EUR/USD Price Forecast: Battling to regain the 1.1600 threshold

EUR/USD Current price: 1.1586

- Hopes for a Federal Reserve rate cut in September weigh on the US Dollar.

- The Eurozone Sentix Investor Confidence unexpectedly fell in August.

- EUR/USD consolidates Friday’s gains, needs to re-conquer the 1.1600 mark.

The EUR/USD pair consolidates Friday’s gains, trading in a tight range just below the 1.1600 mark. The US Dollar (USD) fell on the back of a tepid United States (US) Nonfarm Payrolls (NFP) report, which revived hopes for an interest rate cut in September.

The Federal Reserve (Fed) met before the release, and maintained the cautious stance over interest rate cuts, delivering a hawkish message related to a persistently tight labor market and the risk of higher inflation amid US President Donald Trump's tariff policy.

However, macroeconomic data released these last few weeks showed inflation has not overshot, while the labor market is loosening. Indeed, price pressures are still above the Fed’s 2% goal, but a 25 basis points (bps) rate cut is doable.

The new week brought the Eurozone Sentix Investor Confidence report, which fell in August to -3.7 after advancing 4.5 in July. The poor outcome limits the EUR's advance, despite a slightly better market mood. The US will release June Factory Orders, expected to have shrunken from the 8.2% advance posted in May.

EUR/USD short-term technical outlook

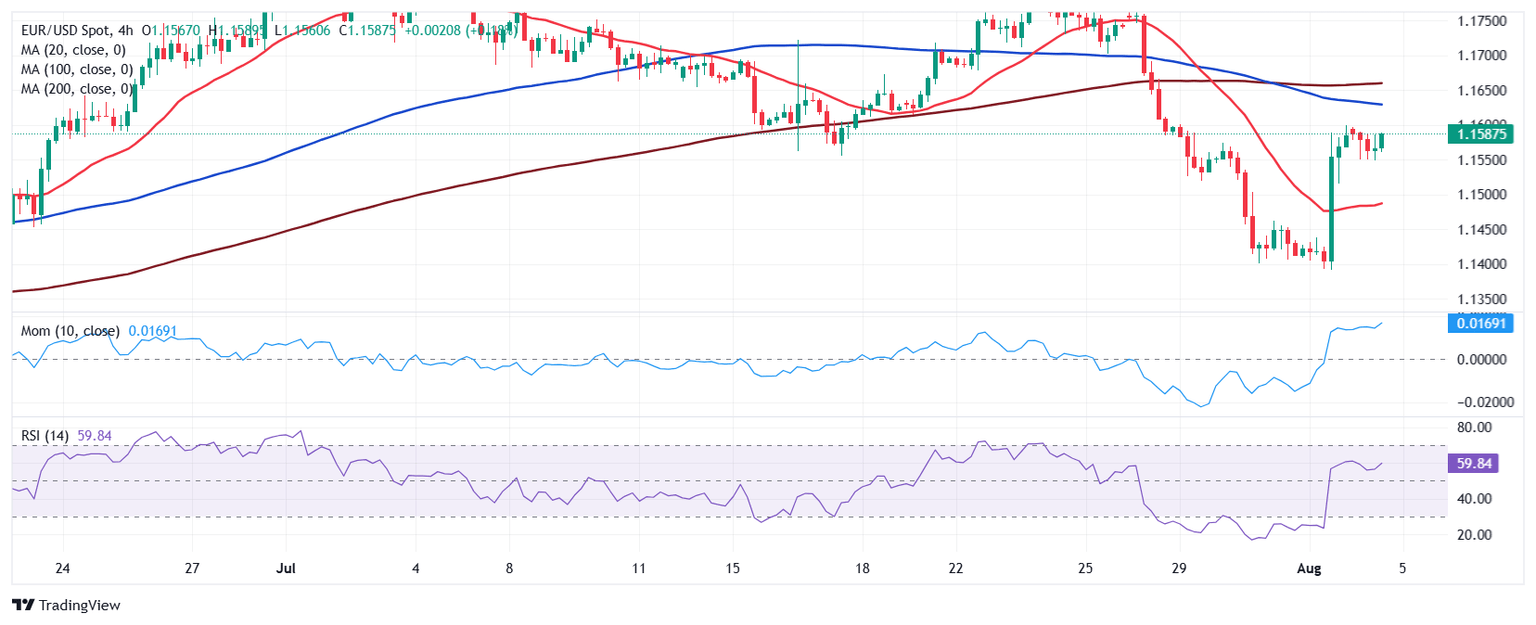

The daily chart for the EUR/USD pair shows the pair met buyers just ahead of a bullish 100 Simple Moving Average (SMA) currently at around 1.1370. A flat 20 SMA, in the meantime, provides resistance at around 1.1640, the level to overcome to turn bullish. Finally, technical indicators corrected oversold conditions, but lost their upward strength just below their midlines, suggesting buyers are still on the sidelines.

In the 4-hour chart, the EUR/USD pair is range-bound, although there are no signs of a potential slide. The 20 SMA lost its bearish strength and turned flat in the 1.1480 area, while technical indicators remain directionless well above their midlines. The pair flirted with the 1.1600 level during Asian trading hours, with gains beyond the level turning the risk towards the upside in the near term.

Support levels: 1.1545 1.1505 1.1470

Resistance levels: 1.1600 1.1640 1.1685

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.