EUR/USD Price Forecast: Further weakness is not ruled out

- EUR/USD traded in a vacillating fashion below the 1.1500 threshold.

- The US Dollar clocked slight gains amid the resurgence of the risk-off mood.

- The US markets remained closed due to the Juneteenth federal holiday.

On Thursday, the Euro (EUR) maintained its position against the US Dollar (USD) around its closing levels from Wednesday.

Indeed, EUR/USD navigated a narrow range in the sub-1.1500 region, while the US Dollar Index (DXY) rose marginally, at some point surpassing the key 99.00 barrier.

War and tariffs stoke market volatility

Heightened tensions in the Middle East have offset any positive momentum from US-China trade talks, while the July 9 deadline for “Liberation Day” tariffs continues to weigh on sentiment. The recent escalation between Israel and Iran has sparked speculation about potential US intervention in the conflict.

Policy path part ways

Following its June meeting, the Fed unanimously opted to keep rates at 4.25–4.50% and revised its quarterly forecasts higher for both unemployment and inflation, reflecting tariff-related risks.

Policymakers remain split on future moves, however: two foresee a single cut in 2025, seven expect no reductions despite a median dot-plot call for 50 bps of cuts by year-end, and eight anticipate rates ending the year between 3.75% and 4.00%.

Conversely, the European Central Bank (ECB) reduced its Deposit Facility Rate to 2.00% earlier this month, adopting a cautiously hawkish stance, with President Lagarde dismissing the possibility of further easing in the absence of a significant decline in external conditions.

Speculative sentiment favours the Euro

Non-commercial interest in the single currency has surged, with CFTC data through June 10 showing open interest near multi-year highs and net long positions at fresh peaks. Commercial hedgers, by contrast, have increased their short exposure, signalling institutional caution.

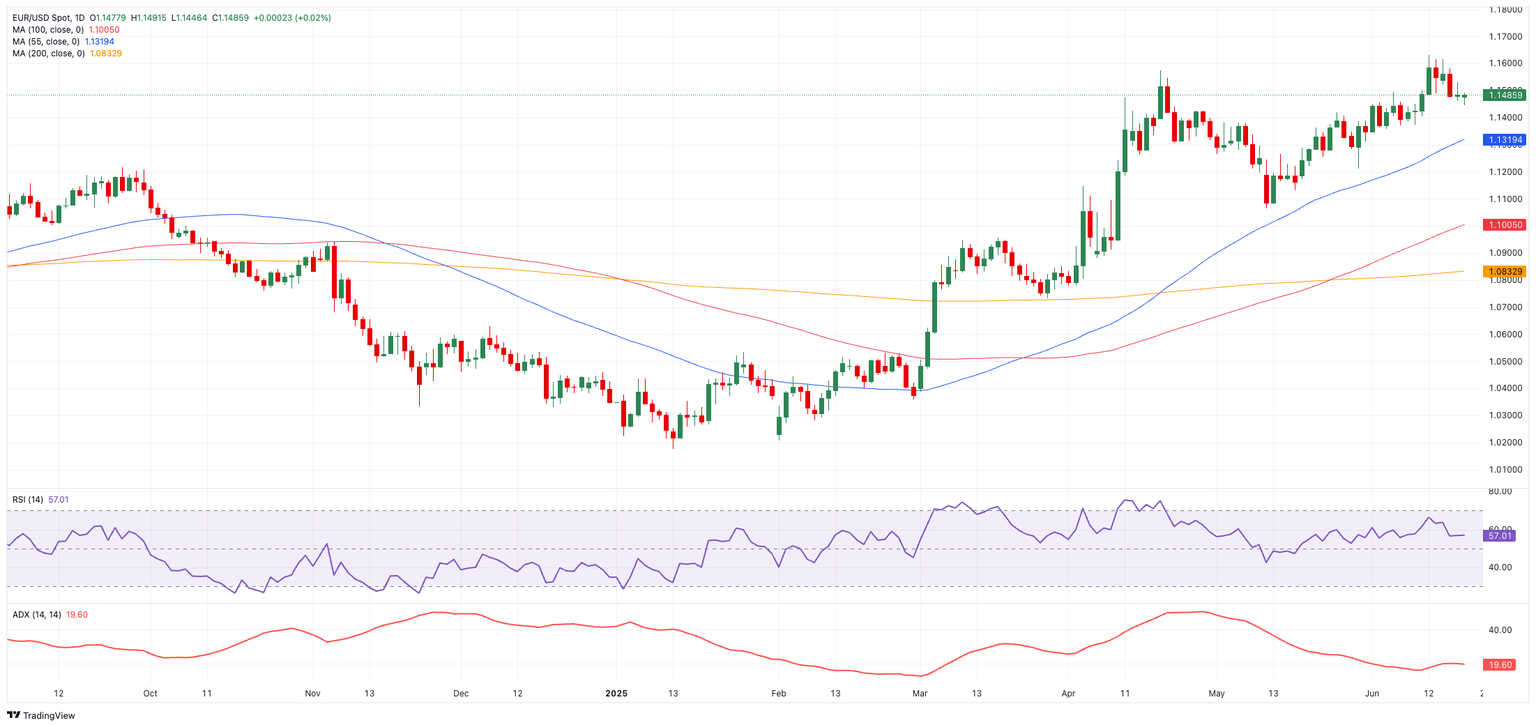

Through the technical window

EUR/USD faces immediate resistance at the June 2025 high of 1.1631, followed by the October 2021 peak at 1.1692 and the 1.1700 milestone.

On the downside, support sits at the 55-day SMA at 1.1323, then the weekly trough of 1.1210 and the monthly base of 1.1064.

The Relative Strength Index (RSI), which is near 57, suggests a bullish tilt, while the Average Directional Index (ADX), which is around 20, indicates only modest trend strength.

EUR/USD daily chart

Moving forward

Next on tap on the domestic calendar will be German Producer Prices, preliminary June Consumer Confidence, and the ECOFIN meeting on June 20.

ECB FAQs

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy for the region. The ECB primary mandate is to maintain price stability, which means keeping inflation at around 2%. Its primary tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

In extreme situations, the European Central Bank can enact a policy tool called Quantitative Easing. QE is the process by which the ECB prints Euros and uses them to buy assets – usually government or corporate bonds – from banks and other financial institutions. QE usually results in a weaker Euro. QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The ECB used it during the Great Financial Crisis in 2009-11, in 2015 when inflation remained stubbornly low, as well as during the covid pandemic.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the European Central Bank (ECB) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the ECB stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Euro.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.