EUR/USD Price Forecast: Higher high still on the table

EUR/USD Current price: 1.1369

- Easing tariff-related concerns underpin the mood, but the USD is still in trouble.

- Federal Reserve officials will flood the news wires in the American session.

- EUR/USD corrects near-term extreme overbought conditions, yet downside limited.

The EUR/USD pair rallied beyond the 1.1400 mark at the beginning of a new week, as the US Dollar (USD) remains on the back foot, despite tariffs-related relief. Trade war tensions remain, albeit the White House announced over the weekend that some technology imports from China will be exempted from the reciprocal tariffs, yet are still subject to the initial 20% levy.

On a negative note, US Commerce Secretary Howard Lutnick said in an ABC News interview on Sunday that these products, alongside semiconductors, will face separate new levies within the next two months. Nevertheless, stock markets trade with optimism, with Asian and European indexes firmly up and pushing Wall Street’s futures higher.

Data-wise, the macroeconomic calendar highlights today several Federal Reserve (Fed) speakers. Other than that, the focus will remain on tariff-related headlines coming from Washington.

EUR/USD short-term technical outlook

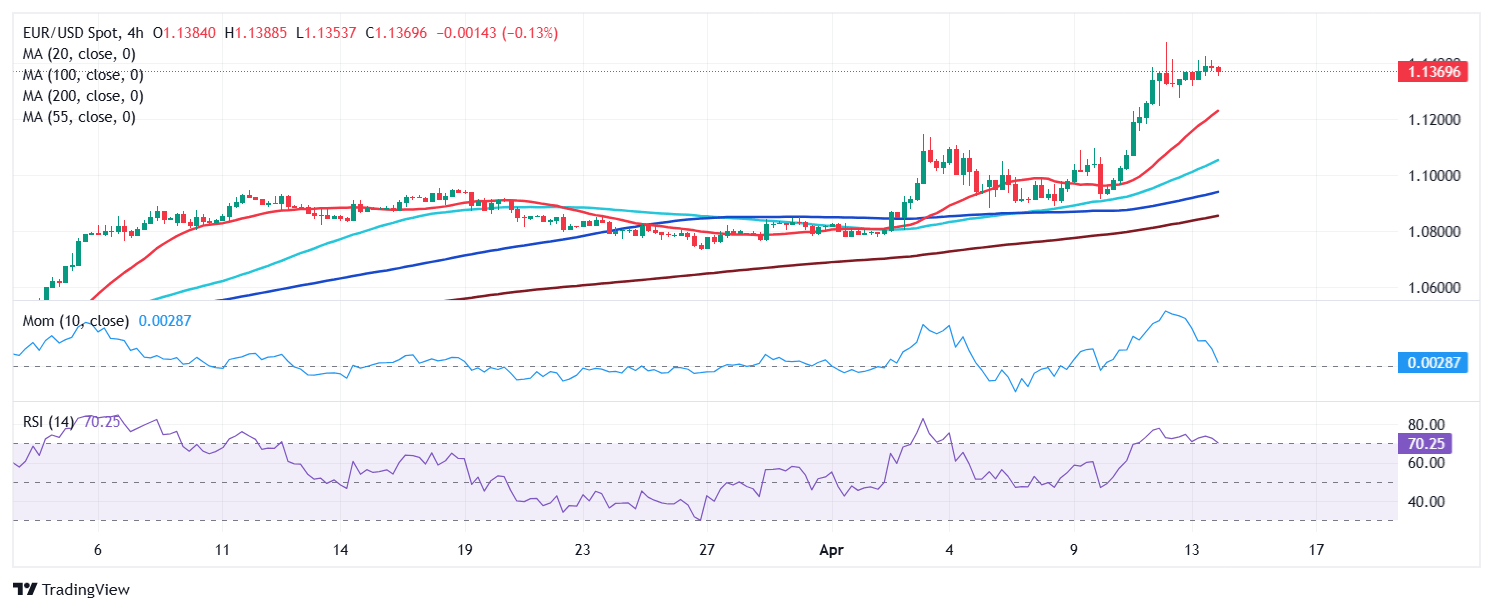

The EUR/USD pair retreated from its intraday peak of 1.1424 and trades in the 1.1360, holding on to gains yet within Friday’s range. From a technical point of view, the daily chart shows the upward momentum eased, with technical indicators lacking directional strength, yet holding at extreme overbought readings. At the same time, the pair develops above all its moving averages, with a bullish 20 Simple Moving Average (SMA) currently at around 1.0930. Overall, the risk remains skewed to the upside, with some consolidation expected before another leg north.

In the near term, and according to the 4-hour chart, the corrective slide is underway, yet readings hint at a limited slide. Technical indicators eased from their recent peaks and aim lower, still near overbought readings. At the same time, the pair develops above all its moving averages, which head higher with uneven strength, still supporting the bullish case.

Support levels: 1.1320 1.1285 1.1240

Resistance levels: 1.1425 1.1470 1.1515

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.