EUR/USD Price Forecast: Fears keep the pair ranging

EUR/USD Current price: 1.1703

- US President Trump announced fresh tariffs, market’s uncertainty soars.

- The June FOMC meeting Minutes repeated the well-known cautious narrative.

- EUR/USD confined to familiar levels around 1.1700, bears maintain the pressure.

The EUR/USD pair trades lifeless at around 1.1700 for a third consecutive day amid renewed inflation and growth concerns. United States (US) President Donald Trump sent a second round of tariffs letters on Wednesday, while announcing a 50% tariff on copper imports going into effect on August 1.

Furthermore, President Trump threatened Brazil with a 50% levy on all goods, accusing the country on attacking US tech companies and of conducting a “witch hunt” against former President Jair Bolsonaro.

Meanwhile, the Federal Open Market Committee (FOMC) released the Minutes of the June meeting. The document maintained the well-known cautious narrative, repeating that officials believe uncertainty has diminished, but remains elevated. The majority of policymakers think that at least some reduction in the federal fund rate is both likely and appropriate before year-end, although some officials prefer not to make reductions before year-end.

Fears limit demand for the high-yielding Euro, yet as concerns came from the US, the Greenback is also unable to attract buyers.

Data-wise, Germany released the final estimate of the June Harmonized Index of Consumer Prices (HICP), confirming it at 2% year-on-year (YoY) as previously estimated. Across the pond, the US released Initial Jobless Claims for the week ended July 5, which rose by 227K, better than the 235K expected and below the previous 232K. Other than that, several Federal Reserve (Fed) speakers will be on the wires during American trading hours.

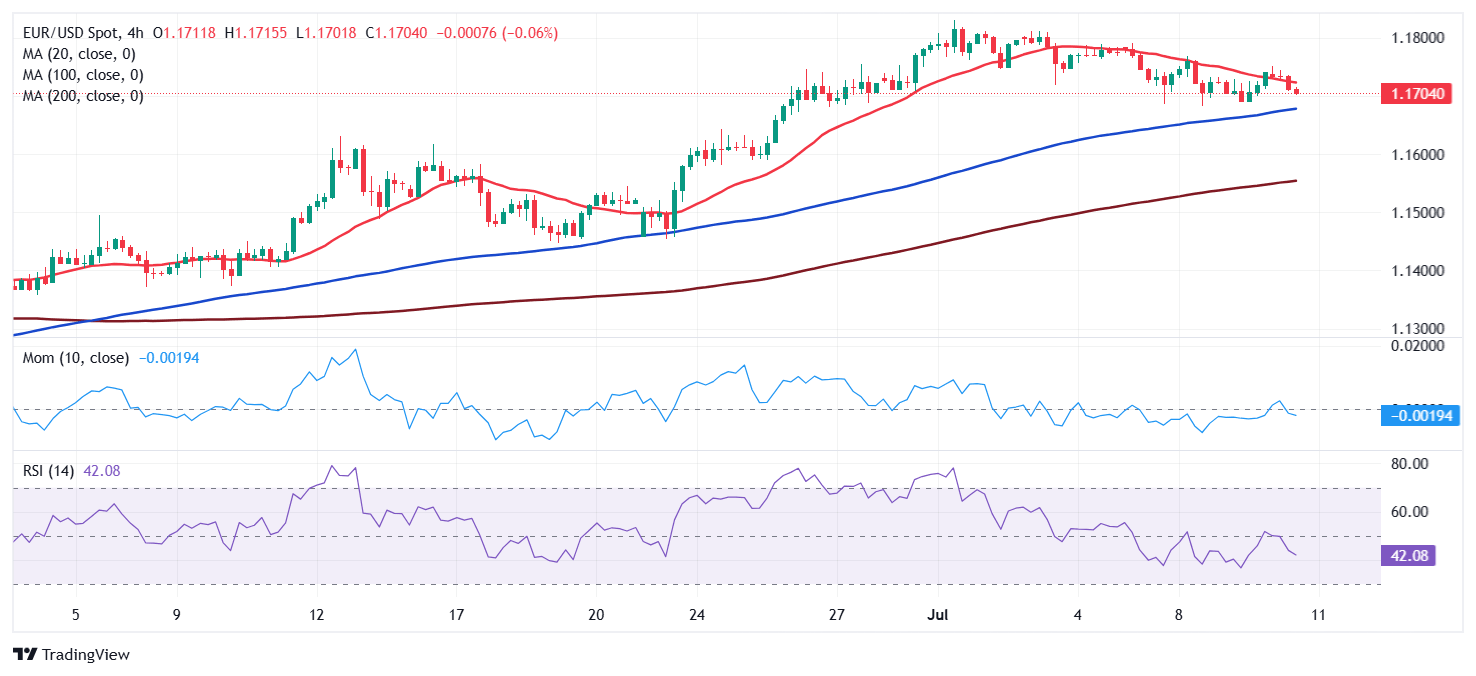

EUR/USD short-term technical outlook

The daily chart for the EUR/USD pair shows it keeps developing above all its moving averages, although the 20 Simple Moving Average (SMA) lost momentum and turned flat, currently at around 1.1650. Technical indicators, in the meantime, grind lower, reaching fresh weekly lows well above their midlines, not enough to support a bearish continuation.

The 4-hour chart shows that EUR/USD is bearish in the near term. The pair briefly traded above a bearish 20 SMA, but quickly returned below it, currently at around 1.1720. The 100 SMA, in the meantime, provides dynamic support at around 1.1670. Finally, technical indicators hedge firmly south within negative levels, supporting a new leg lower, particularly if the 1.1670 area gives up.

Support levels: 1.1675 1.1640 1.1590

Resistance levels: 1.1720 1.1770 1.1805

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.