expected easing of monetary policy fails to materialise. Even further, the ECB described tariffs as “major downside risk.”

Other than that, the focus remains on a slew of Federal Reserve (Fed) speakers that have been flooding the news feeds since the beginning of the week. Generally speaking, Fed officials maintain the hawkish tilt, with their words having no new impact on the USD.

Finally, it's worth adding that Wall Street closed in the red on Tuesday, and given the aforementioned concerns, it aims for another negative day.

EUR/USD short-term technical outlook

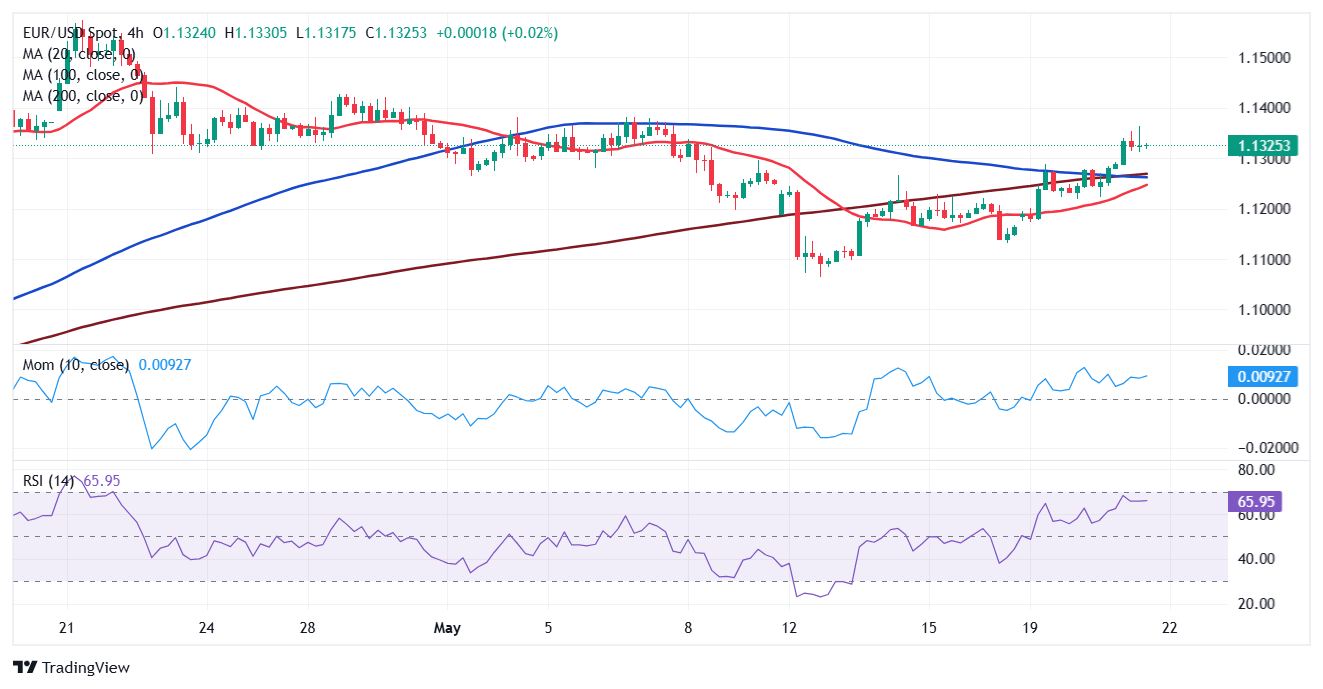

The EUR/USD pair trades at around 1.1320, and the daily chart shows it run past a now flat 20 Simple Moving Average (SMA) providing support at around 1.1275. The same chart shows the 100 SMA is about to cross above the 200 SMA, both far below the current level, hinting at a more sustained bullish run. Finally, technical indicators are crossing their midlines into positive territory, not enough to confirm a strong rally yet.

In the near term, and according to the 4-hour chart, the risk skews to the upside, although the positive momentum eased. The pair trades above all its moving averages, with the 20 SMA gaining upward strength below directionless 100 and 200 SMAS. Technical indicators, in the meantime, turned flat well above their midlines, suggesting selling interest is well-limited.

Support levels: 1.1275 1.1240 1.1200

Resistance levels: 1.1360 1.1400 1.1440

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.