EUR/USD Price Forecast: buyers keep pushing, 1.1740 at sight

EUR/USD Current price: 1.1678

- The Euro advances despite political noise and tepid local data.

- The US Gross Domestic Product was upwardly revised to 3.3% in Q2.

- EUR/USD is bullish in the near term, could reach the 1.1740 price zone.

The EUR/USD pair regained its upward strength on Thursday, hitting an intraday high of 1.1675 during European trading hours. The US Dollar (USD) edged south after dovish comments from Federal Reserve (Fed) Bank of New York President John Williams. Williams said that growth and the fact that the economy is going through an adjustment phase are paving the way for interest rate cuts, although clarifying that policymakers need to see more economic data before reaching a conclusion.

In the meantime, the Euro (EUR) advances despite geopolitical turmoil in the region. On the one hand, Russia's continuous attacks on Ukraine ended up hitting an EU delegation building in Kyiv. EU Commission President Ursula von der Leyen accused Russia of indiscriminate attacks, “last night's attacks show Kremlin will stop at nothing to terrorize Ukraine, even targeting the EU, she said.”

On the other hand, political turmoil in France arose after Prime Minister François Bayrou asked President Emmanuel Macron to reconvene parliament for a confidence vote in his government on September 8. Bayrou’s austerity measures are in the eye of the storm, and the Parliament is unlikely to endorse them.

Finally, the European Central Bank (ECB) released the Monetary Policy Meeting, which showed policymakers are comfortable with the current policy rates, seeing them in neutral territory. The document also showed that officials remain concerned amid persistent uncertainty, and noted both upside and downside risks to growth and inflation.

Data-wise, the EU released the August Economic Sentiment Indicator, which printed at 95.2, easing from the previous 95.7 and missing expectations of 96. The United States (US) published the second estimate of the Q2 Gross Domestic Product (GDP), showing annualized growth in the three months to June was upwardly revised to 3.3% from the previous estimate of 3.1%. Also, Initial Jobless Claims for the week ended August 23 were up by 229K, better than the 230K expected. Figures were not enough to support the USD, which fell further and pushed EUR/USD towards the 1.1700 level. The US will publish July Pending Home Sales and the August Kansas Fed Manufacturing Activity index.

EUR/USD short-term technical outlook

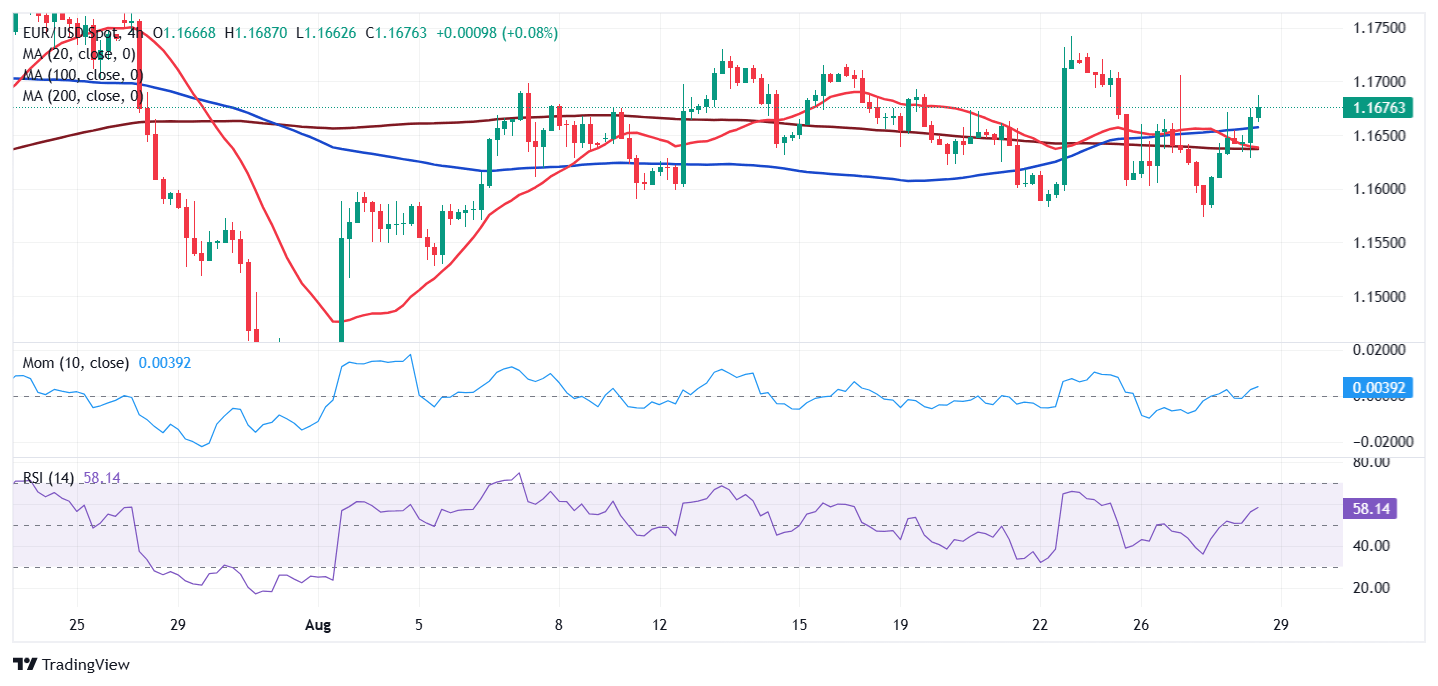

The EUR/USD pair pressures intraday highs, but technical readings in the daily chart show the consolidative phase continues. A mildly bullish 20 Simple Moving Average (SMA) provides near-term support at around 1.1645 while the 100 and 200 SMAs keep heading higher below the shorter one, although losing momentum. Technical indicators, in the meantime, aim marginally higher around their midlines, not enough to confirm additional gains ahead.

In the near term, and according to the 4-hour chart, EUR/USD is poised to extend its advance. It is currently developing above all its moving averages, which remain directionless and confined to a tight intraday range. Finally, technical indicators accelerated higher above their midlines, hinting at another leg north.

Support levels: 1.1645 1.1610 1.1570

Resistance levels: 1.1700 1.1740 1.1785

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.