EUR/USD Price Forecast: Bears aiming for 1.1640

EUR/USD Current price: 1.1722

- Risk aversion backs the US Dollar amid fresh tariffs-related concerns.

- Encouraging European data not enough to keep the Euro afloat.

- EUR/USD gains downward traction in the near term, could soon pierce 1.1700.

The EUR/USD pair is under pressure at the beginning of the new week, with the US Dollar (USD) benefiting from risk aversion. Concerns these days revolve around the United States (US) tariffs, as the deadline set by President Donald Trump looms.

Trump announced massive retaliatory tariffs in May, establishing afterwards a 90-day pause, inviting trade counterparts to reach a better deal for both parts. The deadline was set at July 9, and so far, the US has announced some deals with minor economies. However, there has been no progress with major rivals such as China or the Eurozone.

Over the weekend, US Treasury Secretary Scott Bessent said President Trump will send letters to some trading partners saying increased levies will be put in place on August 1 if there is no progress. Bessent added he expects to see “several big announcements over the next couple of days” about trade deals.

Also, Trump said that countries that align themselves with BRICS (a contraction of the organisation's founders, Brazil, Russia, India, China and South Africa), such as Iran, Egypt, Ethiopia, and the United Arab Emirates, will be subject to additional 10% tariffs, with no exceptions. Uncertainty fuels USD demand despite the positive tone of Wall Street after the long weekend.

Data-wise, the EU published May Retail Sales, which fell by 0.7% on a monthly basis, as expected, while rising by 1.8% from a year earlier, beating the 1.2% anticipated by market participants. Additionally, the Sentix Investor Confidence index improved to 4.5 in July from the 0.2 posted in June. The US calendar has nothing relevant to offer until next Wednesday, when the Federal Open Market Committee (FOMC) will release the minutes of the June meeting.

EUR/USD short-term technical outlook

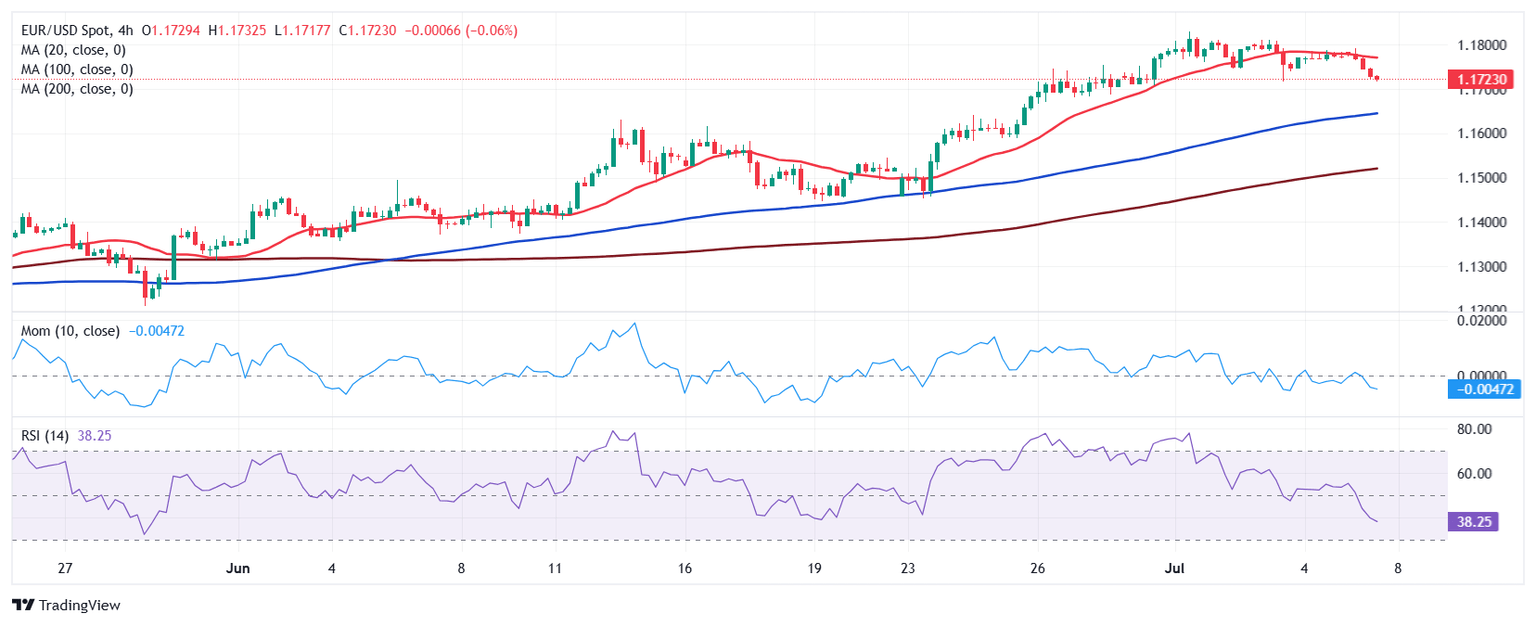

From a technical point of view, the EUR/USD pair is pressing the previous weekly low at 1.1717, aiming to break below it. The daily chat shows the pair remains above all its moving averages, which limit the downward potential in the long term. A bullish 20 Simple Moving Average (SMA) provides dynamic support at around 1.1620. Technical indicators, in the meantime, eased from their recent peaks. The Momentum indicator lacks directional strength well above its 100 line, while the Relative Strength Index (RSI) indicator aims south at around 62, skewing the risk to the downside, yet falling short of suggesting a steep slide.

Technical readings in the 4-hour chart support a bearish extension for EUR/USD towards a still bullish 100 SMA, providing dynamic support in the 1.1640 region. A mildly bearish 20 SMA, in the meantime, has contained advances since last Thursday, providing critical resistance at around 1.1770. Finally, technical indicators have pared their slides but remain within negative levels. A break through the aforementioned weekly could open the door for a continued slide in the near term.

Support levels: 1.1715 1.1685 1.1640

Resistance levels: 1.1770 1.1800 1.1830

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.