EUR/USD Price Forecast: Further weakness appears in the pipeline

- EUR/USD faced renewed downside pressure following Friday’s uptick.

- The US Dollar resumed its sharp rally, reaching new multi-week highs.

- Markets’ attention now shifts to ECB-speak and upcoming PMIs.

EUR/USD resumed its steep multi-week retracement on Monday, flirting with two-month lows near the 1.0800 neighbourhood and maintaining the trade below the crucial 200-day Simple Moving Average (SMA) at 1.0871.

Meanwhile, the US Dollar (USD) stayed strong, pushing the US Dollar Index (DXY) just pips away from the 104.00 barrier, a region last seen in early August. This extra advance in the Greenback was bolstered by multi-week peaks in US yields across the spectrum.

The Dollar's rally, which has been ongoing since the start of the month, has been propped up by robust US fundamentals and a cautious tone from Federal Reserve (Fed) officials, while the resurgence of the “Trump trade” on Monday also contributed to the robust uptick.

While many policymakers appear to favour a 25 basis point cut next month, some, like FOMC Governor Michelle Bowman and Atlanta Fed President Raphael Bostic, showed some caution. Bostic has even suggested that the Fed might skip a cut in November.

According to the CME Group’s FedWatch Tool, markets are currently pricing in around an 85% probability of a quarter-point cut next month.

Across the Atlantic, the European Central Bank (ECB) aligned with expectations by trimming its policy rates by 25 basis points next week, bringing the Deposit Facility Rate to 3.25%.

However, officials left no clues regarding the potential next steps in the next few months, vaguely reiterating the data-dependent stance.

ECB President Christine Lagarde highlighted sluggish growth and weaker-than-expected economic activity in the Eurozone, pointing to a recovery in household spending but also noting downside risks to growth. She added that domestic inflation remains elevated but is expected to reach the bank's target by 2025. While not anticipating a Eurozone recession, Lagarde predicted a "soft landing" for the economy.

Eurozone inflation, measured by the Harmonised Index of Consumer Prices (HICP), dropped below the ECB's target to 1.7% in the year to September. This, alongside stagnant GDP growth, is likely to bolster the case for further ECB rate cuts in the coming months.

As both the Fed and ECB consider their next policy moves, the future of EUR/USD will largely depend on macroeconomic trends. On this, the US economy is seen outperforming the Eurozone, which should in turn offer continued support to the Greenback in the short to medium term.

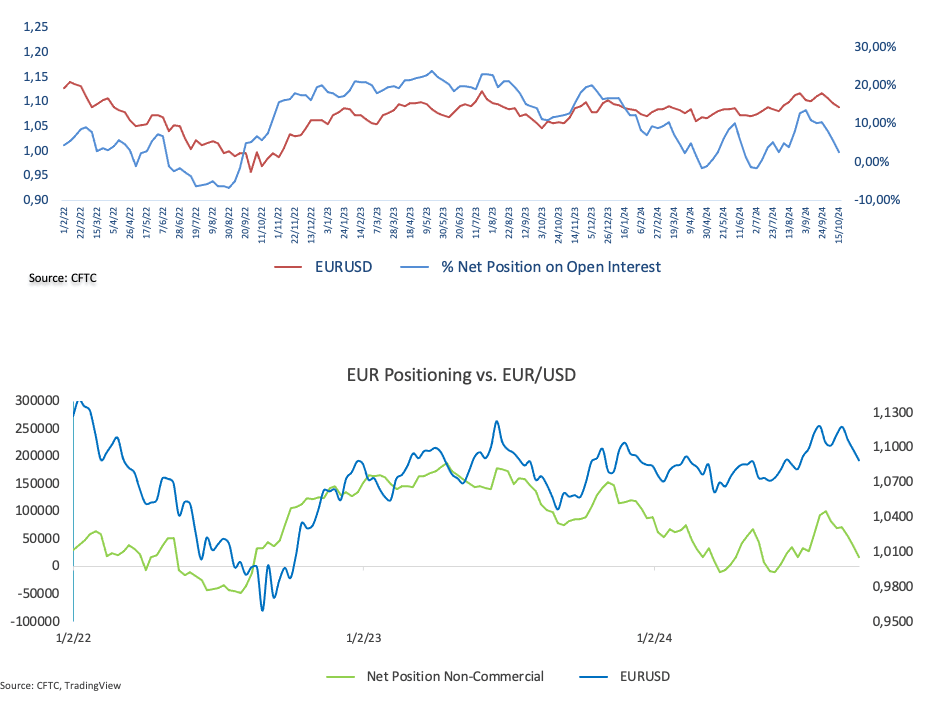

According to CFTC, speculative net longs positions in the Euro declined for the third consecutive week, amidst a multi-week pullback in the long/short ratio. Meanwhile, hedge funds’ net shorts continued to decrease for the sixth straight week, all set against a backdrop of a modest drop in open interest.

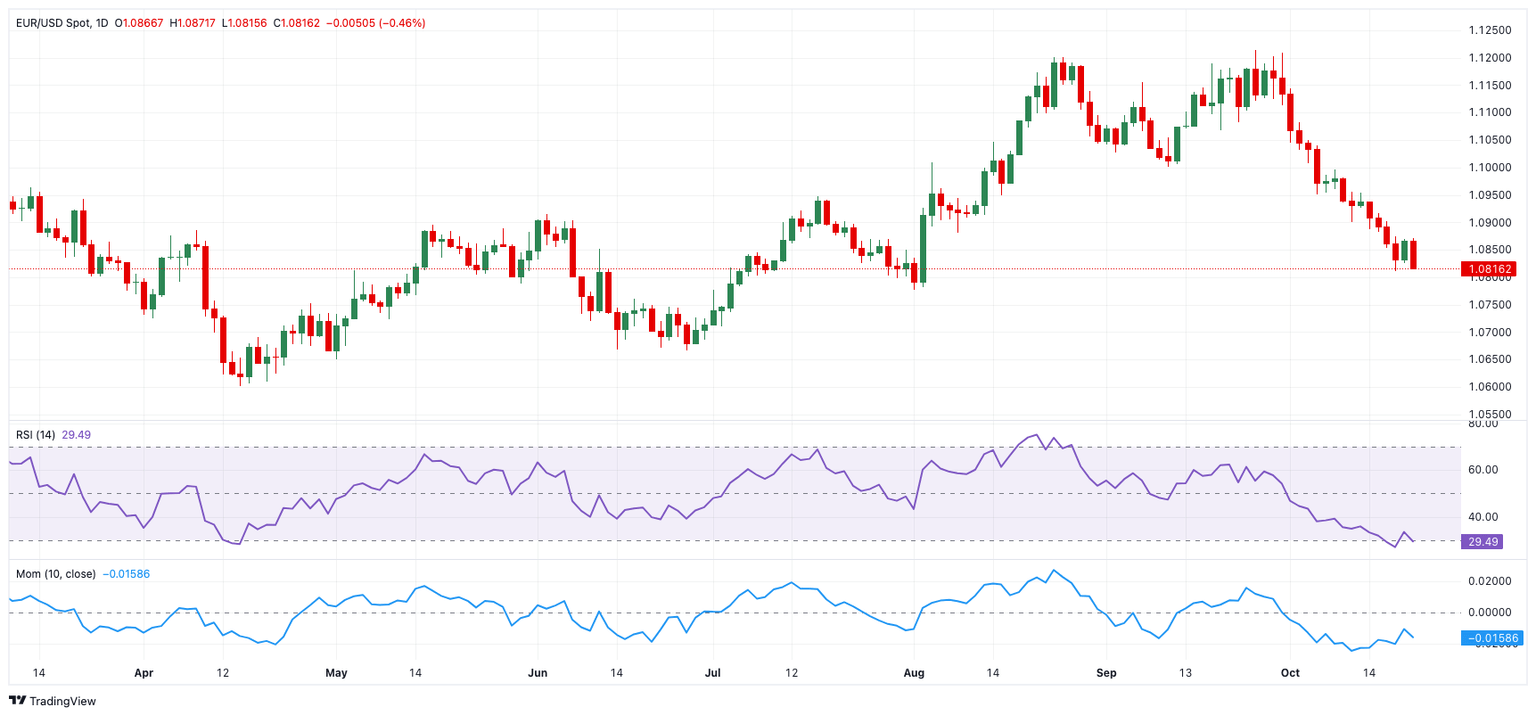

EUR/USD daily chart

EUR/USD short-term technical outlook

Further declines might push EUR/USD to its October low of 1.0810 (October 17), ahead of the key of 1.0800 and prior to the August low of 1.0777 (August 1).

On the upside, the 100-day and 55-day SMAs at 1.0935 and 1.1038, respectively, act as temporary resistance. The 2024 top of 1.1214 (September 25) is likely to be followed by the 2023 peak of 1.1275 (July 18).

Meanwhile, if the pair remains below the critical 200-day SMA of 1.0871, the outlook may deteriorate.

The four-hour chart shows the pair resuming its downward trajectory. Nonetheless, early support is at 1.0810, followed by 1.0777. On the upside, the 55-SMA at 1.0897 leads, followed by 1.0954 and the 100-SMA at 1.0968. The relative strength index (RSI) fell below the 30 yardstick.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.