EUR/USD Price Forecast: Back to the consolidative range?

- EUR/USD faded a move to four-year highs past the 1.1900 barrier.

- The US Dollar managed to regain composure following Powell’s presser.

- The Federal Reserve reduces its FFTR by 25 bps to 4.00%-4.25%, as expected.

The Euro (EUR) lost momentum on Wednesday, pulling EUR/USD down toward 1.1820 and snapping a four-day winning streak that had carried the pair to multi-year highs around 1.1920. The pullback came after the US Dollar (USD) regained its balance following the Federal Reserve’s (Fed) decision to reduce its interest rates.

Indeed, the Fed trimmed the Fed Funds Target Range (FFTR) by 25 basis points to 4.00%–4.25% as expected, sparking a sharp rebound in the US Dollar Index (DXY), which climbed back toward the 97.00 mark after briefly touching multi-week lows near 96.50.

Powell signals caution as Fed cuts rates

The Fed lowered rates by a quarter point, pointing to slowing job growth and rising risks to employment while acknowledging inflation remains “somewhat elevated”. Projections show another 50 basis points of cuts are likely this year, with smaller reductions pencilled in for 2026 and 2027. The 2025 median rate forecast was nudged down to 3.6%, while growth was revised slightly higher to 1.6%. Unemployment was held at 4.5%, and inflation expectations were unchanged.

The decision wasn’t unanimous: new governor Miran pushed for a deeper 50 basis point cut. Still, the Fed kept its balance sheet reduction on track and reiterated its dual mandate.

At his press conference, Chair Jerome Powell struck a careful tone. He noted that job gains have slowed, consumer spending is softening, and inflation is running at 2.7% on headline PCE and 2.9% on core. Tariffs are driving goods prices higher, he said, though services inflation continues to cool. Powell stressed that risks are becoming more balanced, the Fed is moving closer to neutral, and there was little appetite for a bigger cut.

ECB holds steady, inflation near target

The European Central Bank (ECB) left all three key rates unchanged last week, sticking with a data-dependent, meeting-by-meeting approach. Officials said inflation is now broadly aligned with the 2% medium-term goal, with forecasts showing core inflation averaging 2.4% in 2025 before easing to 1.9% in 2026 and 1.8% in 2027.

President Christine Lagarde described the ECB as being in a “good place”, with risks now more evenly balanced, though the Bank emphasised that incoming data will remain the key driver of policy.

Trade tensions cool, but tariffs bite

Markets got some relief on the trade front after Washington and Beijing extended their truce for another 90 days. President Trump postponed tariff hikes until November 10, while China refrained from retaliating. Even so, the tariff burden remains heavy: US imports from China face a 30% levy, while Chinese exports to the US are taxed at 10%.

Washington also secured a new deal with Brussels. The EU agreed to reduce tariffs on US industrial goods and expand access for American farm and fisheries products. In return, Washington imposed a 15% tariff on most European imports, though car tariffs remain a threat depending on EU legislation still in the pipeline.

EUR/USD technical outlook: bulls eye 1.2000

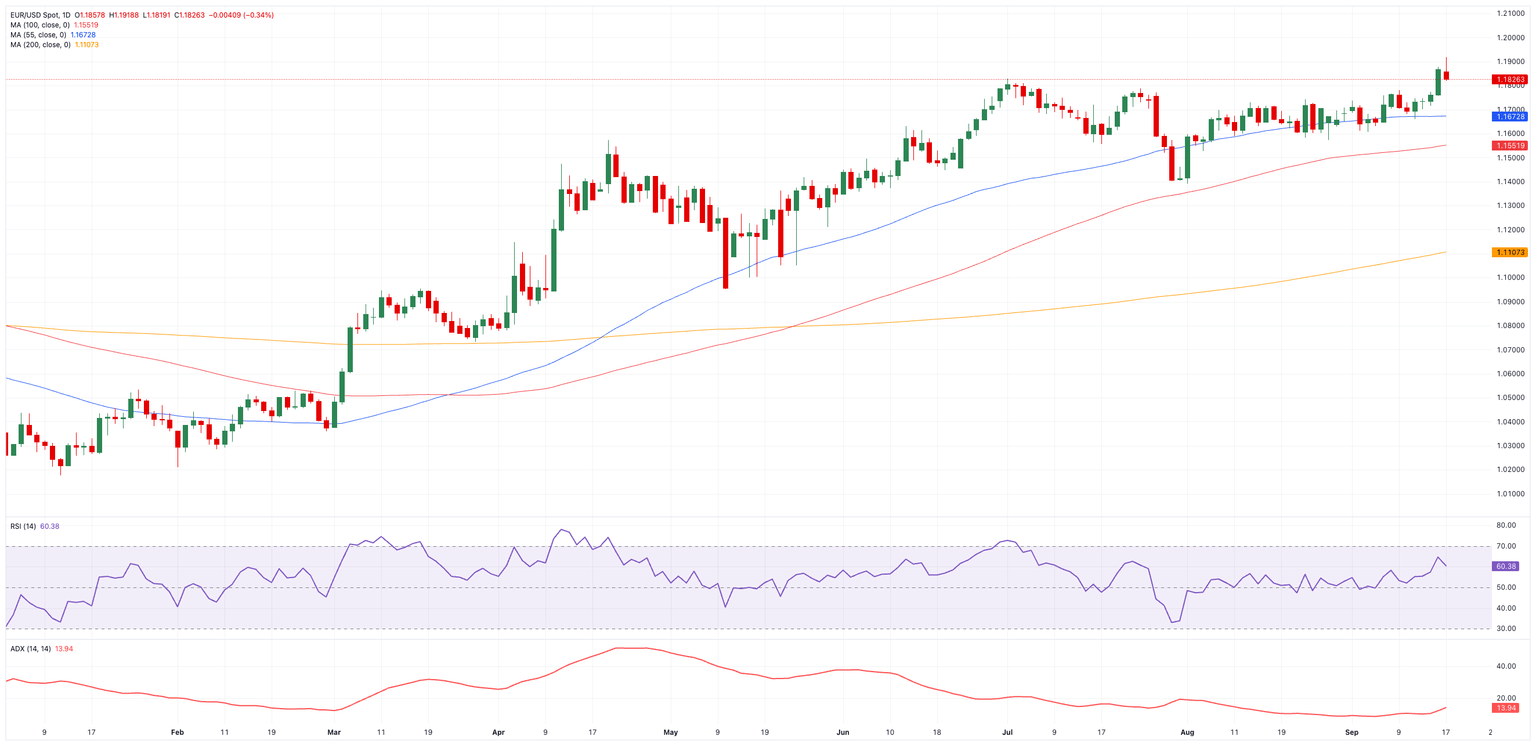

EUR/USD appears to be edging toward a breakout after consolidating in recent sessions. Resistance sits at the 2025 ceiling of 1.1918 (September 17), and a clear move above would put the psychological 1.2000 level back in play.

On the downside, support comes in at the 100-day Simple Moving Average (SMA) around 1.1556, followed by the August base at 1.1391 (August 1) and the May trough at 1.1210 (May 29).

Momentum indicators show a market still leaning bullish but without much conviction. The Relative Strength Index (RSI) has eased back to 61, suggesting buyers remain in control, though the Average Directional Index (ADX) near 16 is indicative of a trend that is still lacking muscle.

EUR/USD daily chart

Where next for EUR/USD?

The Euro looks poised to test the upside, but a decisive break higher may require a fresh spark. That could come from upcoming US data, a stronger policy signal from the Fed, or another twist in global trade negotiations.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.