EUR/USD Price Forecast: Correction has further legs to go

- EUR/USD added to recent weakness and slipped back to three-day troughs.

- The US Dollar regained further composure on positive data and the Fed’s repricing.

- US markets will be closed on July 4 due to the Independence Day holiday.

The Euro (EUR) maintained the bearish trend for the second day in a row vs the US Dollar (USD) on Thursday, with EUR/USD receding to as low as the 1.1720-1.1710 range, or three-day lows, amid a strong bounce in US yields across the curve, in contrast to renewed weakness in Germany’s 10-year bund yields.

Political pressure on the Fed

Despite renewed criticism from President Trump, who called for interest rates as low as “1% or lower” and accused Fed Chair Jerome Powell of neglecting his duties, the greenback shrugged off the remarks and found support on Thursday.

Geopolitics and risk sentiment

A fragile ceasefire in the Middle East last week rekindled investors’ appetite for risk assets, initially weighing heavily on the Greenback and giving the Euro and other risk-linked currencies an extra lift.

Trade tensions remain front and centre

With the July 9 deadline for a US tariff pause looming, markets remain cautious. The European Union (EU) is also negotiating several trade accords, including talks with the UK. President Trump said he has no plans to extend the tariff truce beyond July 9, remained uncertain on a deal with Japan but noted an agreement has been reached with Vietnam and hopes one with India soon.

Policy divergence on hold

The Federal Reserve (Fed) left rates at 4.25%–4.50% in June but upgraded its inflation and unemployment forecasts, with the dot plot still signalling 50 basis points of easing this year.

By contrast, the European Central Bank (ECB) cut its deposit rate to 2.00% earlier this month, and President Christine Lagarde warned any further easing would depend on a clear drop in external demand.

Market positioning still favour the EUR

The latest CFTC data for the week ending June 24 showed non-commercial net longs in the single currency rising to over 111.1K contracts, the highest since January 2024, while commercial players’ net shorts climbed to around 164.3K contracts, levels not seen since December 2023. In addition, open interest has surged to two-week highs around 762.6K contracts.

Technical landscape

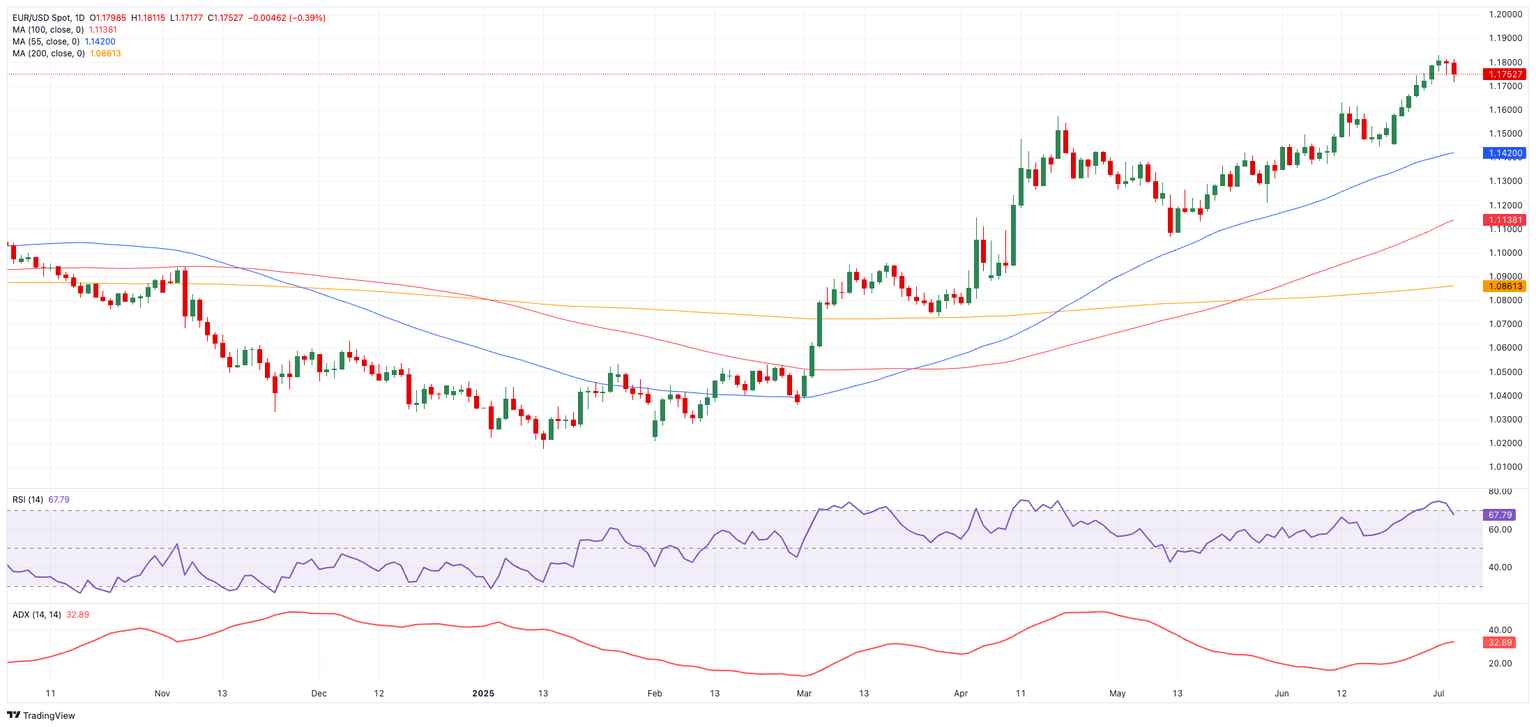

Immediate resistance lies at the 2025 ceiling of 1.1830 (July 1), with the September 2018 high of 1.1815 (September 24) and the June 2018 peak of 1.1852 (June 14) coming into focus should that level give way.

Just the opposite, the 55-day Simple Moving Average (SMA) at 1.1418 offers interim support, prior to the weekly trough at 1.1210 (May 29) and the May floor of 1.1064 (May 12), all sitting above the psychological 1.1000 mark.

Momentum indicators remain constructive; the Relative Strength Index (RSI), which is holding around 68, suggests that conditions are stretched but still upward-leaning, while an Average Directional Index (ADX) reading above 33 indicates a strengthening trend.

EUR/USD daily chart

Medium-term view

The pair's uptrend is anticipated to continue, provided there are no new geopolitical or macroeconomic disturbances, supported by a decrease in risk aversion and the potential for further easing from the Fed.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.