EUR/USD Price Forecast: Cautious buying ahead of first-tier data

EUR/USD Current price: 1.1401

- The Hamburg Commercial Bank upwardly revised the Eurozone May Composite PMI.

- The US May ADP Employment Change report came in much worse than anticipated.

- EUR/USD aims higher, yet lacks directional momentum in the near term.

The EUR/USD pair found an intraday bottom at 1.1357, posting modest intraday gains at the beginning of the American session. The pair is having a hard time attracting speculative interest ahead of first-tier data, but maintains its bullish bias.

So far, the mood is cautiously optimistic amid White House hints of a soon-to-come call between the United States (US) President Donald Trump and his Chinese counterpart Xi Jinping, aimed at resolving trade tensions.

Additionally, speculative interest paid close attention to US employment-related data. Following an encouraging JOLTS Job Openings report on Tuesday, indicating an uptick in open positions, the ADP Employment Change report showed that the private sector added measly 37K new positions in May, much worse than the 115K anticipated. As a result, the US Dollar (USD) fell, helping EUR/USD recover towards the current 1.1400 region.

Earlier in the day, the Hamburg Commercial Bank (HCOB) released the final estimates of the May Services and Composite Purchasing Managers’ Indexes (PMI) for the Eurozone. German figures suffered modest downward revisions, yet for the whole EU, services output was confirmed at 49.7, better than the previous estimate of 48.9. The EU Composite PMI resulted at 50.2, above the 49.5 forecast.

The American calendar includes the US S&P Global PMIs and the ISM Services PMI for May alongside a couple of Federal Reserve (Fed) speakers. However, market players will likely wait for the European Central Bank (ECB) monetary policy decision scheduled for Thursday, and the US Nonfarm Payrolls (NFP) report to be out on Friday, before compromising on a certain direction.

EUR/USD short-term technical outlook

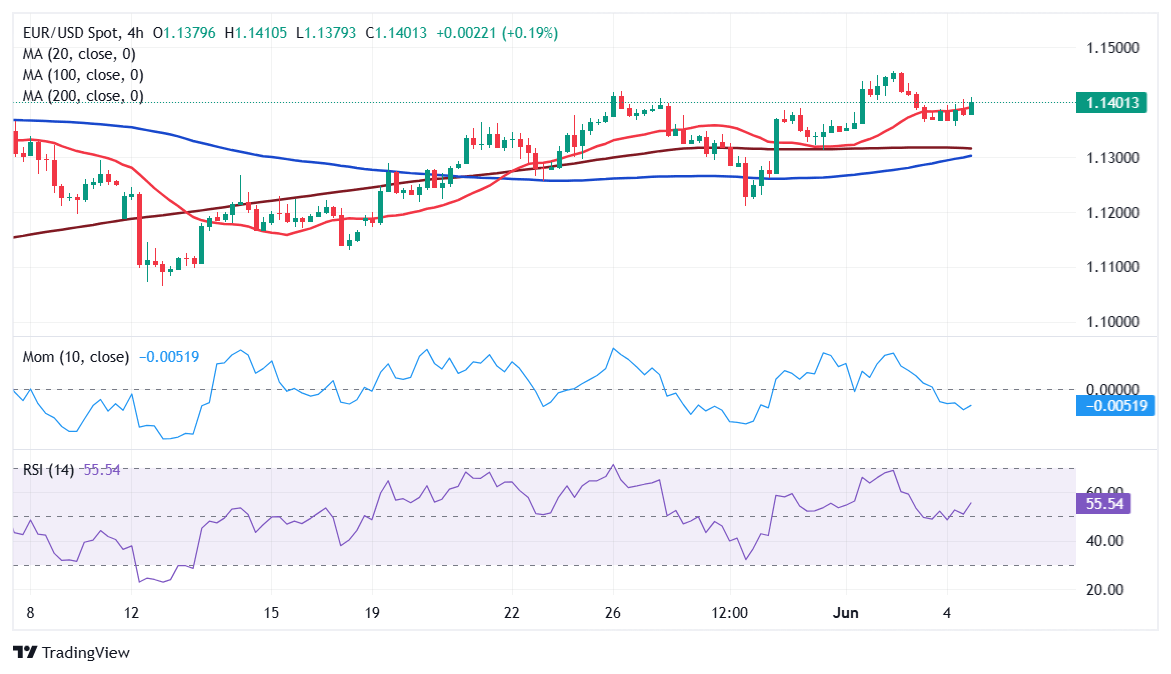

From a technical point of view, the EUR/USD pair is poised to extend its advance, although the momentum is limited. The daily chart shows it trades in the lower half of Monday’s range, but still above all its moving averages. A directionless 20 Simple Moving Average (SMA) providing support in the 1.1270 price zone, while the 100 SMA keeps advancing above the 200 SMA, both far below the shorter one. Technical indicators stabilized well above their midlines, with modest upward slopes.

In the 4-hour chart, the EUR/USD pair is battling to extend gains beyond a mildly bullish 20 SMA after spending most of the day below it. At the same time, technical indicators hold above their midlines, but heading nowhere, in line with the absence of directional convictions. The pair would need to clear the 1.1420 area to be able to extend intraday gains, unlikely ahead of the first-tier events coming later this week.

Support levels: 1.1350 1.1310 1.1270

Resistance levels: 1.1420 1.1460 1.1505

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.