EUR/USD Price Forecast: Buyers giving up amid looming US employment data

EUR/USD Current price: 1.0326

- US President Donald Trump’s tariffs continue to drive the market’s mood.

- United States employment-related figures taking centre stage this week.

- EUR/USD at risk of resuming its slide, 1.0220 in sight once 1.0300 gives up.

The EUR/USD pair held above 1.0300 throughout the first half of Tuesday, reaching the 1.0340 region in the mid-European session, yet unable to extend its Monday recovery. Concerns about United States (US) President Donald Trump’s announcement on tariffs receded after talks with Mexican and Canadian authorities.

Mexico's President Claudia Sheinbaum and Canadian Prime Minister Justin Trudeau announced late Monday that Trump will postpone levies for 30 days, as both countries committed to increase border security.

Tensions with China, however, persist. The Asian giant announced tariffs of 15% on American Coal and LNG and 10% on US oil and agricultural machinery. Still, the tariff’s deadline with China would arrive on February 10, leaving room for both economies to stuck a deal.

Data-wise, the European macroeconomic calendar had nothing relevant to offer. As for the US, the country will release December Factory Orders and JOLTS Job Openings for the same month. Employment-related figures are relevant ahead of the release of the January Nonfarm Payrolls report on Friday.

EUR/USD short-term technical outlook

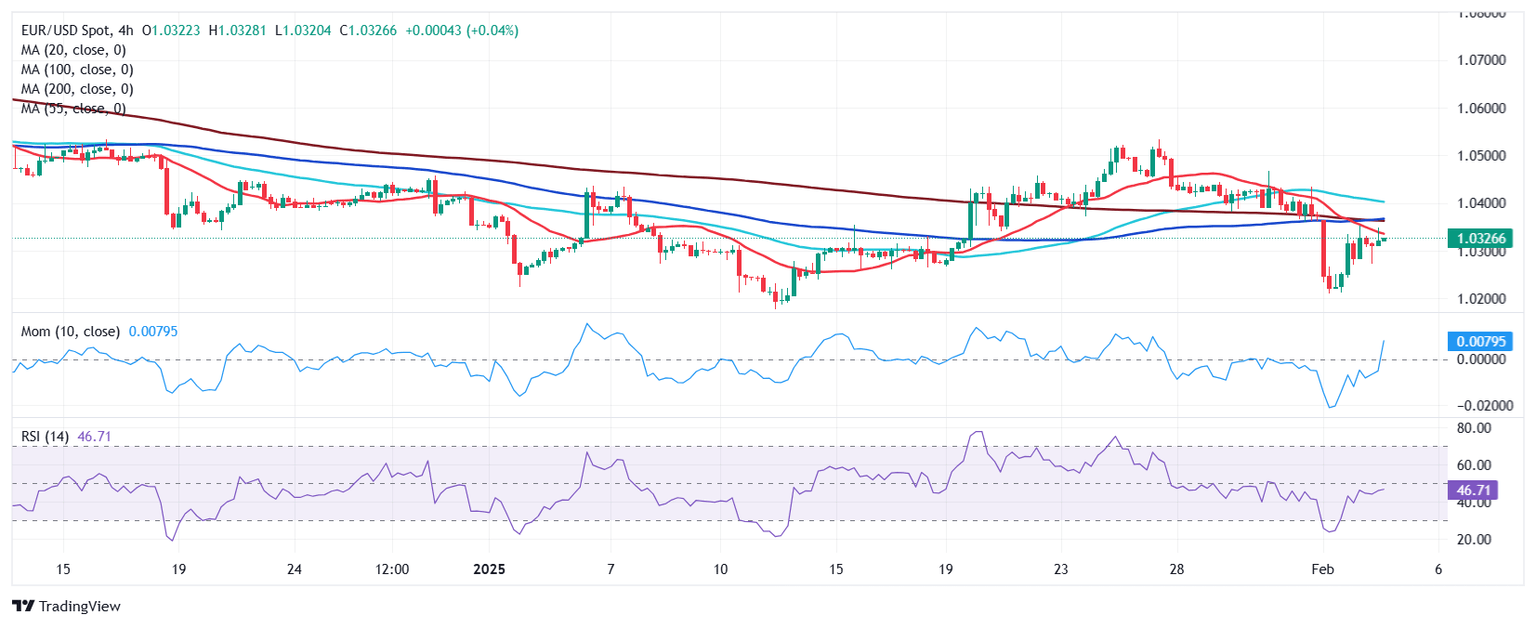

The EUR/USD pair retreated from an intraday peak of 1.0349 and trades with modest losses around 1.0320 ahead of the American opening. In the daily chart, the risk of a bearish extension has increased. The pair remains below a mildly bearish 20 Simple Moving Average (SMA), acting as dynamic resistance at around 1.0355. The 100 SMA, in the meantime, accelerates south far above the shorter one, reflecting increased selling interest. Finally, technical indicators aim south, with the Momentum indicator still hovering within neutral levels but the Relative Strength Index (RSI) indicator heading firmly lower at around 42.

The near-term picture is bearish. In the 4-hour chart, EUR/USD repeatedly found sellers around a bearish 20 SMA, which has crossed below flat 100 and 200 SMAs, usually a sign of increased selling interest. At the same time, technical indicators resumed their slides within negative territory, albeit with modest downward strength.

Support levels: 1.0300 1.0265 1.0220

Resistance levels: 1.0355 1.0390 1.0440

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.