EUR/USD Price Forecast: Further range bound trade on the cards

- EUR/USD failed to sustain earlier gains past the 1.1200 barrier on Thursday.

- The US Dollar resumed its decline as trade enthusiasm lost impulse.

- US Producer Prices came in below expectations in April.

The Euro (EUR) quickly faded the initial strength, ending the day marginally up on Thursday. Indeed, EUR/USD came under fresh selling pressure soon after hitting daily tops near 1.1230 in a context of humble losses in the US Dollar (USD).

The US Dollar Index (DXY), in the meantime, navigated a tight range in the area below the 101.00 level, following a correction in US Treasury yields across different time frames.

Optimism around global trade dims

Initial optimism around US–China trade developments helped lift risk appetite, after both sides agreed to roll back tariffs from over 100% to 10%, with a 90-day freeze on further hikes. A 20% tariff on fentanyl-linked imports from China remained in place, keeping the overall tariff burden at 30%.

That agreement followed a US–UK trade pact and bullish commentary from President Trump hinting at more deals ahead.

However, the absence of concrete detail in the US–China agreement continued to fuel market scepticism, limiting follow-through on the dollar’s rebound and offering the risk complex a temporary lift.

Fed–ECB divergence grows clearer

The widening policy gap between the Federal Reserve (Fed) and the European Central Bank (ECB) is another focal point for FX markets.

While the Fed kept interest rates unchanged and maintained its hawkish guidance, the ECB delivered a 25 basis points cut last month, lowering its deposit rate to 2.25%.

Another ECB cut could arrive as early as June, while the Fed is now seen holding rates steady at least until September. Markets still price in two Fed cuts by year-end, helped by soft April inflation readings and tempered trade expectations.

Speculative flows stay bullish on the Euro

Despite recent volatility, speculative appetite for the euro remains solid. CFTC data through May 6 showed net long positions holding near recent highs at 75.7K contracts, with open interest rising to 738K—its highest level since September 2024.

However, commercial traders remained net short, highlighting corporate caution amid ongoing macro uncertainty.

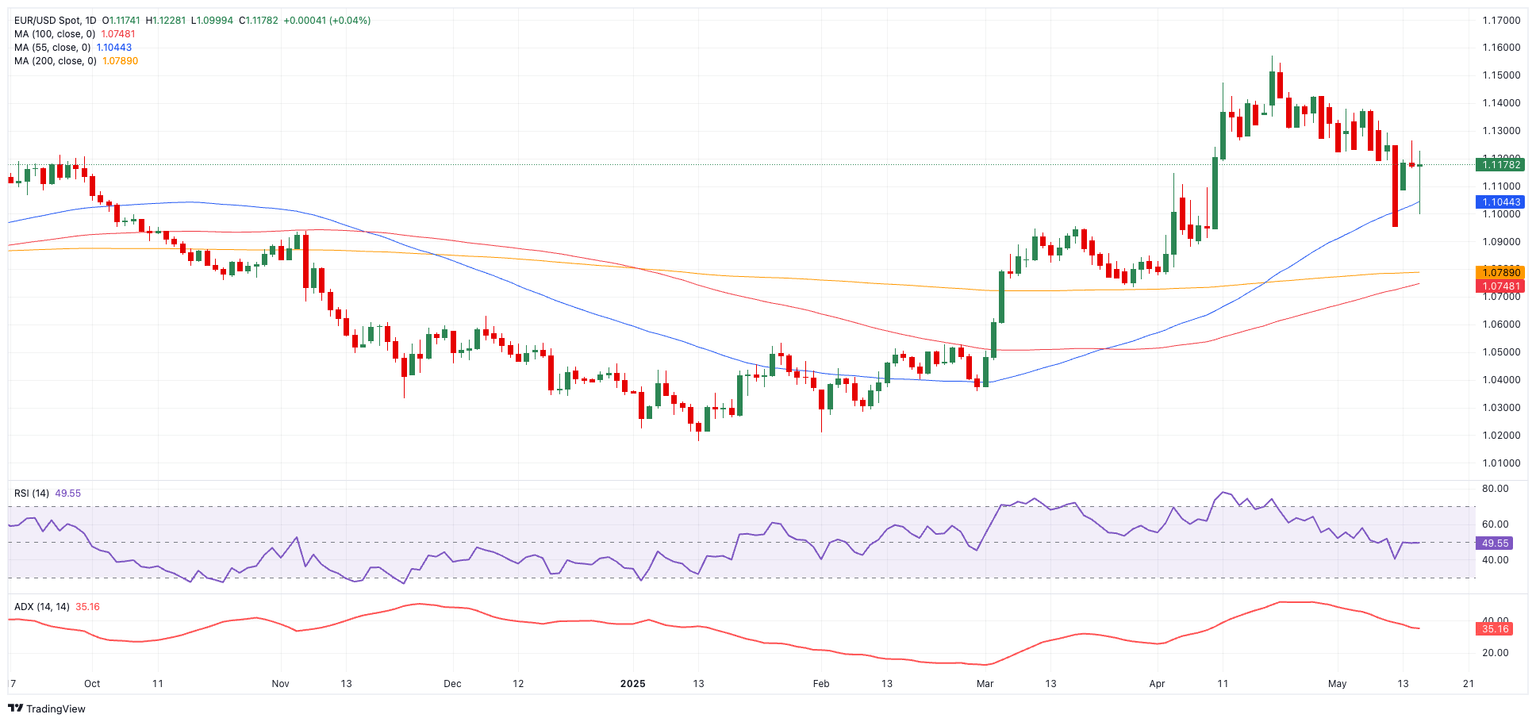

Technical outlook: Resistance proving sticky

EUR/USD continues to face resistance at its 2025 high of 1.1572 (April 21). Beyond that, the 1.1600 handle and the October 2021 peak at 1.1692 mark the next upside hurdles.

Support levels to watch include the May low at 1.1064 (May 12), followed by the temporary 55-day SMA at 1.1055 and the key 200-day SMA at 1.0796.

Momentum indicators are sending mixed signals. The Relative Strength Index (RSI) has dropped below 48, suggesting a mild bearish bias, while the Average Directional Index (ADX) at 32 points to a still-active but weakening trend.

EUR/USD daily chart

Outlook: Volatility ahead

EUR/USD looks likely to remain volatile, driven by shifting headlines and central bank divergence. While speculative positioning continues to favour the euro, uncertainty around trade policy and monetary outlooks is likely to keep the pair on an uneven path in the near term.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.