EUR/USD Price Forecast: Gearing up for US data and Powell

EUR/USD Current price: 1.1796

- The September EU Hamburg Commercial Bank PMIs came in mixed.

- US Federal Reserve Chair Jerome Powell is scheduled to speak about the economic outlook.

- EUR/USD losses upward momentum ahead of 1.1800, downside still limited.

The EUR/USD pair trades just shy of the 1.1800 mark, still confined to familiar levels as market participants await fresh clues on United States (US) economic progress and the words from Federal Reserve (Fed) Chair Jerome Powell.

Financial markets keep revolving around the latest Fed’s decision to trim interest rates and reconcile with additional cuts in the foreseeable future. The US Dollar (USD) remains pressured, although the dominant bearish trend has begun fading now that there’s more clarity on what’s next in the monetary front.

As the day unfolds, market players price in mixed European data, as the Hamburg Commercial Bank (HBOC) published the preliminary estimates of the September Purchasing Managers’ Indexes (PMIs). EU data came in mixed, with a downtick in manufacturing output balanced with a better-than-anticipated services index. As a result, the Composite PMI resulted at 51.2, slightly better than the 51.1 anticipated and the previous 51.

Coming up next are the US S&P Global PMIs, with manufacturing and services output expected to remain steady at expansionary levels. The Composite PMI is expected to print at 54.6, matching the August reading. Additionally, Fed Chair Powell is due to speak about the economic outlook at the Greater Providence Chamber of Commerce Economic Outlook Luncheon in Rhode Island. Speculative interest will be looking at data and Powell for clues that confirm the ongoing optimism about the US economic progress.

EUR/USD short-term technical outlook

The daily chart for the EUR/USD pair shows it is confined to a tight intraday range, hovering around its opening. The risk remains skewed to the upside, albeit the momentum is lost. Technical indicators turned marginally lower, but remain within positive levels, limiting the odds for a relevant slide. At the same time, EUR/USD keeps holding above a mildly bullish Simple Moving Average (SMA), providing dynamic support at around 1.1730. Finally, the 100 and 200 SMAs grind north far below the shorter one, in line with limited USD demand.

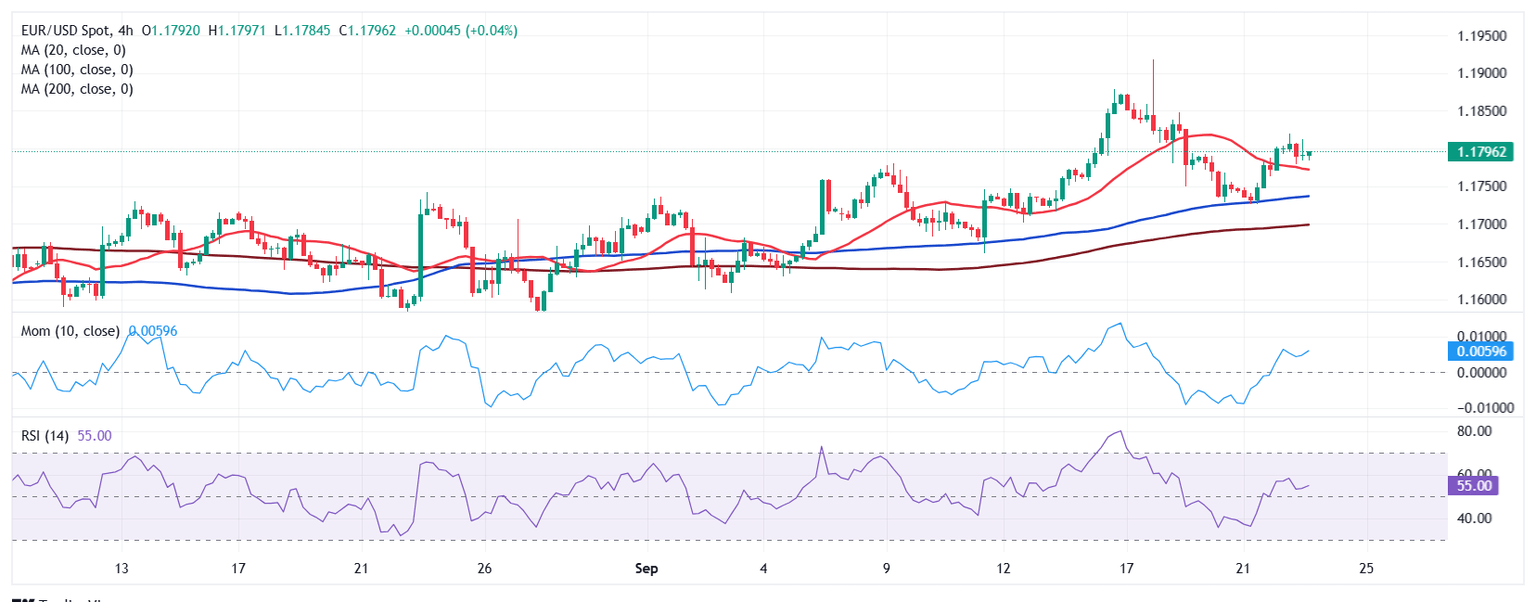

The near-term picture is pretty much neutral. The 4-hour chart shows that the Momentum indicator stands directionless just above its 100 line, while the Relative Strength Index (RSI) indicator turned marginally lower and stands at around 53. Finally, the EUR/USD pair develops above all its moving averages, with a flat 20 SMA providing intraday support at around 1.1770.

Support levels: 1.1770 1.1730 1.1690

Resistance levels: 1.1820 1.1855 1.1890

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.